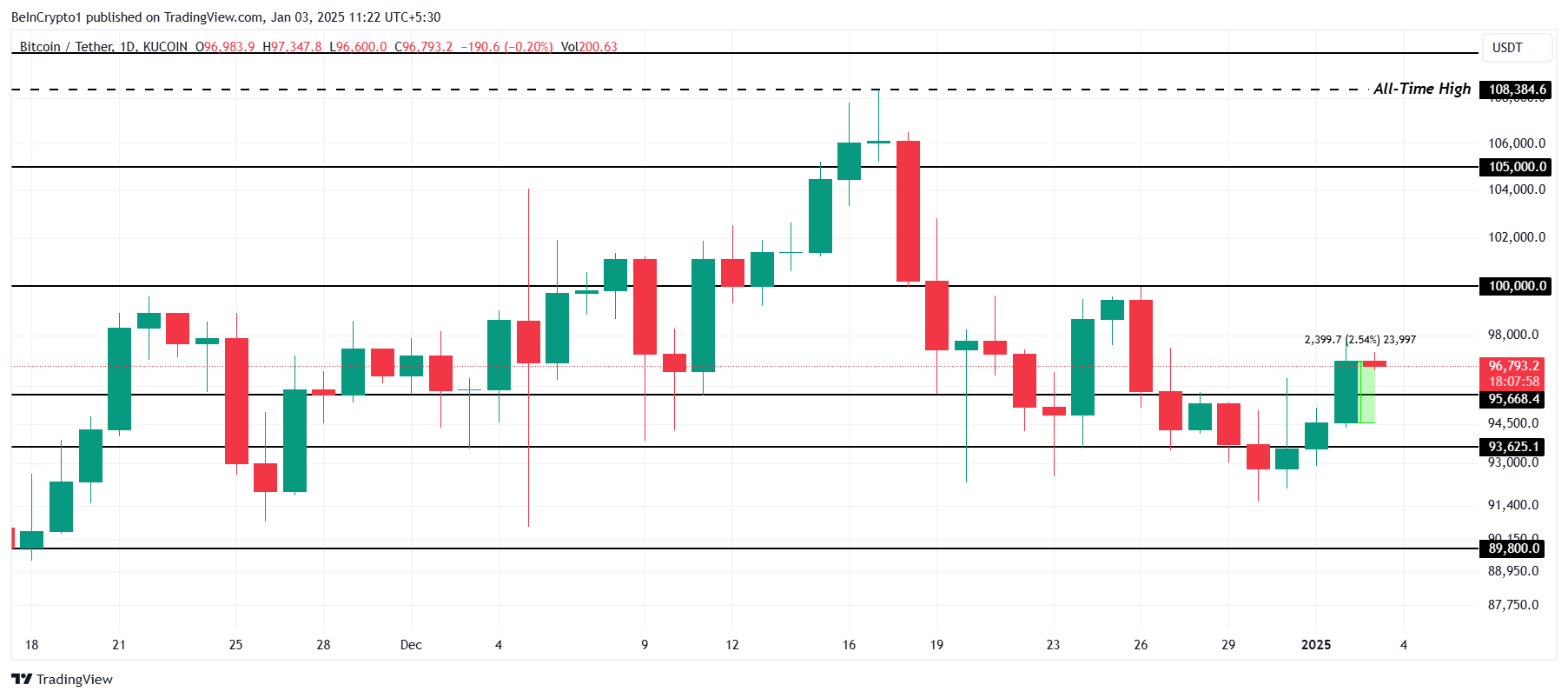

Bitcoin has struggled to reclaim $100,000 as a support level, reflecting the lack of momentum in recent price action.

Despite this, investor sentiment remains optimistic, with confidence bolstered by growing institutional support for Bitcoin and its symbolic milestone of 16 years.

