Mantra (OM) price is going through a critical technical phase as multiple indicators point to potential bearish pressure in the future. The DeFi token is down 13% over the past seven days, continuing the correction from its all-time high reached on November 18, with current prices down 21% from that peak.

Technical indicators paint a mixed picture, with the RSI holding neutral territory while the Ichimoku Cloud suggests bearish momentum is strengthening. Adding to the uncertainty, a potential death cross formation looms on the horizon, which could accelerate the downside move if confirmed.

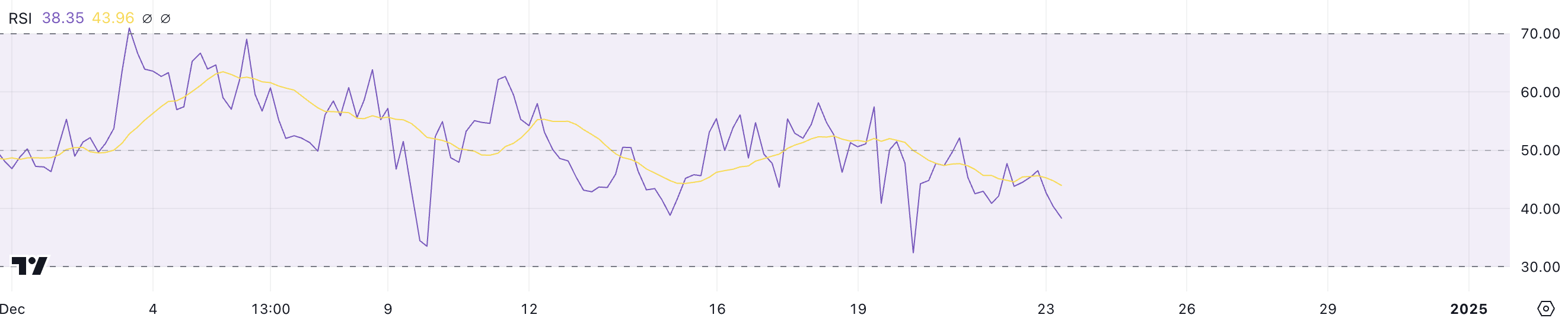

OM RSI has been neutral since December 3

The relative strength index (RSI) for OM remained relatively neutral at 38.3, showing minimal volatility since December 3rd. The RSI is a momentum oscillator that ranges from 0 to 100, with values below 30 indicating oversold conditions and values above 70 indicating overbought levels. .

A midrange between these thresholds, especially around 40–60, usually indicates a neutral market condition where neither buyers nor sellers have decisive control.

With Mantra RSI currently at 38.3, the asset is slightly below the neutral midpoint of 50, suggesting mild bearish pressure but not enough to indicate oversold conditions. This extended period of neutral RSI readings could indicate a consolidation phase with the potential for a directional move once the indicator breaks decisively above 50 (bullish) or below 30 (bearish).

The current reading suggests traders may be waiting for stronger signals before making significant moves, although the slight bearish slope at 38.3 requires attention to potential downside risks.

Ichimoku Cloud Shows Bearish Sentiment for OM

The Ichimoku Cloud chart for OM shows a bearish trend developing over the past week.

The green line (Chikou Span) crossed below the price action and the blue line (conversion line) fell below the red line (base line), forming a bearish cross around December 19th.

The cloud itself changed color from green to red, indicating a change in sentiment from bullish to bearish. The price is currently trading below the cloud and all major Ichimoku lines, indicating strong downward momentum.

However, as all lines begin to converge near the current price level, this could signal a potential consolidation phase or trend change.

OM Price Prediction: $3.31 Support Is Fundamental

The short-term moving average for OM currently maintains its position above the long-term one, albeit with diminishing momentum, hinting at a potential death cross formation.

If this bearish signal materializes when the shorter MA crosses above the longer MA, Mantra price may face increased selling pressure pushing it towards the support level at $3.31 with further fall to $3.03 if the first support fails .

Alternatively, if OM price manages to regain bullish momentum before the death cross forms, the price could target immediate resistance at $3.76.

A successful breakout of this level could pave the way for further gains towards $4.25, although this scenario would require a clear change in current market sentiment and perhaps another surge in real asset (RWA) metrics.