The price of Injective (INJ) has fallen sharply, rising 30% in the last seven days and 14% in the last 24 hours. Trading volume soared more than 250% during the same period, reaching $274 million.

This strong price action is supported by bullish technical indicators, including an overbought RSI at 80.6 and BBTrend at its highest level since November 2024. If the golden cross materializes, INJ could see further gains, targeting $26.5, $29.4 and potentially $35.2, but downside risks remain if support levels fail to hold.

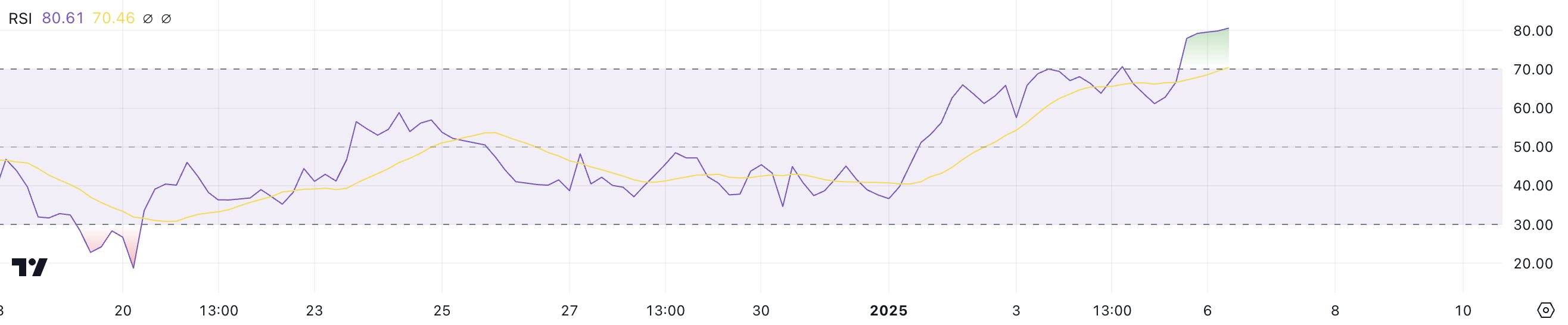

INJ RSI is currently in overbought territory

The Relative Strength Index (RSI) has risen sharply and is now at 80.6, up from 61 just a day ago and 36 a week ago when its price began its recent rise. RSI is a momentum indicator that measures the speed and magnitude of price movements on a scale of 0 to 100, allowing you to understand whether an asset is overbought or oversold.

Readings above 70 typically signal overbought conditions, suggesting that a pullback or consolidation may be imminent, while readings below 30 indicate oversold conditions, often hinting at a potential price rebound.

At its current level of 80.6, the INJ RSI suggests the asset is deep in overbought territory, reflecting strong bullish momentum driven by aggressive buying.

While this points to strong market enthusiasm and the potential for near-term gains, it also raises caution about a possible cooling.

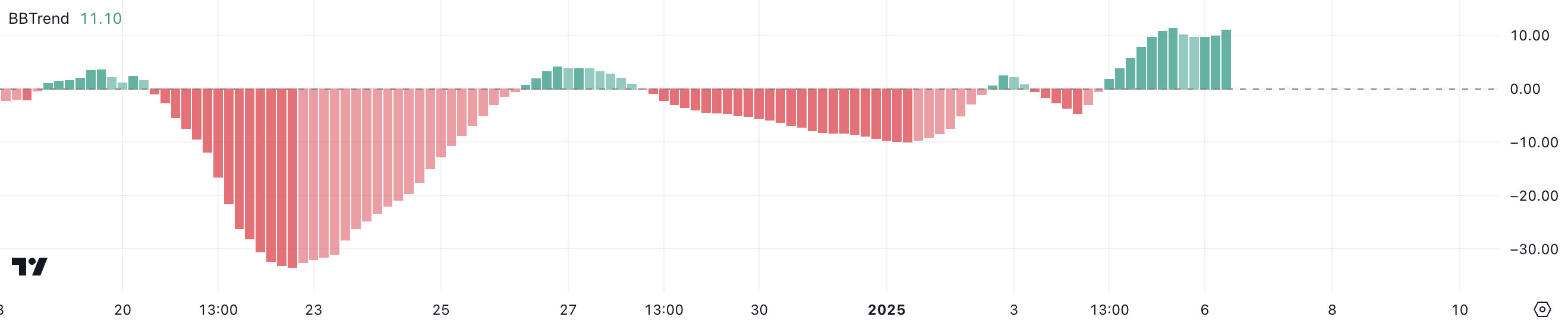

Injective BBBTrend reaches highest level since November 2024

Injective was launched with the promise of being a layer 1 blockchain that would revolutionize finance. Its BBTrend currently sits at 11.05, just below its recent peak of 11.36 a few hours ago. This is the highest level since late November 2024, reflecting a significant recovery from -4.58 just two days ago on January 4th.

BBTrend, derived from Bollinger Bands, measures the strength and direction of a price trend. Positive values indicate upward momentum, while negative values indicate bearish conditions.

At its current level, INJ’s BBTrend indicates strong bullish momentum, suggesting that buyers are firmly in control and driving the price higher. A sharp recovery from negative territory shows a change in market sentiment in favor of continuing the upward trend.

However, as BBTrend is close to its recent highs, there could be stabilization or a slight pullback if buying pressure subsides, although the overall trend remains positive. Traders should keep an eye on whether INJ price can maintain this momentum or whether it enters a consolidation phase in the short term.

INJ Price Forecast: New 36.4% Jump Ahead?

The EMA lines for the INJ price indicate that the price is on the verge of forming a golden cross. This occurs when the short-term EMA crosses the long-term EMA. If this happens, it could reignite buying momentum and prompt INJ to test resistance at $26.5 as rumors grow about the cryptocurrency’s attempts to revolutionize TradFi’s earnings.

A break above this level could pave the way for further gains, with $29.4 the next key target. If momentum remains strong, INJ could even test $35.2, a level not seen since early December 2024.

Conversely, if the trend reverses and the golden cross does not materialize, the INJ price may face downward pressure. The first critical support is at $23.98 and a break below this level could lead to further declines. In a more bearish scenario, the price could fall to $19.7.