The price of Ethereum finally demonstrates the signs of bull continuation after the restoration of the key level.

Nevertheless, the market has yet to do work in order to pave the way for a new historical maximum.

Technical analysis

Edris Drady

Daily schedule

On the daily graphics, the price bounced from the support level of $ 3,200 and broke 3,500 dollars up. If the asset can stay above this area, in the short term you can expect growth to a level of $ 4000.

Since RSI also shows values above 50%, the impulse is again bull, which increases the likelihood of implementing this scenario.

4-hour schedule

The 4-hour schedule shows a clearer picture of the recent price movement. However, this also demonstrates a potentially alarming signal. Although the market with force broke through the level of $ 3500, the bear’s discrepancy between the recent maximums of prices and the RSI indicator is a signal that should be taken into account.

This bear divergence can lead, at least, to the rollback and re -testing the level of $ 3500 before continuing growth in the coming days.

Intra -net analysis

Edris Drady

Ethereum financing rates

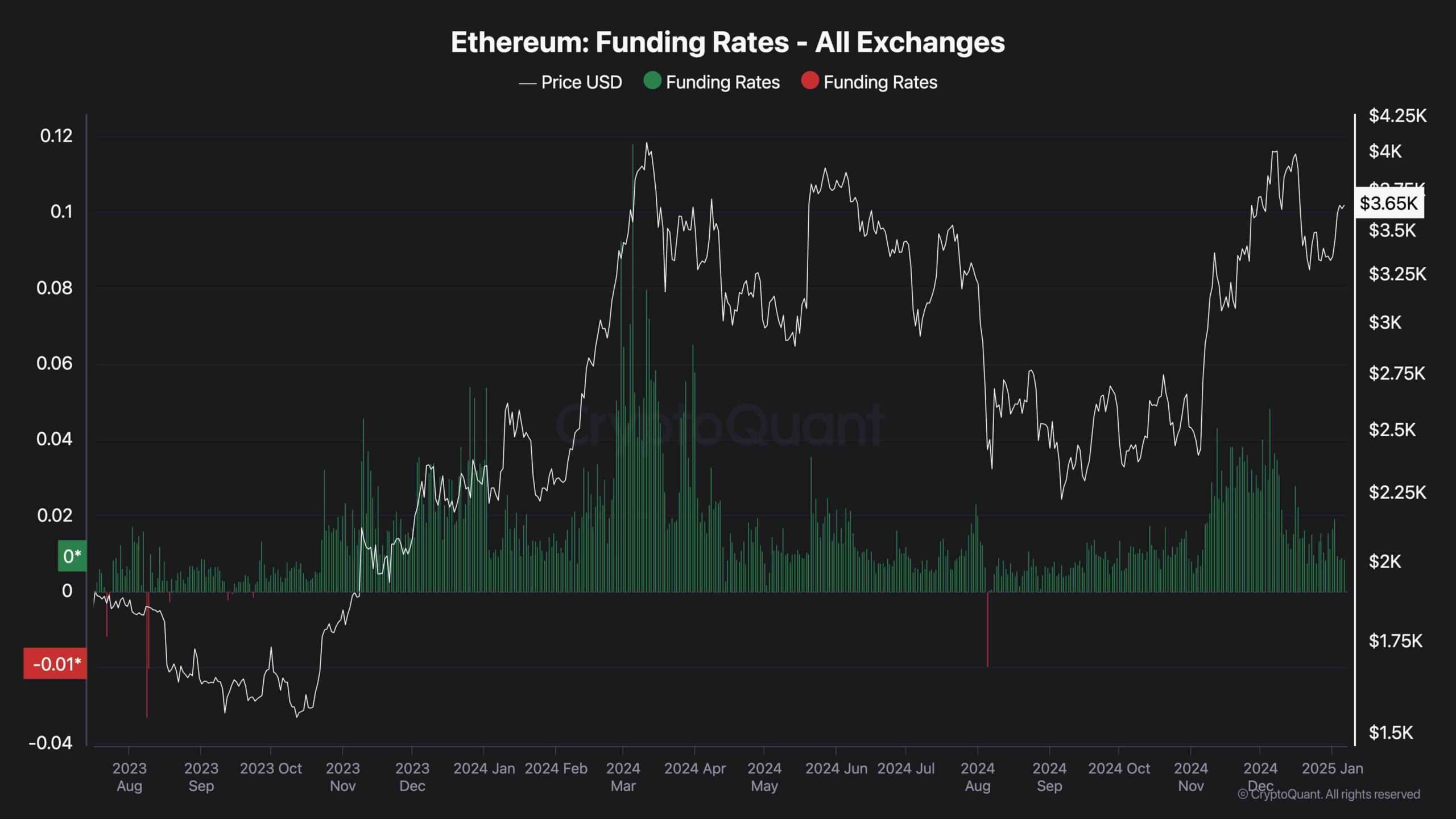

Although the price of Ethereum over the past few months lasted higher $ 3,000, many investors were full of optimism that the market would soon establish a new historical maximum. However, this significant optimism also led to a correction that stopped the ascending asset trend.

This diagram presents an indicator of Ethereum financing rates, which shows whether buyers or sellers in the futures market are more aggressive to fulfill their orders. As shown on the schedule, funding rates were shown by extremely high values when the price first approached the level of $ 4,000. However, the subsequent subsequently long -term liquidation cascades led to correction and consolidation.

Meanwhile, funding rates have decreased over the past few weeks, which indicates that the mood in the futures market has become significantly cool. This can lead to sustainable growth in the coming weeks if sufficient demand is present in the spot market.