Helium (HNT) has been among the top performers in the last few sessions.

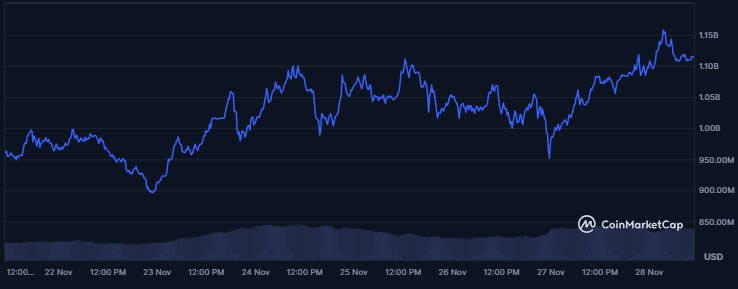

The bullish price action over the previous seven days has seen the company’s market capitalization rise from a one-week low of $899 million to $1.16 billion today.

The uptrend indicates a strong bullish resurgence, giving HNT the opportunity for stable price action.

Technical indicators support the optimistic outlook for helium.

The token has broken through the $6.50 resistance and is currently trading at $6.53. Staying above this zone will trigger an uptrend to $7.2 and above.

HNT is ripe for further growth

Helium’s latest performance appears to have shifted its trajectory towards bullish growth.

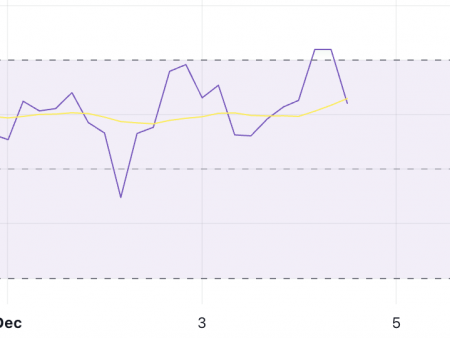

The digital coin is hovering well above the vital 50-day and 200-day exponential moving averages on the 4-hour time frame.

This signals significant buying momentum that is likely to keep prices higher in the coming sessions.

Additionally, the EMA lines highlight a potential golden cross.

A bullish pattern occurs when the shorter-term EMA crosses above the longer-term EMA, suggesting the start of a sustained rally.

The moving average convergence and divergence line crossed the signal line upward on the daily chart.

The green bars of the histogram confirm the bullish case for HNT.

Additionally, a relative strength index of 55 indicates more room for growth before the altcoin reaches overbought areas.

The indicator rose from 46 to pressure levels during the day, highlighting strengthening bullish momentum.

RSI measures the speed and strength of price trends on a scale of 0 to 100.

Readings above 70 indicate overbought conditions and possible declines, while readings below 30 indicate oversold conditions, often causing a rebound.

The current value indicates that HNT may rise further before reaching overbought territory.

Chaikin’s latest cash flow jump out of negative territory adds to the bullish narrative.

The indicators rose from -0.04 on November 26 to +012 at the time of publication, confirming investor confidence in HNT’s performance.

The CMF measures capital flows into and out of digital currency: values above 0 indicate buyer dominance, and values below 0 signal selling pressure.

Chaikin’s current cash flow highlights the huge bullish sentiment.

This shows that capital inflows are supporting the prevailing upward trend. Continuing this trend will likely mean further increases in the price of HNT.

Helium price forecast

At the time of publication, the altcoin is trading at $6.53, up 15% in the last 24 hours.

Notably, it broke above the $6.50 resistance zone, confirming continued gains ahead of a possible decline.

The emerging golden cross will welcome massive bullish moves that will lift the altcoin above $7.2 and cement the bullish trajectory.

However, sudden selling activity will weaken the uptrend, pushing HNT towards critical support levels.

The token will likely fall to $6.0 before reaching $5.57 or $5.28. This will result in a total loss of 20% from current prices.

Post-Helium Momentum Intensifies as Market Cap Recovers $1B: What’s Next for HNT Price? appeared first on Invezz