Bitcoin struggled to get $ 100,000 as a level of support over the past six weeks, despite repeated attempts. Nevertheless, recent market trends suggest that this may soon change.

A remarkable fall on sale, in combination with a change in the mood of investors, provides a promising setting of the price action of cryptocurrency.

Bitcoin -investors get tired of sale

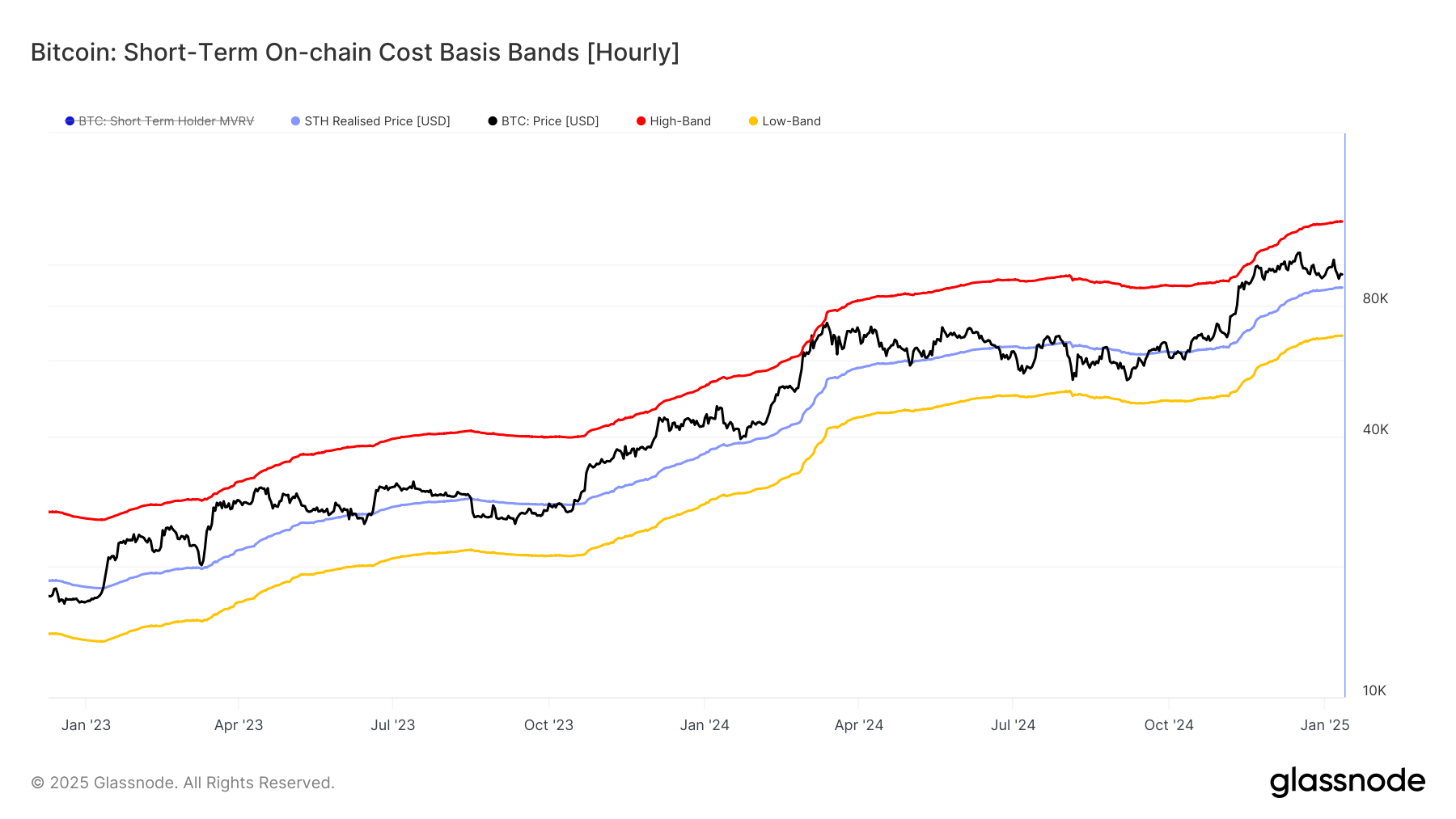

The short -term base of the cost of bitcoins reveals a significant shift in market conditions. Bitcoin is currently trading about 7% higher than the short -term owner (STH), which is 88,135 US dollars. This price of the bonus indicates a growing confidence among new investors. Nevertheless, the inability to stabilize above this level may mean a decreasing mood, which often precedes wider market corrections.

