Bitcoin (BTC) continued his descending trajectory, trading close to the key support of $ 90,000 against the backdrop of a permanent market for the market. Its price has decreased by more than 8% last week, which causes concerns about further potential reduction.

With a decrease in the pressure of the purchase and the fall of institutional participation, the risks of bitcoins are reduced below $ 90,000 in the near future. That’s why.

Bitcoin is fighting because institutional confidence is reduced

In a one -day BTC/USD BTC diagram, it is traded under the red line of its Super Trend indicator. This indicator monitors the direction and strength of the price of the asset. It is displayed in the form of a line on the price graph, changing color to indicate the trend: green for subspress and red for a descending trend.

When the price of the asset falls below its super trend indicator, it signals a bear pulse and a decrease in the pressure pressure. Traiders usually consider this as a sales signal or warning.

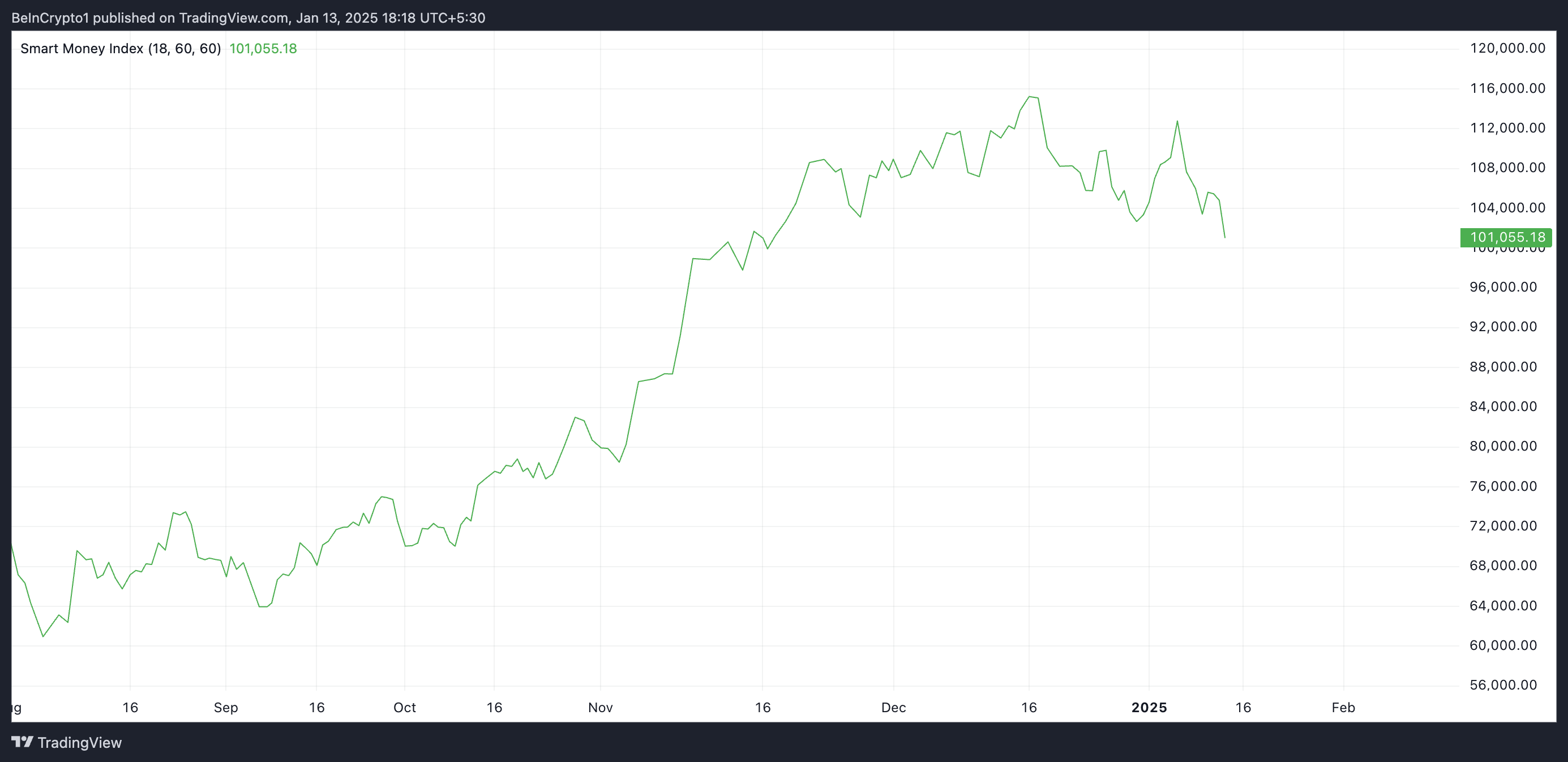

In addition, from January 6, the BTC (SMI) smart money index has been constantly reduced from January 6. At the time of writing this article, the indicator is 101 055, since then lowering 10%.

SMI Activa monitors the activities of experienced or institutional investors, analyzing the market behavior during the first and last hours of trade. When the indicator rises, it involves an increase in the activity of buyers by these investors, signaling the growing confidence in the asset.

On the other hand, a decrease in SMI implies a high sale and reduces trust from these investors. This hints at the potential reduction in BTC price in the near future.

In a recent post on the X veteran, Crypto -Wider Peter Brandt confirms this bear. According to him, the BTC price assessment in a one -day diagram showed the potential formation of the upper head and shoulders (H&S).

The H&S sample consists of three peaks: the central peak (“head”) is the highest, surrounded by two smaller peaks (“shoulders”). The line connecting the lowest points of these peaks is called a “neckline”.

As Brandt is identified, in the case of BTC, one of three things can occur: the H&S template can complete the tendency to its goal, tolerate failure and create a bear trap or turn into a larger, more complex template.

BTC Price Forecast: Bear Template Appears

Reducing BTC demand involves potential confirmation of the trend and a further decrease in its price. In this script, a coin can fall below $ 90,000, bargaining at about $ 85,224.

On the other hand, a shift in market trends can lead to an increase in BTC price to 102,538 dollars.