With the cryptocurrency market’s valuation at $3.33 trillion and Bitcoin holding steady above the $90,000 range for 43 days in a row, an intriguing trend has emerged as vintage crypto wallets begin to step up after years of dormancy.

Transfers worth millions of dollars from long-inactive crypto wallets

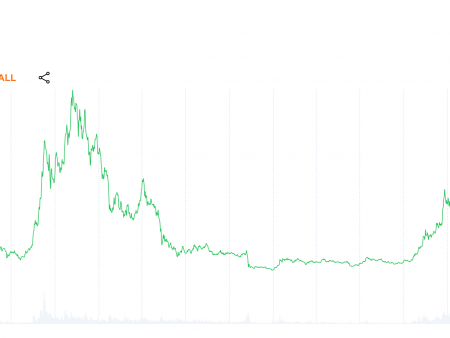

By the end of 2024, digital currency prices will be significantly higher than at the beginning of the year. These elevated prices have prompted long-term holders to rethink their strategies, leading to moves in cryptocurrencies that had remained untouched for years. Bitcoin.com News recently took notice of several old unspent Bitcoin transaction outputs (UTXOs) that were moved for the first time in over a decade. Similar activities involving dormant crypto wallets have been observed on other blockchains.

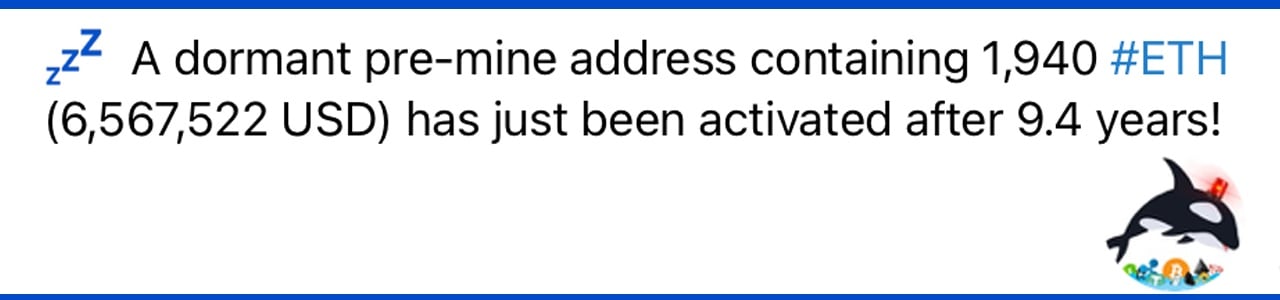

Just two days ago, on December 27, Whale Alert, a blockchain tracking tool, detected a Genesis Ethereum wallet transferring 1,940 Ether worth $6.5 million after being dormant for 9.4 years. The wallet still contains 467.77 Ether, a portion that, unlike Genesis Ether, was not originally purchased on July 30, 2015. Onchain data showed that the ether was transferred to a wallet identified as linked to Coinbase. On Saturday, December 28, additional Bitcoin (BTC) supplies were moved from wallets that had been inactive for years.

On Sunday, Sani, owner and operator of timechainindex.com, took to social media to talk about a wallet that transferred 7,000 BTC after a seven-year hiatus. Sharing the wallet address, Sani noted, “This Chad held 7000 BTC for 7 years, from $62 million to $663 million, the funds weren’t sold, they just divided them into 1000 BTC addresses.” This high-profile wallet was originally created on April 20, 2018 and previously contained 9,465.71 BTC. Over the weekend, btcparser.com also discovered a long-dormant address for moving funds in 2014.

A legacy Pay-to-Public-Key-Hash (P2PKH) address created on January 10, 2014 today transferred 357.40 BTC worth $33.9 million. The transaction was confirmed at block 876.810, with the entire amount sent to an unidentified Pay-to-Witness-Public-Key-Hash (P2WPKH) wallet. Although bitcoins are now worth $33.9 million at current rates, they were worth just $302,360 in 2014, when they were first purchased.

Blockchair.com’s privacy analysis tool gave the 2014 transaction a “low” score of 35 out of 100, with 100 being the highest level of privacy. This low score is due to address overlap and repeated use of the same address in the input data. Similarly, wallet transfer received a score of 45 out of 100 in 2018, facing similar privacy issues due to repeatedly using the same address and sending round amounts.

The recent surge in activity from long-dormant crypto wallets paints a picture of strategic evolution over the years and the enduring legacy of early adopters. As these awakenings are reflected in blockchain networks, they demonstrate a strong belief in decentralized settlement systems. As always, the future of these revived assets continues to be an exciting prospect.