Solana (SOL) recently broke out of a period of sideways momentum, reclaiming $200 as support after being stuck below that level for most of December.

This bullish move has reignited investor optimism, suggesting that SOL could continue its recovery towards higher price targets.

Solana investors are hopeful

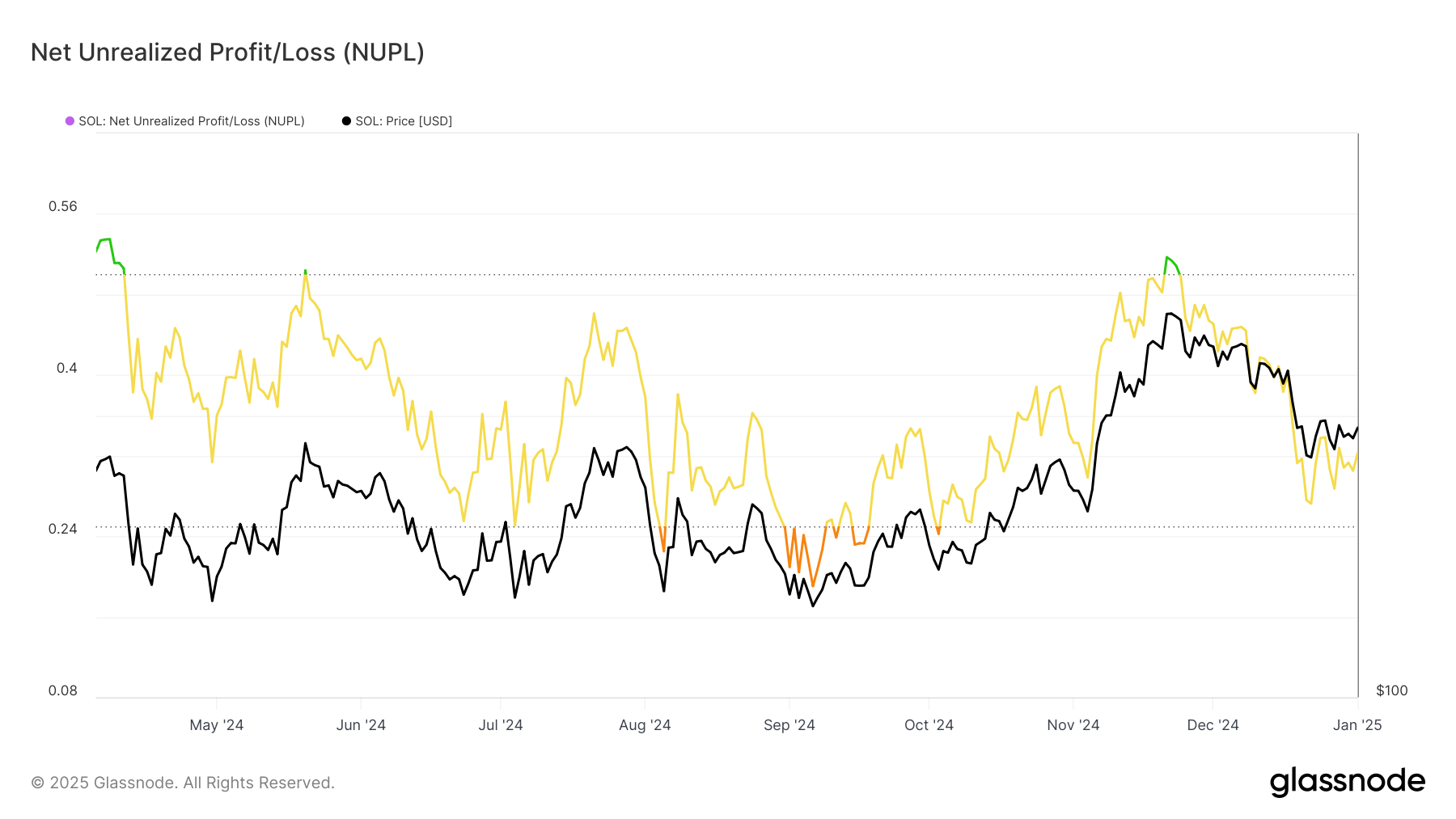

The Net Unrealized Gain/Loss (NUPL) indicator for Solana shows that despite recent price volatility, investors remain confident in the altcoin’s recovery. Many are holding off on selling their assets, which helps prevent excessive downward pressure. This optimism supports the current uptrend, offering a basis for further growth.

This investor confidence often plays a critical role in supporting economic recovery. By holding their positions, market participants help reduce supply pressure, making it easier for bullish momentum to take hold. As a result, SOL is well positioned to capitalize on this sentiment and continue its upward trajectory.

