With Bitcoin barely reaching $100,000, are profit takers in control of the market, or is it setting up for another massive rally?

Table of contents

BTC is cooling down

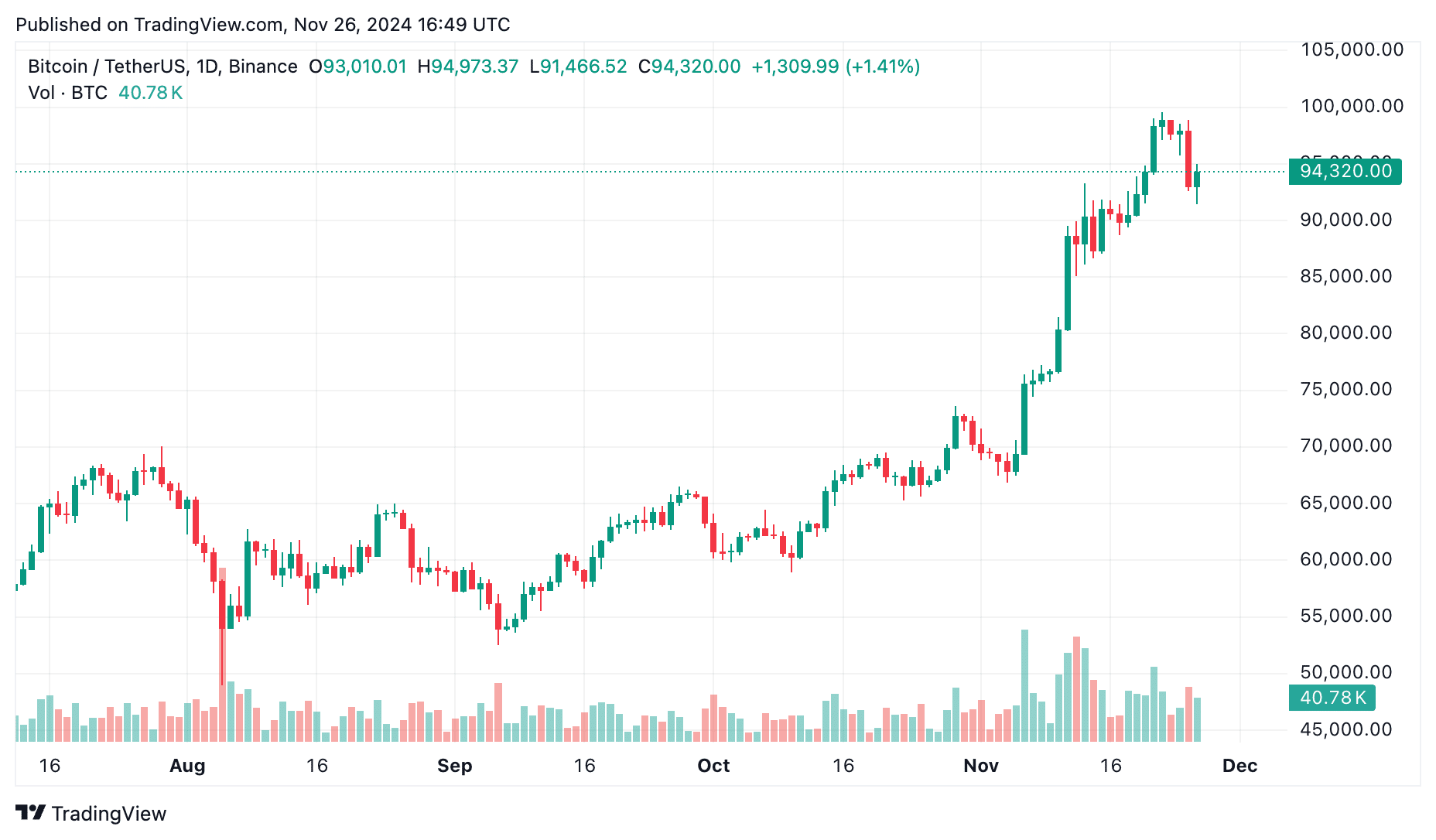

Bitcoin (BTC) has seen a spectacular rally lately, but the party appears to be taking a breather. After approaching the $100,000 mark, the world’s largest cryptocurrency by market capitalization is cooling off.