Bitcoin investors are bullish

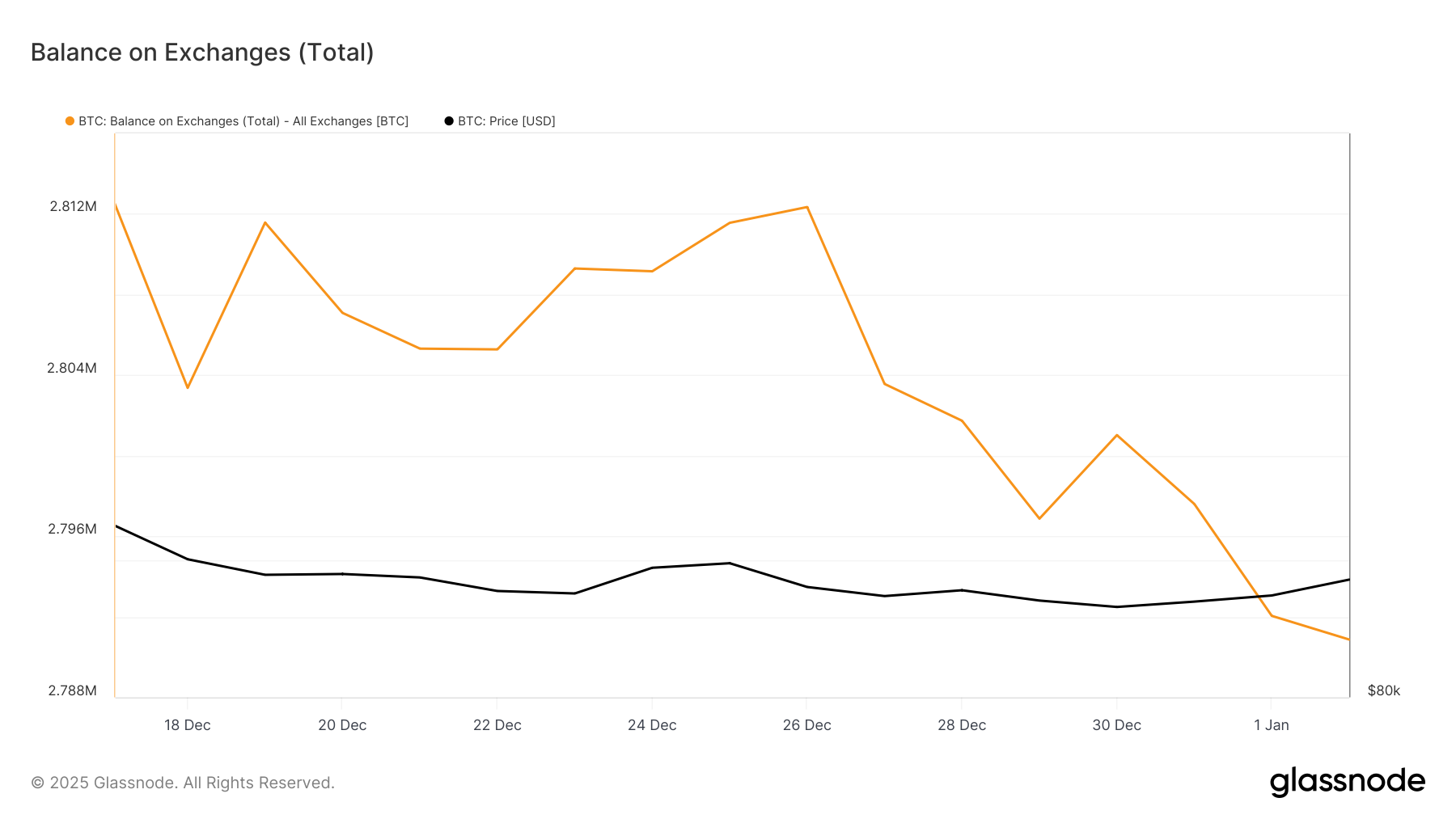

Bitcoin supply on exchanges has fallen by 11,000 BTC in the last 48 hours, signaling easing selling pressure. Since the beginning of the year, the accumulation has grown to $1 billion, while investors are constantly purchasing BTC even against the backdrop of stagnant prices. This trend underscores Bitcoin holders’ confidence in potential growth.

