Table of Contents

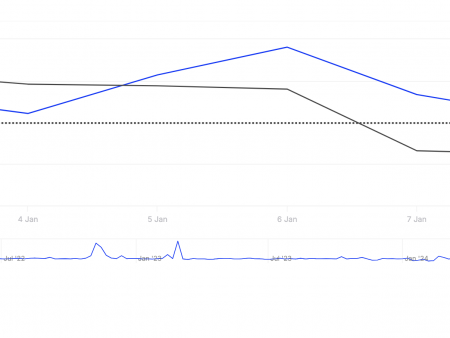

Working week in the financial markets – Analyzing the Graph:

The price of #SPX500 continues to trade within the horizontal range of $4330 to $4600.

Considering the recent downward movement observed throughout the last week and the anticipation of rising inflation, it is reasonable to expect that the price will continue its descent towards the lower boundary of the consolidation range, which is $4330.

The beginning of the working week in the financial markets

What Occurred Last Week?

On Wednesday, September 6, data regarding business activity indices in both the non-manufacturing and services sectors for August were released:

– USA – Services PMI: 50.5 (previously 52.3)

– USA – ISM Non-Manufacturing PMI: 54.5 (previously 52.7)

On Thursday, September 7, figures pertaining to initial jobless claims were made public:

– Initial Jobless Claims: 216 thousand (previously 228 thousand).

The prior week’s data, reflecting a decline in service sector activity and an increase in the non-manufacturing sector, introduced uncertainty into the market. Consequently, fund managers continued to partially adjust their positions.

For a more in-depth analysis of inflation expectations, refer to the previous post available

What to Anticipate This Week?

Wednesday, September 13

– 15:30 UTC +3: CPI inflation (Consumer Price Index) for August

Thursday, September 14th

– 15:30 UTC +3: PPI inflation (Producer Price Index) for August

– 15:30 UTC +3: Retail Sales (August)

Friday, September 15th

– 16:15 UTC +3: Industrial Production (August)

– 18:00 UTC +3: Consumer Inflation Expectations (August)

This week is poised to deliver a wealth of significant macroeconomic data, exerting a pivotal influence on market trends for the latter half of September through the first half of October.

The consensus forecast for inflation bears a pessimistic outlook, with the CPI expected to rise to 3.6% compared to the previous figure of 3.2%.

#SPX500 #AnalysisOverview