Ki Young Joo, founder of analytics platform CryptoQuant, warned investors not to be tempted to rush to sell their bitcoins.

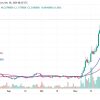

The warning came as Bitcoin eventually broke through the $100,000 mark, one of its highest psychological resistance levels. Bitcoin has since peaked at $103,900 before settling slightly below that level.

Prior to this event, some analysts had speculated that the market could experience a significant decline once Bitcoin crossed the $100K threshold, with many expecting profit-taking at this important psychological level.

However, a sale at this stage could prove costly, according to analysts such as Young Ju. “Don’t sell your Bitcoin,” he urged, stressing that Bitcoin is currently in the price discovery phase and exiting the market too early may not be wise.

Personal regret about closing a ‘generational’ Bitcoin long position

Young Joo shared a personal anecdote to illustrate his point. He recalled a pivotal moment about four years ago, when Bitcoin reached $10,000 for the first time after months of consolidation.

Overcome with excitement, he took a screenshot of the event on Binance. However, what followed was even more remarkable: Bitcoin has never dropped below $10,000 since then.

Young Joo later went long on Bitcoin at $17,000, planning to hold it for years and eventually pass it on to his grandson. However, he left the market too early.

Looking back, he admitted that his biggest regret was closing the position too early. He acknowledged that even experienced traders often act impulsively, despite their insight.

The founder of CryptoQuant used this reflection to highlight a key lesson he has learned over the years: Bitcoin’s price discovery phase occurs every four years.

With this in mind, he urged the crypto community to take a step back and consider the bigger picture. He cautioned against the tendency to overreact during volatile market phases.

What will happen to Bitcoin after $100 thousand?

Notably, industry experts view Bitcoin reaching the $100K milestone as just the beginning. Bitwise CIO Matt Hougan argues that Bitcoin’s true goal is $500k, at which point he believes BTC will evolve into a mature store of value similar to gold. He expects Bitcoin to capture 50% of gold’s market capitalization, fueled by government and institutional investment.

In the short term, analyst Ali Martinez predicts that Bitcoin could reach $138K, perhaps $150K, before a pullback begins. Corrections could bring it down to $105K or $96K with support at $83K and $72K.

Institutional FOMO in Bitcoin at $100K

Notably, institutional investors are now buying Bitcoin with FOMO at $100K. A recent report revealed that publicly traded Bitcoin mining company Hut 8 plans to raise up to $500 million to purchase Bitcoin as a strategic reserve asset.

This institutional FOMO is further supported by data showing sustained buying pressure from US investors, as evidenced by the Coinbase Premium Index.