Bitcoin’s ability to maintain its current levels above the basis of STH costs has a decisive important value. If prices fall below this threshold, this can signal fluctuations among short -term holders. Conversely, holding above this level can strengthen confidence, strengthening bull moods in the market.

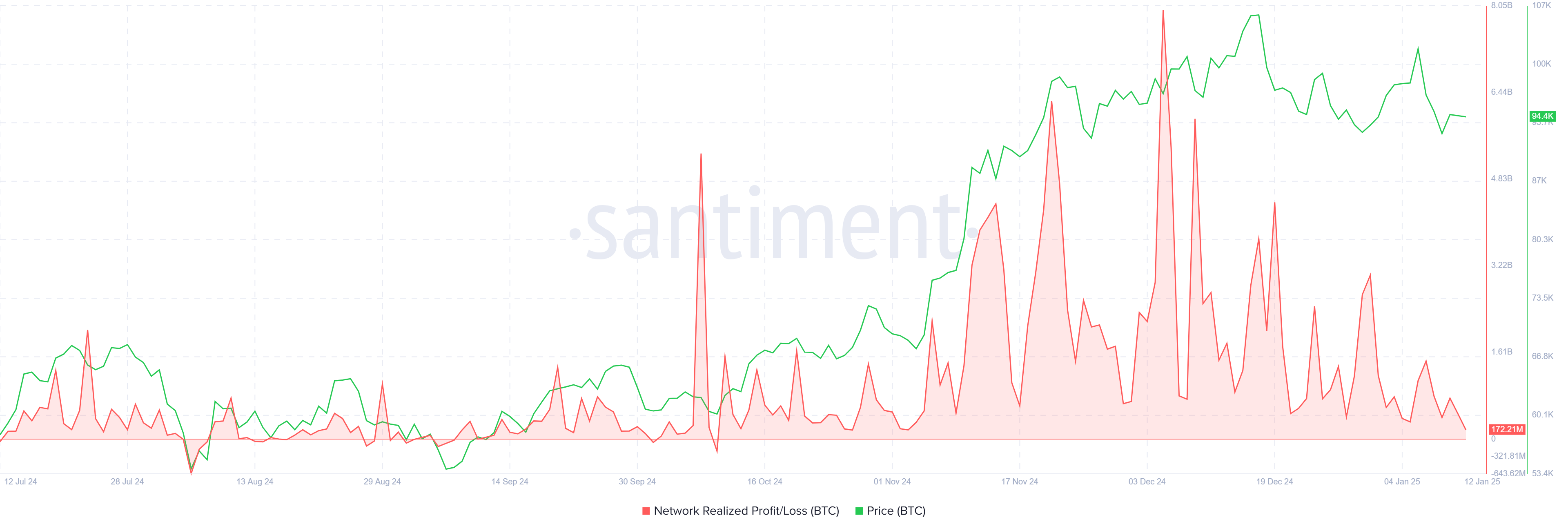

The indicators of the impulse macron additionally emphasize the potential of bitcoins for recovery. Realized profit fell to a three -month minimum, signaling a decrease in sales pressure. This reduced activity indicates that investors prefer to hold, and not go out, which indicates a decrease in a bear mood.

Bitcoin gives the fall of the realized profit to restore the impulse. With a smaller number of sellers in the market, the purchase pressure may have priority by laying the way for sustainable recovery. Such a shift will give Bitcoin to the respiratory room necessary for aiming the level of resistance of the key.

