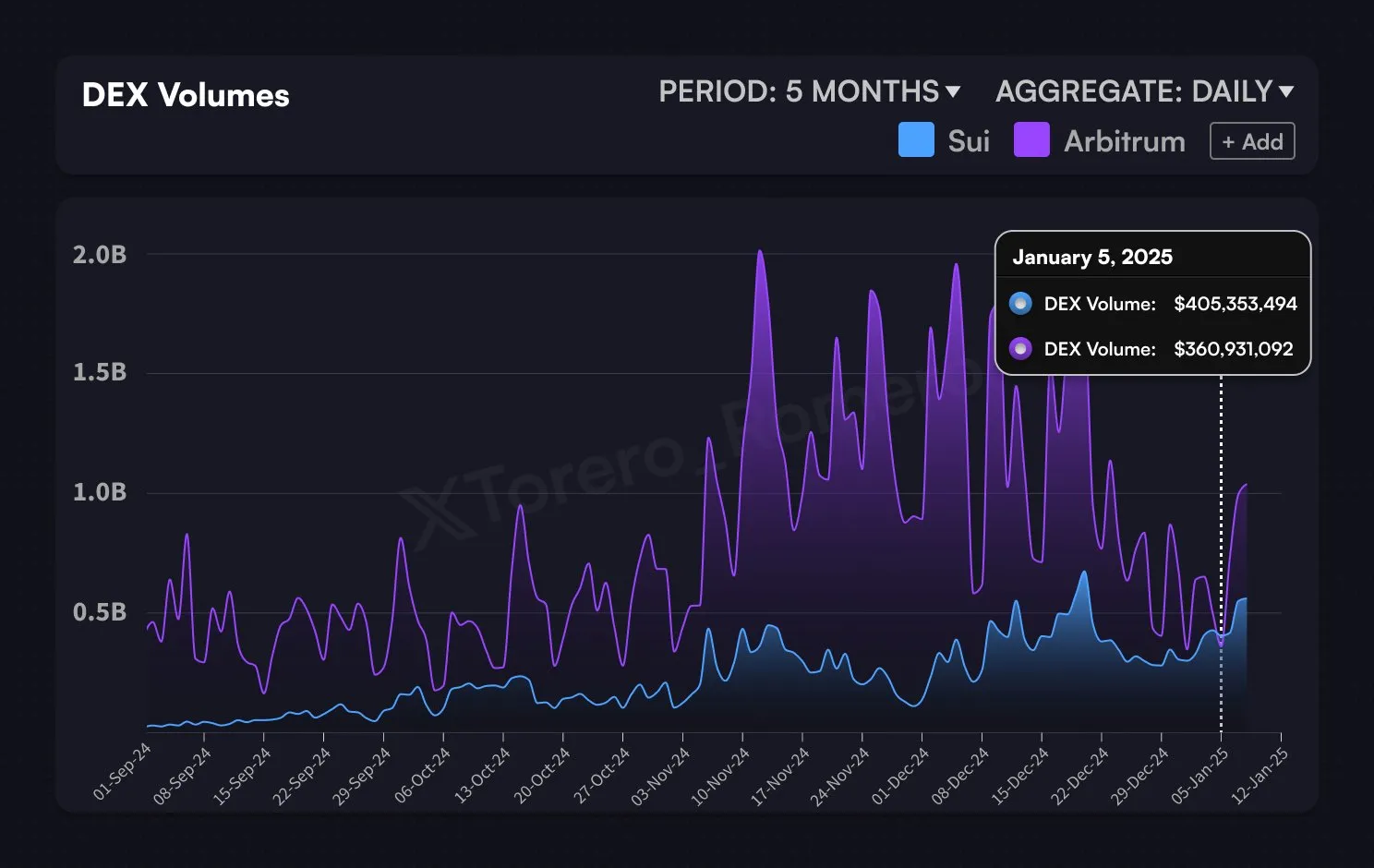

Last week, SUI surpassed the arbitrator in the volume of decentralized exchange (DEX) last week, noting a significant stage.

The data showed that the volume of DEX SUI reached $ 405,353,494 on January 5, 2025 compared to $ 360 931 092.

This development emphasized not only the growing liquidity and involvement of SUI users, but also its growing fame in the landscape of decentralized finance (Defi).

The volume of DEX in SUI reflected the wider market dynamics and investors’ confidence. Such a throw in the superiority of volume suggested a shift in the preferences of users and technological reliability, which potentially affects future investments and development strategies on both platforms.

As the SUI continues to end, it can attract more projects and liquidity, further increasing the relevance of the market.

This event was crucial for the interested parties in the Defi space, since it could show the reorganization of power among the leading DEX platforms, which potentially affects future prices and innovations in this sector.

This is vital for understanding the developing dynamics of DEX and their influence on a wider cryptocurrency market.

Price action and forecast

The price action of the Sui/USDT pair was in a clear tendency to increase the 4-hour period of time identified by the ascending support line, which SUI Price has respectfully since mid-November.

This trend constantly maintains the price, offering strong bull moods in the market.

The key prices of prices currently amounted to about $ 4.81, and recent actions showed that the price is stabilized above this line after some fluctuations.

Given the template, if the SUI retains this level of support, future scenarios may include a re -test of higher resistances of $ 5.20, visible as previous peaks.

However, the terms for these movements will depend on the dynamics of the market and the influx of volume.

Conversely, a break below this ascending support can show that SUI is aimed at lower supports, potentially near the mark of $ 4.00, to further decrease or stabilization.

This ascending trend line and the reaction to it will be crucial for predicting the price action of SUI in the coming weeks.

It would be reasonable to observe traders to observe these levels of signs of continuing or changing the current trend.

Monthly general active accounts

Analysis of the surge of active accounts SUI revealed a significant acceptance of users against the background of a wider market correction.

In May 2023, the number of active accounts began to rise, reaching a peak of 40 million by January 2025.

This is a sharp increase, especially an increase of 20.35% over the past 30 days, suggested a growing confidence in the usefulness of SUI and the potential for sustainable growth.

A sustainable increase in almost every month, with noticeable bursts of involving users corresponding to key events or integrations on the SUI network.

This model indicated that as the network expands its functions and the ecosystem, more users were motivated to join, positively reflecting the health and vitality of the network.

Historically, such increases among active users correlated with an assessment of the price of token, since a larger user base can lead to a larger volume of transactions and increased liquidity.

Consequently, the current expansion in active accounts can potentially soften SUI against serious downs on a wider crypto market, which may lead to a more stable price.

Given this dynamics, investors may expect that SUI will show less volatility compared to other assets during market corrections supported by its reliable and growing user base.

This analysis showed that the SUI was well located for a potential movement upward, depending on wider market conditions, stabilizing.