Crypto Avalanche (AVAX) attracts considerable attention, since analysts offer bull settings in a weekly diagram with a possible price target of $ 240.

This optimism is due to the pattern of the cup and processing identified by the analyst Best_analysts, which often signals the long -term trajectory of the rising.

Meanwhile, short -term trading strategies identify potential opportunities at current prices.

Cup and sample processing in a weekly diagram

The best analysts suggested that Avalanche Crypto is in the process of forming a cup and a handle pattern, which is bull.

The “Cup” is an intermediate phase of accumulation, which is determined on the weekly diagram with a rounded bottom.

This stage shows a further improvement and continuation of the trend towards an increase, as well as an increase in the trust of investors.

The “handle” phase, short -term consolidation, often precedes the gap. The pen seems to be at the last stage, which indicates a bull breakthrough.

If this setting is valid, then Avax Price can be on the way to a long -term target of $ 240.

Moving average and levels of fibonacci

This is evident from the fact that the average movements of the keys indicate an increase. The price of an avalanche above 200 is a sliding medium, which is an important long -term line of support trend.

In addition, a 50-week sliding average below the price, which indicates that the short-term bull tendency remains untouched.

Fibonacci recovery levels also indicate significant levels of resistance and support. The level of 0.618 at the level of $ 48 and the level of $ 1.00 by 60 US dollars are critical resistance before the price can start climbing up to $ 240.

The level of recovery 0.5 at the level of $ 36.84 acted as a strong support of the tendency to increase, increasing the prospects of bull.

Short -term short -term trade Avalanche

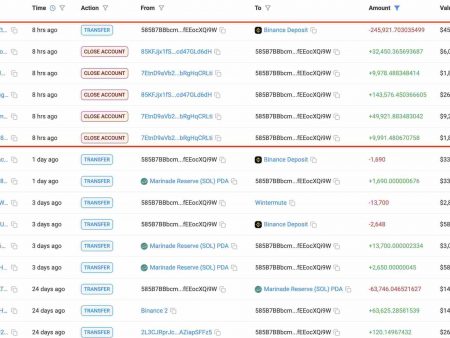

The analyst Valeriyaapex also presents a short-term trading installation for traders in a 4-hour order block, where institutional players will probably set a tendency.

The order block is the most important area that indicates previous possible changes, and therefore buyers can return.

The analyst observed the internal collection of liquidity, which means that market players can take up positions.

In addition, a liquidity regiment appeared, which can help in a short -term price by an avalanche.

About $ 36.71 can be taken from trade, with an order for a stop installed in the amount of $ 33,588 in order to protect against loss below.

The level of profit is 38.294 US dollars, $ 40.400 and $ 45,061, which is the main level of potential growth resistance.

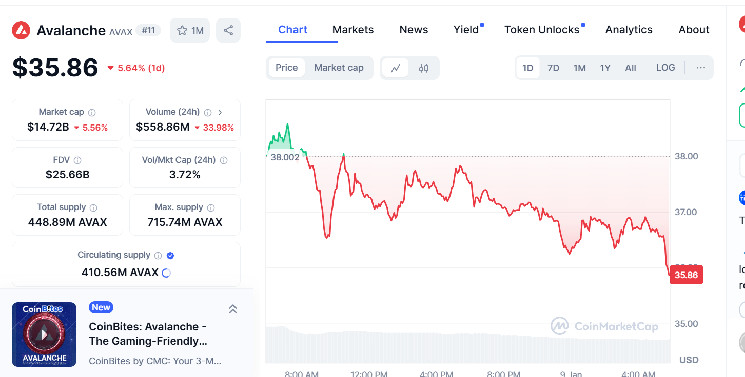

The current aviation price

At the moment, Avax Price was under pressure and decreased by 5.64% to trade at the level of $ 35.86.

The crypto -price on the avalanche began just above 38.00 dollars, and then gradually began to fall. The market is investigating short -term support for about $ 35.50, which will help maintain the market if the pressure is underestimated.

Market capitalization fell to 14.72 billion dollars. The United States, which decreased by 5.56%, and the 24-hour bidding also fell by 33.98% to $ 558.86 million. USA.

This reflects the lack of strong interest in buying a situation that was aggravated by price weakness.

This may be due to the general negative market mood for bear markets in the cryptocurrency industry.

This means that few people are actively involved in the market that simply worsens the situation.

Evidence of liquidity restrictions is the lack of customers who want to buy when others are sold.

Nevertheless, the current circulating offer of AVAX decreased to 410.56 million tokens with a total proposal of tokens 448.89 million tokens.

This is due to the fact that the circulating sentence is quite high, and the demand was recently a little weakened.

Key levels to see

Any support of about $ 35.50 will be important for AVAX to avoid large losses. In case of violation of this level, the price can find the following support of $ 34.00.

In order for Avax Price to reach a bull impulse again, it must break through to the resistance levels of $ 37.00 and 38.50 US dollars.

While AVAX is traded at these levels, the probability of a larger number of purchase signals, such as a cup and a sample or institutional accumulation, is still on the radar.