Data from Arkham Intelligence shows that the El Salvadoran government continues to pursue its “1 Bitcoin a Day” investment strategy, accumulating a total of 5.955 thousand BTC in its portfolio. Bitcoin’s price topped the $100,000 mark early Thursday morning, a development that put El Salvador’s President Nayib Bukele in a “delightful” mood.

El Salvador holds more than $610.5 million worth of Bitcoin (BTC), according to blockchain data tracking firm Arkham Intelligence. The country, which became the world’s first country to accept Bitcoin as legal tender in 2021, saw the value of its cryptocurrency portfolio rise when BTC broke the $100,000 barrier on December 5.

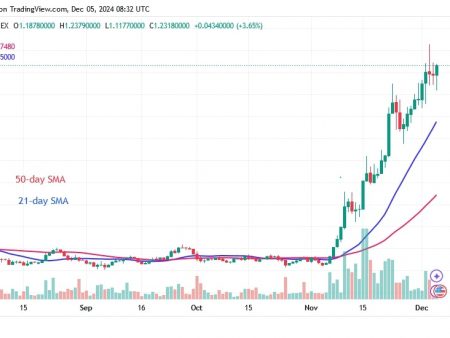

Bitcoin’s rise to six figures comes after a year of sustained growth and favorable macroeconomic factors coupled with Donald Trump’s recent victory in the US presidential election. At the time of writing, Bitcoin is trading at just over $101,000, representing a year-to-date gain of over 117%.

Bitcoin’s Impact on El Salvador’s Portfolio

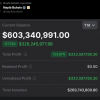

The government of El Salvador, which is buying Bitcoin, currently owns 5,995 BTC, purchased at an average price of $45,297 per coin. According to the current BTC valuation, the country’s assets are worth over $613 million, a significant 126.18% increase from their initial investment of $269.7 million.

President Bukele took to social media platform X to celebrate the achievement, posting a portfolio chart that showed unrealized gains of over $333.5 million. Tech mogul Elon Musk responded to the post, calling the Salvadoran government’s investment in Bitcoin “impressive.” Bukele responded with a photo with the caption: “It’s not much, but it’s honest work.”

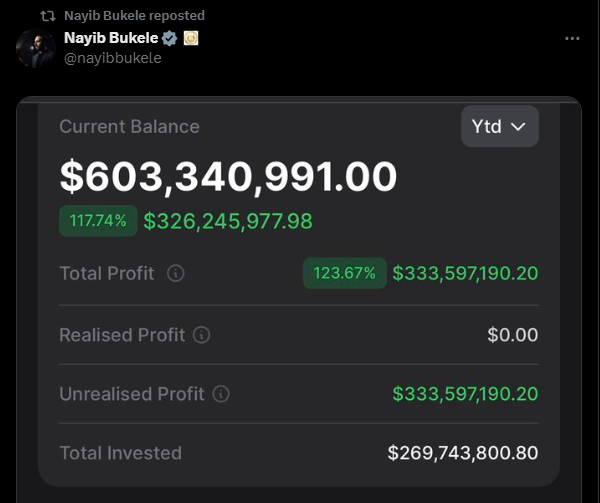

El Salvador’s experiment with Bitcoin began in September 2021. At the time, President Bukele faced significant skepticism from the International Monetary Fund (IMF) in declaring BTC legal tender. On November 17, 2022, Bukele posted on social media the country’s plan to purchase one Bitcoin per day.

Earlier this year, the IMF called on El Salvador to increase transparency in its bitcoin adoption strategy. He stressed the importance of taking additional measures to address potential risks associated with their monetary policy, believing that BTC will cause severe long-term economic consequences due to its price volatility.

The government initially came under fire from financial watchdogs for investing public funds in a volatile asset. However, Bukele remained steadfast in his bullishness on Bitcoin, arguing that Bitcoin would promote financial inclusion, attract tourism and reduce remittance costs.

Over the years, El Salvador has introduced several initiatives to support Bitcoin adoption. These include the development of Bitcoin City, a tax-free zone powered by geothermal energy from the country’s volcanoes, and the issuance of Volcano Bonds to finance infrastructure projects. Despite challenges including Bitcoin price fluctuations and public protests, the Bukele administration has maintained its commitment to Bitcoin.

Bhutan’s Parallel Bitcoin Strategy

El Salvador’s Bitcoin success story has inspired other countries, including Bhutan, which recently revealed its hydropower-powered Bitcoin mining operations. Like El Salvador, Bhutan is seeking to use Bitcoin to diversify its economy and increase its financial independence.

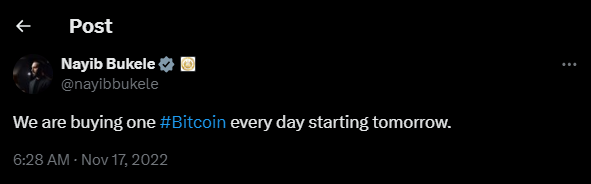

Arkham monitoring shows that at the time of publication, the Bhutanese government owned 12,211 thousand BTC, worth a total of $1.25 billion.

In September, Bhutan’s Bitcoin holdings exceeded 13,000 BTC, which was valued at approximately $750 million at the time. A month later, the government sold $33.5 million worth of Bitcoin through cryptocurrency exchange Binance.

Bhutan ranks fifth in the world in terms of BTC reserves, behind only the US, China, UK and Ukraine. Although the country’s current BTC reserves are significantly smaller than those of the US, China and the UK, Bhutan’s reserves exceed those of El Salvador.

From Scratch to Web3 Pro: Your 90-Day Career Start Plan