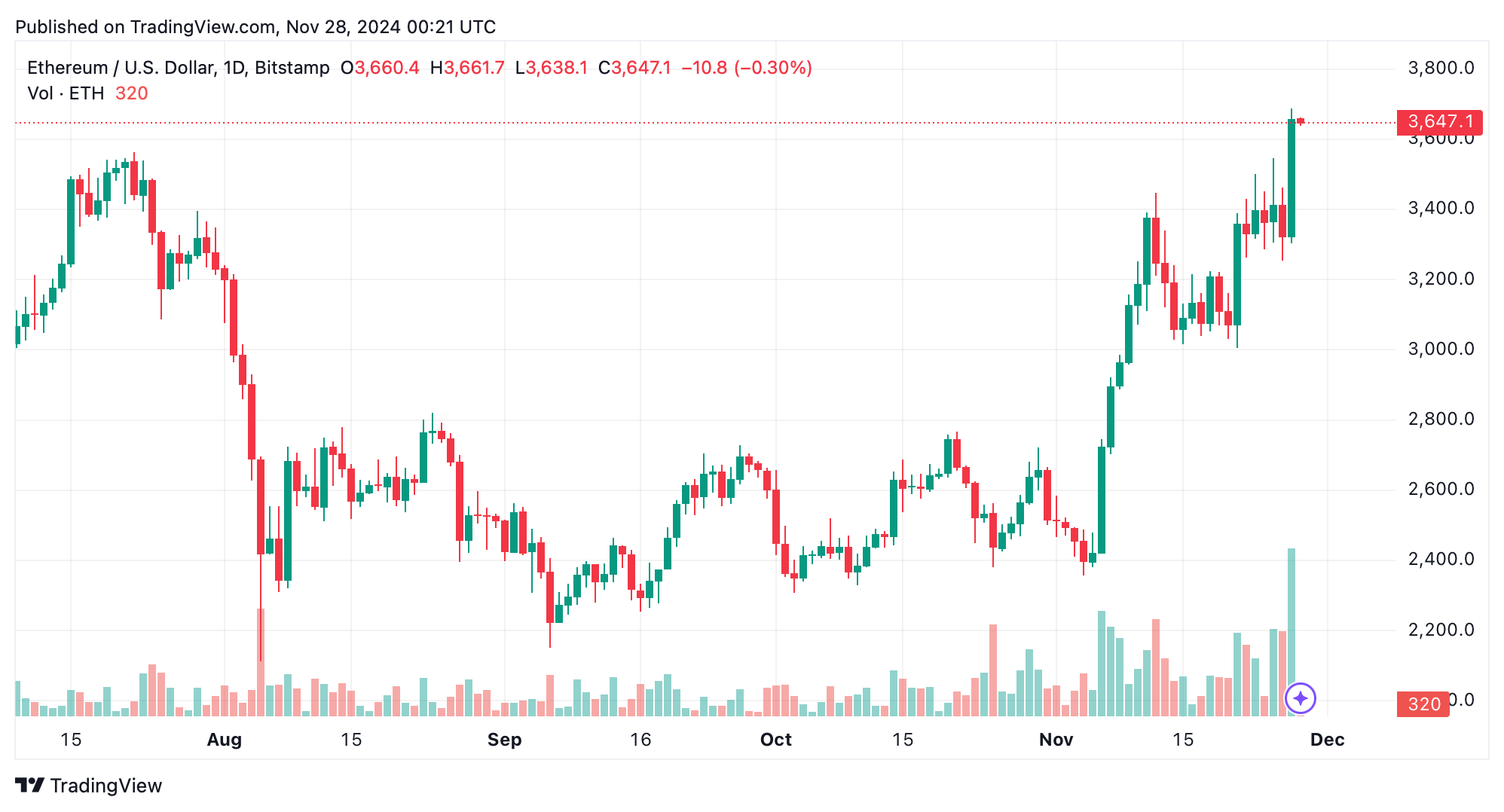

As Bitcoin rallied slightly on Wednesday, Ether (ETH) stole the spotlight, jumping more than 10% in just 24 hours. The second-largest cryptocurrency currently claims over 13% of the total market capitalization of $3.33 trillion.

Ether’s $47 Billion Jump Sparks Wild Speculation: Beyond $7,500?

