Hedera (HBAR) price has risen to its highest level since 2021, showing significant momentum in the cryptocurrency market. The coin has skyrocketed 721% in the last 30 days, outperforming most major cryptocurrencies in terms of gains.

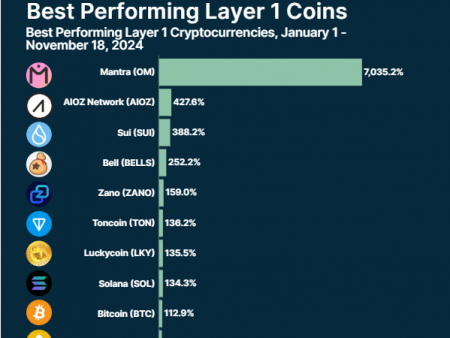

With a market capitalization reaching $13.44 billion, HBAR has surpassed well-known projects such as SUI, Uniswap and Litecoin. Technical indicators across multiple timeframes indicate strong bullish momentum, although some indicators hint at potential consolidation ahead.

The current HBAR uptrend is still strong

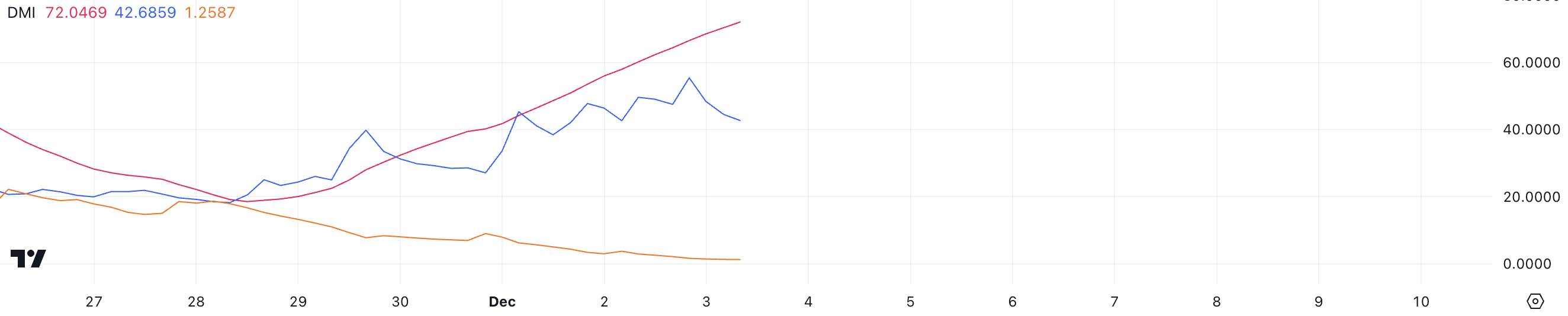

The HBAR Directional Motion Index (DMI) is trending very strongly, with an average Directional Motion Index (ADX) of 72.

ADX measures the strength of a trend regardless of its direction: values above 25 indicate a strong trend, and values above 50 indicate an exceptionally strong trend. At 72 HBAR, ADX indicates an extremely strong trend in the market.

The Positive Directional Indicator (D+) at 42.6, despite falling from 55, coupled with the very low Negative Directional Indicator (D-) at 1.2 confirms strong bullish momentum for HBAR price.

The wide spread between D+ and D- supports the continuation of the uptrend, although the decline in D+ suggests some easing of buying pressure. However, as long as D+ remains significantly above D-, the structure of the bullish trend remains unchanged.

The Ichimoku cloud shows that the header price may be overpriced

The Ichimoku Cloud chart for Hedera is showing strong bullish momentum, with the price trading well above the baseline (kijun sen) and conversion line (tenkan sen).

A wide separation between these lines indicates accelerating upward momentum, although prices may be moving too far above the baseline.

The cloud (kumo) structure is bullish, future cloud formation is in an upward trend, suggesting continued upward support.

However, the significant distance between Hedera’s current price and the cloud suggests that the price may be overextended in the short term, potentially leading to a retest of the cloud’s baseline or top as support levels during any consolidation phase.

HBAR Price Prediction: Could It Pull Back to $0.27?

Hedera’s price action is showing exceptional bullish momentum, rising 721% in 30 days and reaching levels not seen since 2021. The EMAs are in a perfect bullish position, with shorter timeframes outperforming longer ones, suggesting continued upward momentum.

A break above the $0.39 resistance could trigger further advances towards the psychological $0.45 and $0.50 levels, representing a 42% upside potential.

However, the extended rally saw the price well above key EMAs and the Ichimoku Cloud, indicating a possible overextension in HBAR price.

Support levels at $0.27 and $0.19 could provide bounce points during any corrective moves, with $0.12 serving as critical support if selling pressure intensifies.