Ripple’s XRP performed remarkably well in November and early December 2024, attracting investor attention and attracting capital. However, various indicators suggest that XRPL’s native token may soon experience a corrective failure, raising alarm in the trading community.

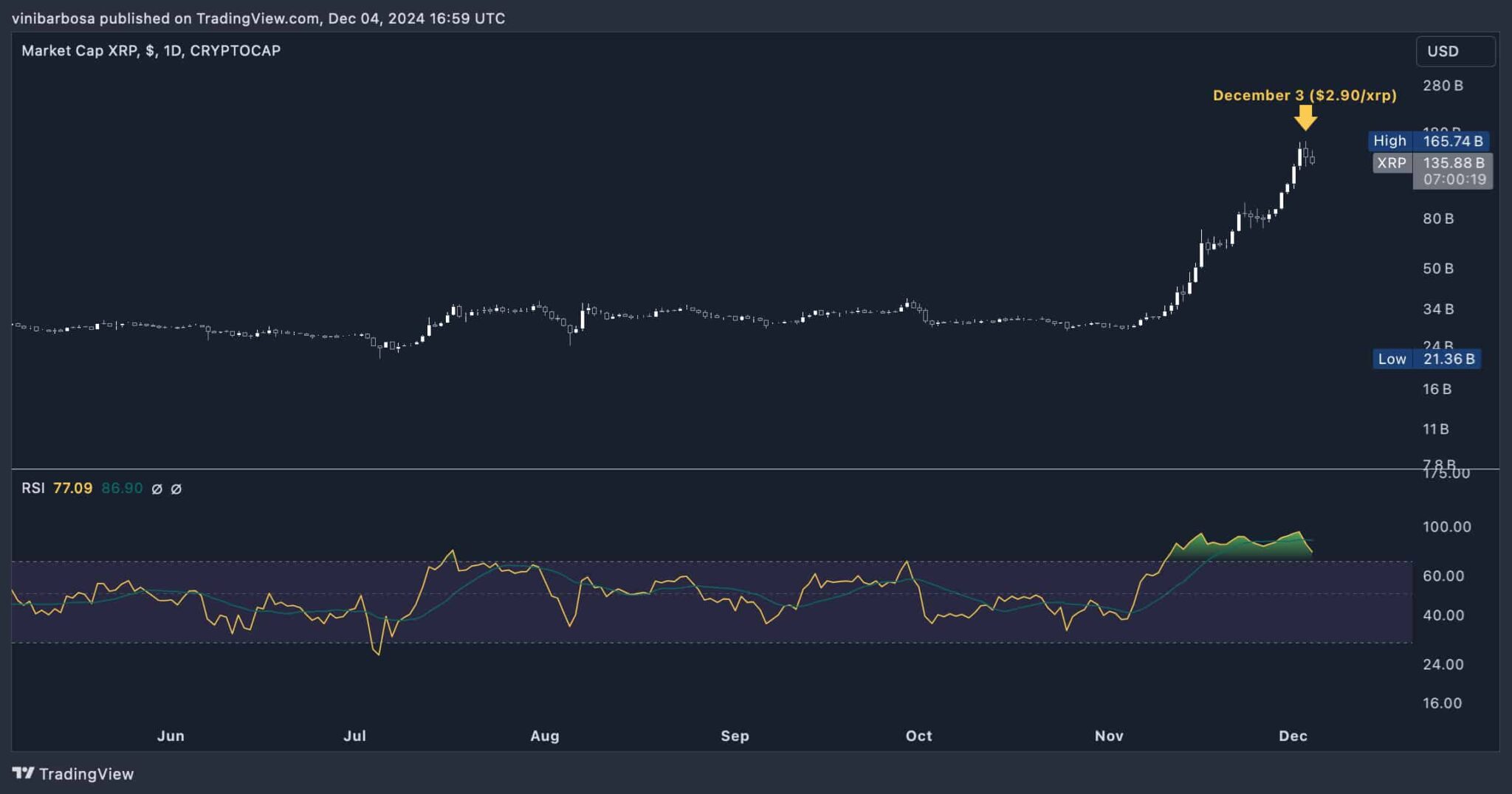

On December 3, XRP reached an all-time high (ATH) market capitalization of $165.74 billion at a price of $2.90 per token, despite trading at a discount to its all-time high price of $3.40. Notably, this rally made XRP the third most valuable cryptocurrency by market capitalization, surpassing Solana (SOL) and USDT Tether.

The ATH capitalization suggests peak demand amid significant inflation in the circulating supply of XRP due to Ripple’s ongoing unlocking and selling activities. Ripple, which is by far the largest holder of XRP, recently prepared for what may be its final reset in 2024.

As demand peaks and retailers turn their attention to the digital asset launched in 2012, technical indicators point to greed and fatigue.

Technical Indicators Suggest XRP Could Crash Soon

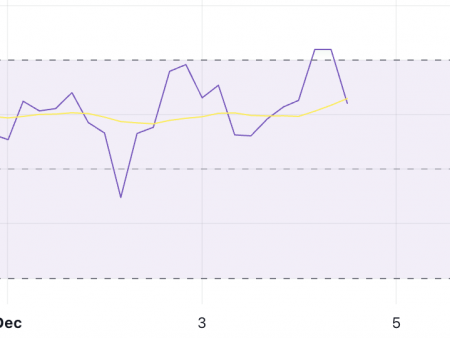

In particular, the daily XRP Relative Strength Index (RSI) since November 11 shows a clear overbought condition above 75 points. During the record high market capitalization, the RSI peaked at 95 points, which is usually an appropriate warning.

The weekly RSI is showing an equally worrying signal that XRP could soon experience a belated correction, currently at 91.17.

Interestingly, the last time XRP’s weekly RSI marked such an overbought position, the token fell nearly 80% from November to December 2020, hitting a local bottom at $0.1713 after hitting $0.788.

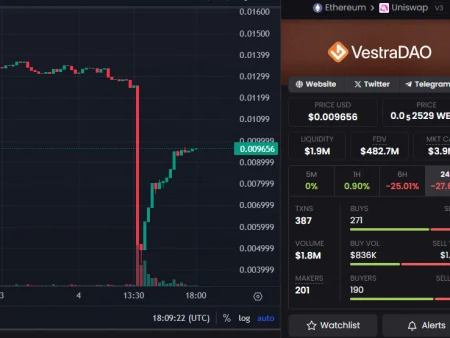

At the same time, decentralized finance analyst Andrey urged traders to “calm down with the leverage slider.” Andrey shared CoinGlassA heat map of funding rates that shows an over-leveraged cryptocurrency market that is highly imbalanced on long positions.

Brothers? take it easy with the leverage slider pic.twitter.com/5WqxFi3NL7

– Andrey ( ) (@AndreiMX_) December 4, 2024

Due to this, traders long XRP are currently required to pay short sellers a funding rate of 66% per annum. This opens the door to a potential long squeeze that could cause the XRP price to fall and seek downside support.

However, XRP may still find the strength to continue moving higher despite these signals, as it has done in the past. Cryptocurrencies are highly volatile and unpredictable assets, requiring extreme caution from traders and investors navigating their choppy waters.

Featured image from Shutterstock.