The largest cryptocurrency companies have risen over the past 24 hours as the market enters a widely anticipated bull year, with Bitcoin (BTC) topping $95,000 to recover from last week’s losses.

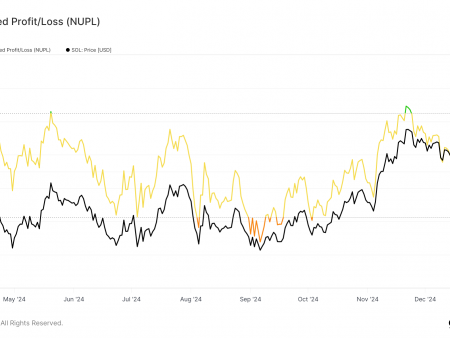

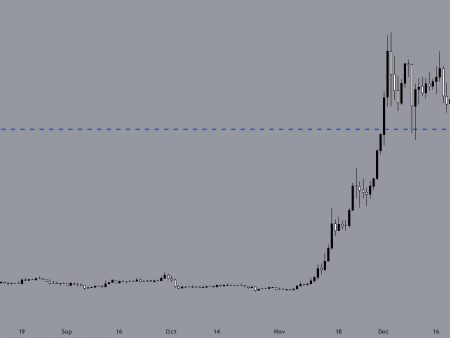

Solana (SOL) also started 2025 on a high note, rising 11% in the last 24 hours to break past the $200 mark and set an optimistic tone for the new year. Solana started rising from a low of $187 on Jan. 1 and reached an intraday high of $207.76 in Thursday trading at the time of publication.

SOL is currently trading at $206.71, up 12% from where it started the year. Trading volumes also increased; Solana’s trading volume was $3.68 billion over the previous 24 hours, up 24.54% over that time period, according to CoinMarketCap.

Solana’s rise above $200 marks a good start to 2025, but the road ahead could be challenging as Solana faces resistance levels. The first major resistance is at $219, which coincides with the daily SMA 50, followed by $246 and the all-time high of $264, which was reached on November 23, 2024.

On the other hand, support is provided at $175 and daily SMA 200 in case of falling prices.

Prospects for increasing Solana ETF

There is a growing number of companies vying for the Solana ETF, including VanEck, Grayscale, 21Shares, Bitwise and Canary Capital.

Solana Spot ETFs are currently being reviewed by the US Securities and Exchange Commission (SEC), with a preliminary decision expected by the end of January 2025.

The filing deadline for Grayscale’s Solana ETF is Jan. 23, while four other applicants are awaiting a preliminary ruling by Jan. 25, 45 days after the SEC received its ETF application in November.

The Solana ETF has a 77% chance of approval this year, according to Polymarkets. Crypto investors are looking at the approved Solana ETF as a potential price boost, with some believing it has yet to be priced in.