BTC Price Forecast: Raising Barrier

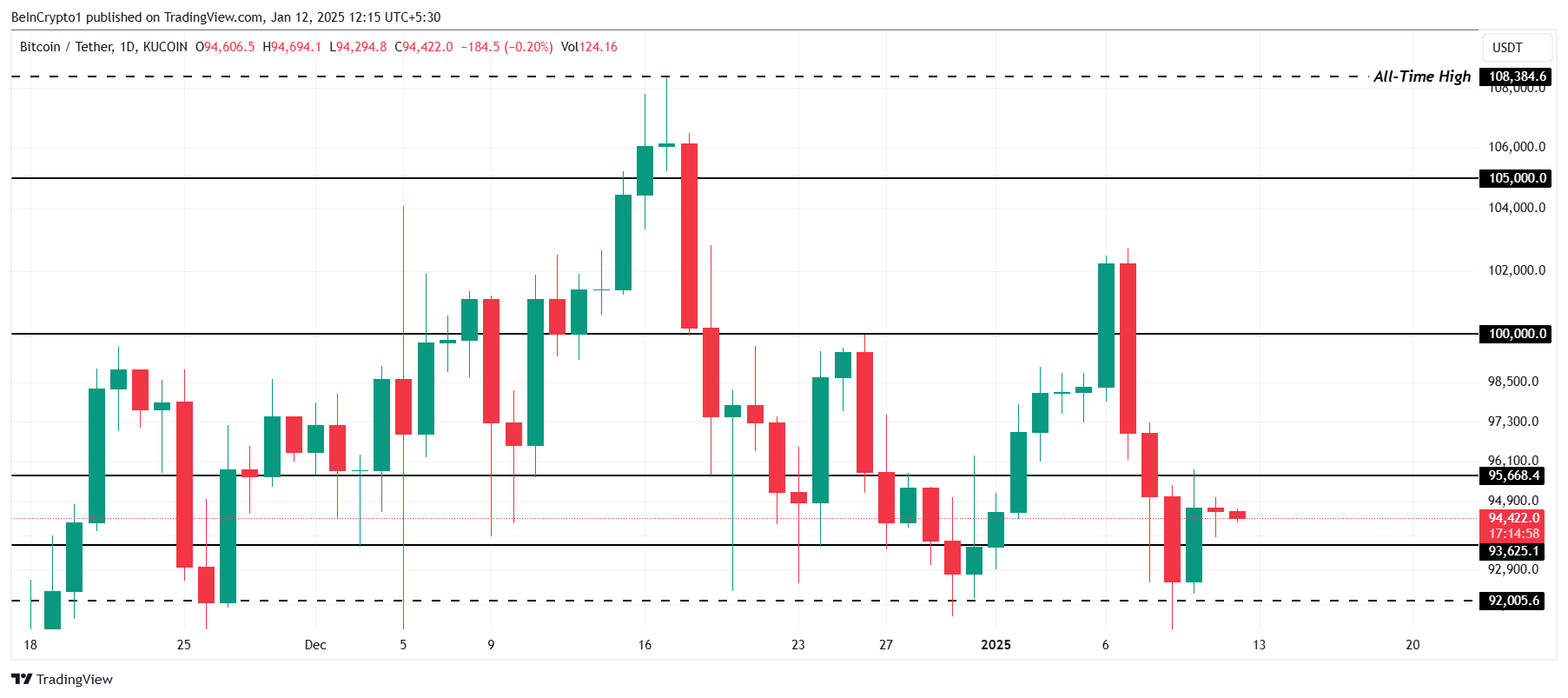

Bitcoin is currently trading at $ 94,422, just below the resistance level of $ 95,668. This barrier is the last obstacle before cryptocurrency can strive for $ 100,000. Violation of this resistance could cause an updated bull impulse, bringing BTC closer to the achievement of this psychological milestone.

The predominant factors support a strong bull case for bitcoins. A breakthrough above $ 95,668 will clarify the path for sustainable upward movement. If the pulse is saved, BTC can surpass $ 100,000, setting a new standard for its price trajectory.

However, the inability to violate $ 95,668 can lead to a rollback. Bitcoin can check the support of $ 93,625, and if it loses this level, the price can fall further to $ 92 005. Such a decrease will change the efforts in the prospect of the bull -diving perspective and a delay with a shade of recovery, leaving the market in a state of uncertainty.