The recent AXL price decline does not show any signs of softening, and the metrics on the chain are hinting at the great pain in anticipation of the crypto acting.

AXELAR, a programmable blockchain interaction platform with Ticker AXL, fell by three days in a row to $ 0.6152 during printing, reducing its market capitalization to $ 552 million. Altcoin was in the descending trend since December 16, during which its price fell by 40%, and monthly losses – 27.8%.

Several indicators in the chain suggest that the asset may encounter lower pressure in the coming days.

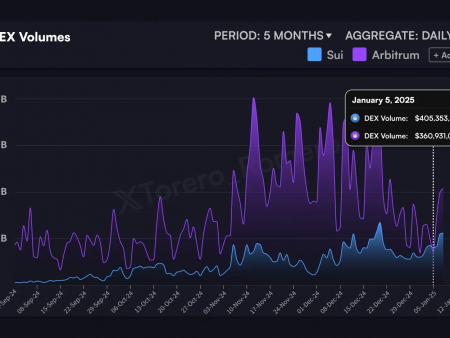

It is noteworthy that the AXELAR Defi ecosystem has lost most of its total cost, blocked over the past month. Since December 18, the project has fallen from 367 million dollars to $ 254 million when writing, according to Defillama. This is a sign of a decrease in user activity and a decrease in investor trust.

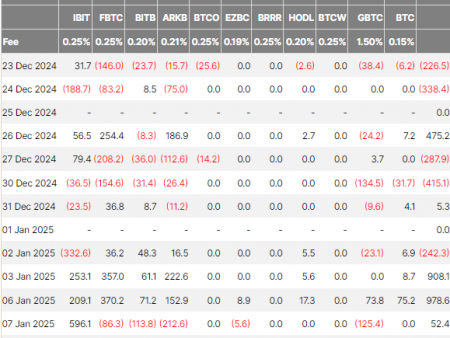

In addition, Traders AXL more and more often move their exchanging assets over the past week, according to Coinglass. An increase in clean flows Exchange can lead to prices in the short term, since investors can strive to cash either out of the fact that they weaken the trust in the project or move funds to other projects.