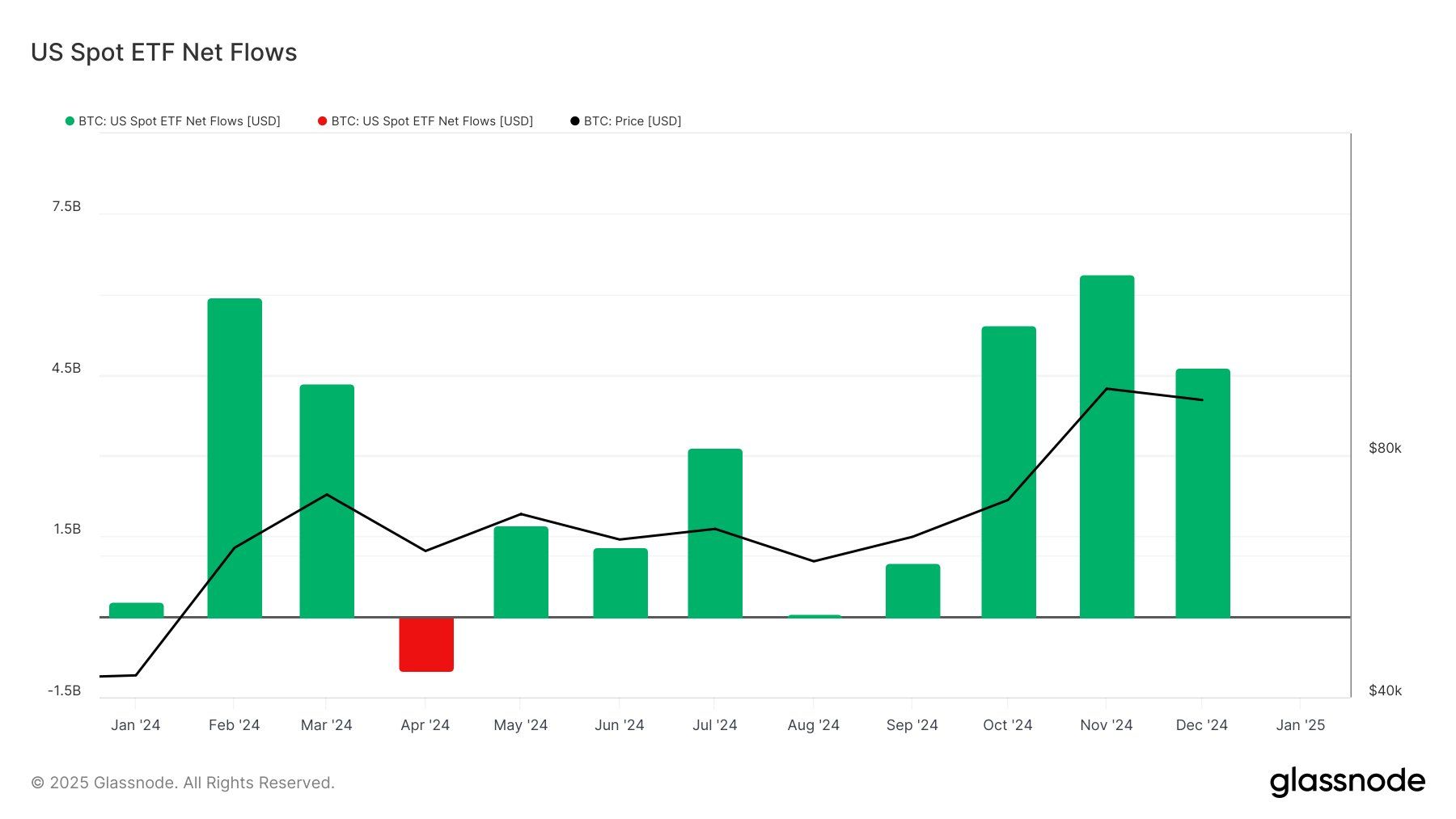

Institutional interest in Bitcoin reached a new high, with net inflows into spot BTC ETFs totaling $4.63 billion in December. This figure is significantly higher than the 2024 monthly average of $2.77 billion, highlighting the growing appetite for Bitcoin among institutional investors.

Although most of the inflows occurred in the first half of December, bearish conditions in the second half did not lead to a significant decline in activity. Continued support from institutions reflects a long-term outlook that could help Bitcoin recover and boost its price.

BTC Price Prediction: Violation Detected

Bitcoin is currently trading at $96,793, holding above the $95,668 support level. To regain $100,000, BTC must prevent falling below this critical threshold. Current market signals suggest the possibility of an upward move.

Optimistic signals from investor support and institutional inflows indicate a decline is unlikely. If Bitcoin moves $100,000 into support, it could pave the way for a rally to $105,000, which would be a significant step forward in its recovery.

However, losing the $95,668 support level could push BTC towards $93,625, causing concern among investors. A further decline below this level would invalidate the bullish outlook, potentially sending Bitcoin towards $89,800. Maintaining key levels remains vital to maintaining market optimism.