The broader cryptocurrency market pulled back lower after Bitcoin (BTC) hit a new all-time high (ATH) of approximately $106,490 on December 17. After the high, BTC price fell to around $94,000 before failing to retest the $100,000 mark. Prices subsequently fell below $93,000 but had recovered to $95,256 by press time, for a year-to-date (YTD) return of 126.67%.

While the broad consensus is that this is just a temporary period of consolidation before the broader market rally continues, even temporary dips could add to bearish sentiment. Since short sellers have benefited greatly from this latest move lower, they have doubled down on their bets – a move that leaves room for potential cuts.

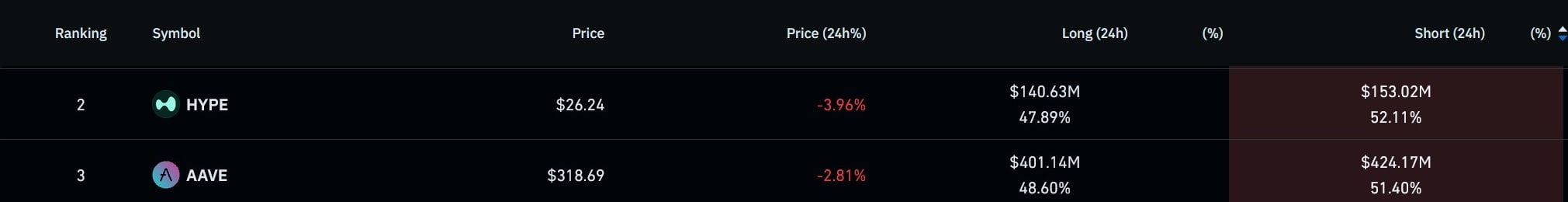

To determine potential short squeeze opportunities for January 2025, Finbold obtained derivatives data from CoinGlass choose two cryptocurrencies that show high short volume and have the potential for significant price growth.

Analysis of the data revealed two promising candidates – Aave (AAVE) and Hyperliquid (HYPE), both of which are well-established digital assets with significant market caps.

Short volume on AAVE and HYPE begins to grow

While there were about $140.63 million in long positions in AAVE, $153.02 million was placed in short orders. Currently, 52.11% of the daily open interest is on the short side.

Although Hyperliquid’s daily open interest is slightly less bearish at 51.40% in favor of the short side, the total volume is significantly higher. In the last 24 hours, $424.17 million worth of HYPE short positions were placed, while $401.14 million was used to open long positions.

While this is typically lower than what is required for a short squeeze, if the pace continues, open interest for both assets could move further bearish by the end of January.

Readers should note that there is no guarantee that these cryptocurrencies will experience a short squeeze. Although the bears currently have a slight advantage, a short squeeze requires a quick and powerful turn from bearish to bullish sentiment with a large number of open positions in the previous direction.

However, that being said, these are the two assets that have experienced the most bearish changes in the last 24 hours. If the pace continues into January, a significant portion of capital could be at risk.

Both AAVE and HYPE are likely to benefit from platform improvements in 2025 – the HYPE rate launched on December 30th, providing a strong bullish catalyst for the asset, and the long-awaited launch of Aave V4, scheduled for early 2025, will undoubtedly benefit. same with AAVE.

Featured image via Shutterstock