Ethan Pek, an employee of the National Center for Studies in the field of state policy, submitted a proposal to Bitcoin Treasury shareholders for META on behalf of his family shares.

As Tim Giotzman shared, a consulting businessman and bitcoin -adovocate, this initiative was emphasized in Message on xField

The National Center, based in Washington, the analytical center actively calls for corporations to consider Bitcoin as hedging against inflation and economic uncertainty.

In December 2024, his project Free Enterprise submitted an offer at the annual meeting of Microsoft shareholders, with a request to evaluate the potential of bitcoins as a treasury asset.

This proposal attracted noticeable attention: Microstrategy Chairman Michael Saylor publicly supported this initiative, emphasizing the qualities resistant to Bitcoin inflation.

Similarly, the National Center was submitted by Amazon by the Bitcoin treasury proposal, recommended by the company to allocate 5% of its Bitcoin assets.

This proposal emphasized the excellent efficiency of Bitcoin compared to traditional corporate bonds, emphasizing its potential to protect corporate treasury bonds from the humiliation of currency.

When META is represented, the National Center continues its protection, emphasizing Bitcoin’s fixed proposal and a growing recognition as a strategic asset among institutional investors.

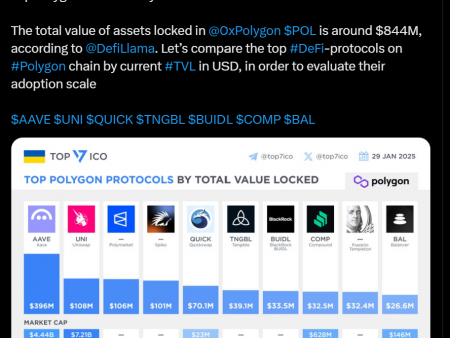

The proposal provides examples of corporate adoption, such as microstructure, along with recent developments such as the growing thrust of the BlackRock Bitcoin ETF.

The proposal also corresponds to the far -sighted history of META when adopting advanced technologies.

“The meta has the opportunity to lead the movement to adopt corporate bitcoin, demonstrating its commitment to innovation and financial stability,” the statement said.

The proposals of the National Center are part of a broader trend when institutional investors and activists advocate Bitcoin as a corporate treasury asset.

Companies such as Microstrategy have established guidelines for the integration of bitcoins into their financial strategies, and their shares have surpassed the market by 2191% over the past five years, according to data played in the proposal.

If META considers this proposal, it will join the growing list of companies that study Bitcoin potential for diversification and protect their treasury obligations.