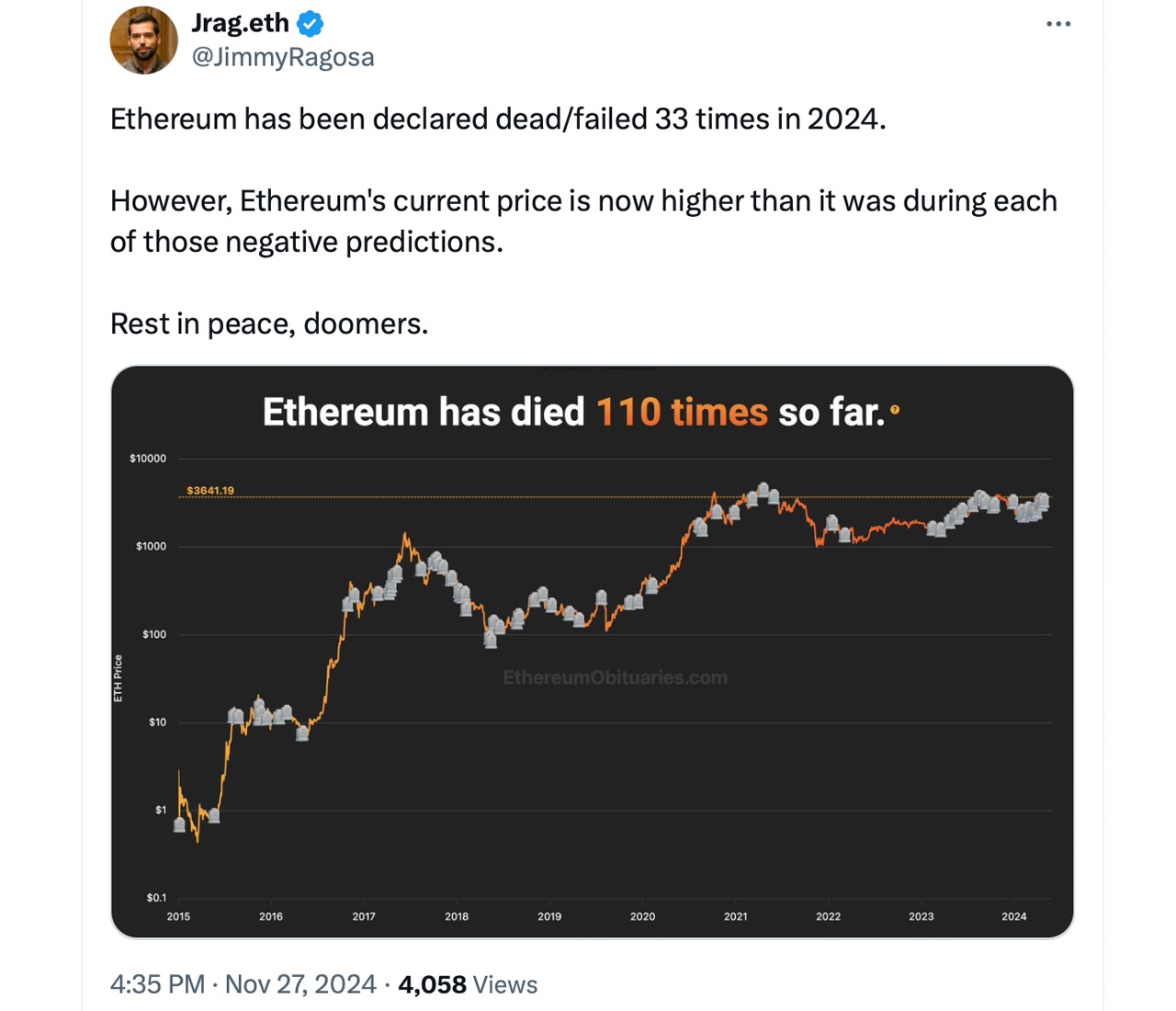

Bitcoin (BTC) gained 4.4% against the US dollar over the same period, but Ethereum surged ahead, rising 10.66%. In 2024, BTC left Ethereum (ETH) in the dust, outperforming it by almost three times – a gap that demonstrates the clear difference in their market performance this year.

However, Ethereum tends to shine when Bitcoin slows down, and Wednesday, November 27 was no exception. Ether trading volume was $47.87 billion, with leading exchanges such as Binance, Digifinex and Bybit leading the way.

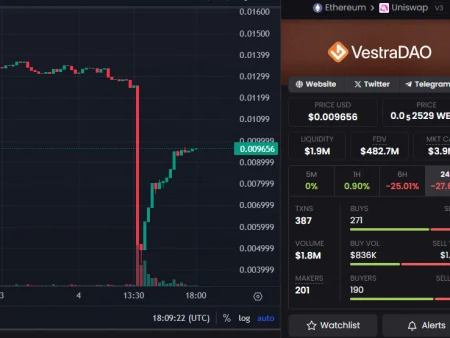

Tether (USDT) has become the most popular ETH trading pair, behind US Dollar, FDUSD, USDC, BTC, Korean Won and Euro. Meanwhile, on the derivatives side, $56.5 million was liquidated in the last day, with $47.73 million of that coming from short ETH positions. Trading at $3,647, Ether still needs to climb 24.8% to reclaim its all-time high of $4.8K set in 2021.

This upward momentum has sparked optimism among enthusiasts. “Ethereum SuperTrend Weekly Chart Triggers Buy Signal,” said Tony “Bull” Severino on X. “Ether is up 120% since the 2023 Buy Signal.” Severino added:

Another 120% of today’s signal will be $7,500 per share. [ethereum].

Ethereum’s recent rise hints at a possible shakeup in the crypto scene as traders set their sights on altcoins. Blockchaincenter.net’s Altcoin Season Index (ASI) currently scores 65 out of 100, approaching the 75 required to declare “altcoin season.” While Ether still has a ways to go to reach its peak, this momentum could reignite enthusiasm for altcoins.