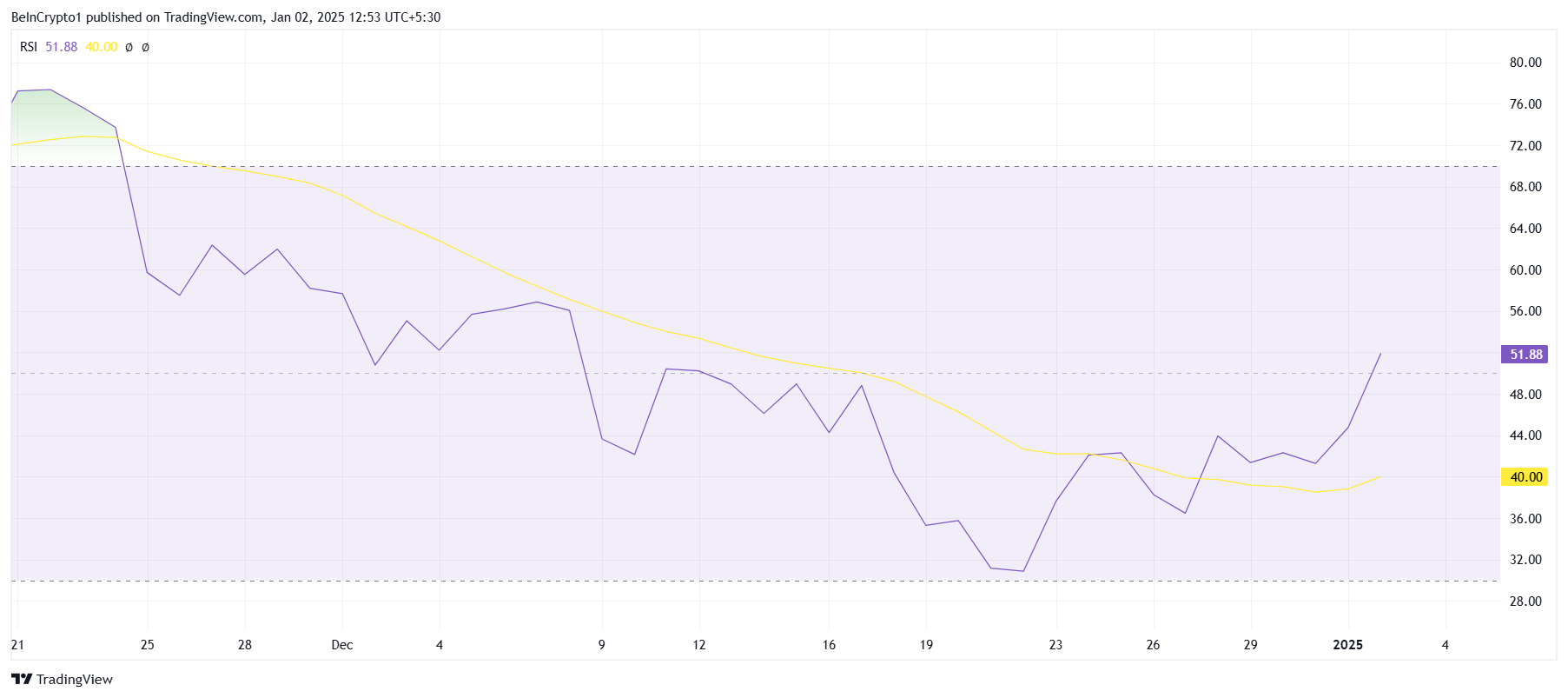

Solana’s macro momentum is also gaining strength, with the relative strength index (RSI) once again rising above the neutral level of 50.0. This move signals that bullish momentum is returning, potentially paving the way for further price gains. A sustained RSI above 50.0 usually indicates a favorable environment for an upside move.

The renewed bullish strength is expected to help Solana regain critical resistance levels. If this momentum continues, SOL could continue to grow and reach higher price targets. Technical indicators show that the altcoin is in a strong position to recover from recent setbacks.

SOL Price Forecast: Resumption of Recovery

Solana is currently trading at $205, up 8.7% in the last 24 hours. This surge allowed SOL to break through the $201 resistance and turn it into support. Maintaining this level will be critical to maintaining the ongoing economic recovery and achieving further gains.

SOL’s next target is to regain $221 as support, a critical barrier standing between the altcoin and its $245 target. A successful hit at $245 would allow Solana to recover most of her recent losses, strengthening her bullish outlook and boosting investor sentiment.

However, a lack of sustained momentum or profit-taking could cause SOL to fall below the $201 support level. If this happens, the altcoin could settle above $186 or even fall below that level, completely invalidating the bullish thesis.