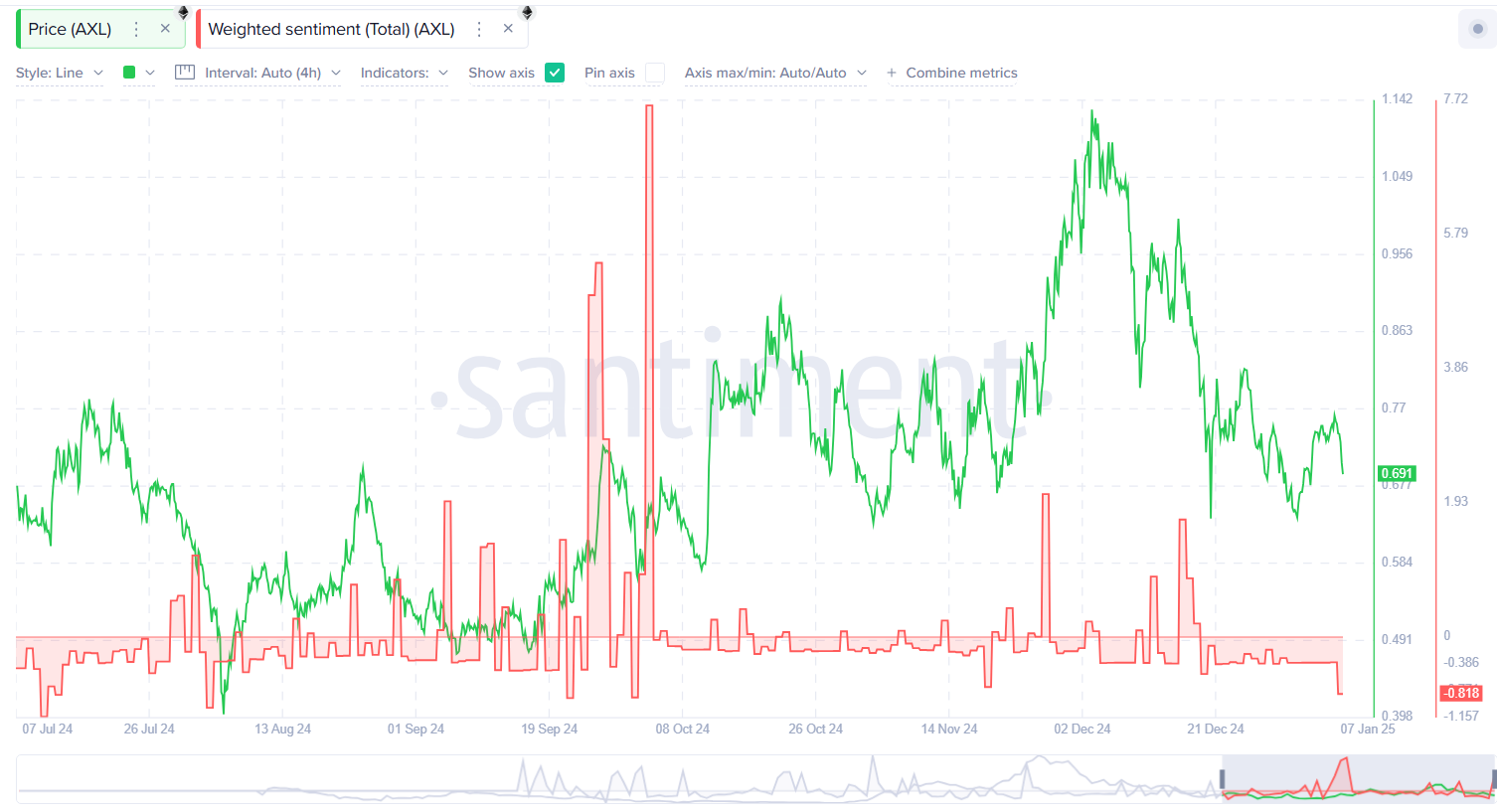

Social sentiments surrounding Altcoin also have become bearish, with its balanced moods at present at -0.818, which emphasizes increased pessimism among merchants.

In addition, the demand among Altcoin merchants has declined over the past five days. According to Coinglass, the open percentage of Axl futures fell from $ 19.9 million. USA 4 to 10.44 million dollars. USA at the time of writing.

Another factor contributing to the recent AXL decline is the predominant risk mood caused by the hawk position of the federal reserves when reducing interest rates and an increase in US bonds, which did not compete with both traditional and crypto markets. The recent decrease in Bitcoin (BTC) below 100,000 US dollars further increased losses in the altcoins market, where the volatility and risk of reduction are usually more pronounced.

Bear technical

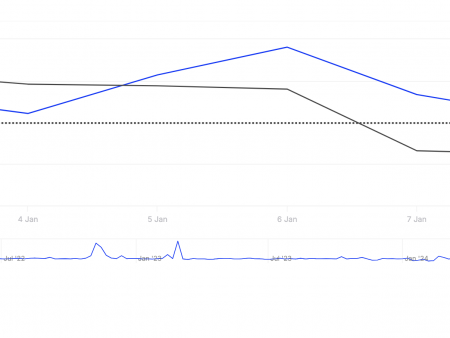

On the 1-day price diagram on the AXL/USD, the sliding medium divergence indicator showed the intersection of the MACD line (blue) under the signal line (orange), which indicates a change in the bear price in the short term. This was additionally confirmed by both lines of the price generator indicating down, and the Supertrend line is higher than the price during the print.

In addition, the CHAIKIN cash flows index showed -0.11, which indicates a mild bear impulse, since the sale, slightly outweighing the pressure on the purchase on the market.

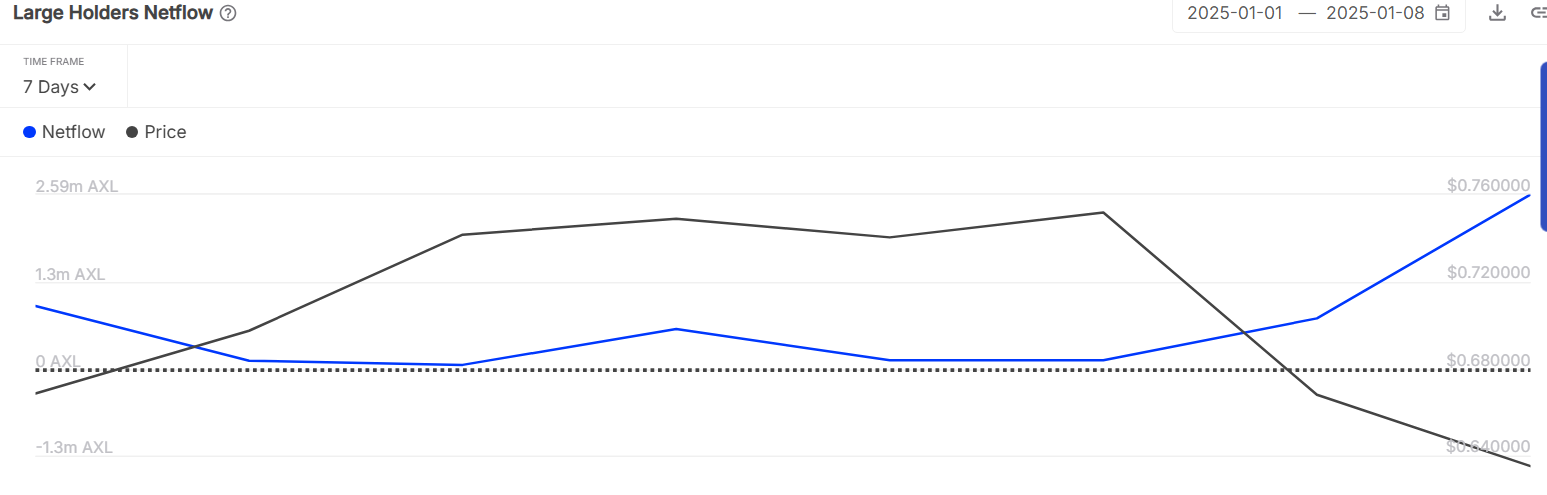

Nevertheless, the token can find some relief, since the whales showed an increased share in AXL at the current prices of prices. In the period from January 6 to January 8, the tributary of the whale wallet increased from 128.48 thousand tokens to 2.59 million. Retail investors can follow their example, since investments in whales are often perceived as a bull signal.

In addition, Altcoin can recover if Bitcoin becomes a strong rebound from recent losses in anticipation of the inauguration of the elected President Donald Trump at the end of January.