As of November 26, Bitcoin is trading at $94,300, down 3% in the last 24 hours. This pullback comes after BTC hit an all-time high of $99,655 on November 22.

The recent price action seems to be a classic case of profit taking. This selling pressure was initially mitigated by strong demand from spot Bitcoin ETFs, which saw net inflows over five days.

However, on November 25, this trend changed: according to CoinGlass, outflows from the ETF amounted to $435 million.

However, zooming out, the broader sentiment around Bitcoin remains bullish. Following the US presidential election on November 5, when Donald Trump unexpectedly returned to the political scene, BTC rose by more than 30%.

Meanwhile, anticipation of political changes, especially with the impending resignation of SEC Chairman Gary Gensler, who is scheduled to step down on January 20, 2025, has only fueled speculation that cryptocurrency may finally find itself on a friendlier regulatory footing.

So where does Bitcoin go next? Has the peak already been reached or is this just a pause before the next ascent? Let’s find out.

What’s really going on with Bitcoin?

While Bitcoin endures its current correction, the larger story around BTC remains inextricably linked to one of its most ardent proponents: MicroStrategy.

The software and Bitcoin investment firm led by Michael Saylor made headlines again with its monumental purchase of 55,500 BTC between November 18 and November 24.

MicroStrategy purchased 55,500 BTC for ~$5.4 billion at a price of ~$97,862 per #bitcoin and achieved BTC returns of 35.2% QTD and 59.3% YTD. As of 11/24/2024, we hold $386,700 BTC purchased for ~$21.9 billion at ~$56,761/Bitcoin. $MSTR https://t.co/79ExzXk4UM

— Michael Saylor⚡️ (@saylor) November 25, 2024

The $5.4 billion acquisition—at an average price of $97,862 per bitcoin—represents MicroStrategy’s largest weekly purchase to date. With this latest success, the company now owns approximately 386,700 BTC, purchased at an average price of $56,761 per token.

MicroStrategy has now disclosed Bitcoin acquisitions on three consecutive Mondays since Donald Trump’s re-election, accumulating $11.43 billion worth of BTC in November alone.

This aggressive accumulation reinforces institutional confidence in Bitcoin as a long-term asset, fueled by expectations of a crypto-friendly regulatory environment under the new administration.

However, in the short term, these high-profile purchases add volatility to an already volatile market. On November 25, Bitcoin was trading at $98,000, but after the purchase price of $97,862 was announced, speculative traders reacted quickly. Within hours, BTC fell to $92,240, triggering a sharp liquidation in the derivatives markets.

According to CoinGlass, as of November 26, more than $149 million worth of BTC futures contracts were wiped out in the last 24 hours, with bulls bearing the brunt of the brunt—$113 million in longs liquidated, compared to $35 million in shorts.

Retail traders tend to interpret institutional bid prices as market benchmarks, often moving their bids closer to these levels. When this occurs during a period of heightened market leverage, even minor corrections can escalate into sharper sell-offs as liquidation cascades unfold.

Despite this short-term turbulence, the long-term outlook remains optimistic. With over 134,000 BTC taken out of the market in November alone, the company is essentially locking up liquidity, leaving less Bitcoin available to meet future demand.

Over time, this could increase price momentum during the next surge in buying interest.

Experts Shed Light on BTC’s Path

Bitcoin’s recent pullback may seem alarming, but experts in the crypto space are calling for calm – and with good reason.

Santiment, a leading online analytics platform, recently shed light on an important trend: the behavior of large Bitcoin holders.

🐳 Is it time to panic after Bitcoin opened the week with a moderate pullback below $95K? Whales and sharks certainly don’t think so. In November alone, wallets with a minimum of 10 BTC accumulated another 63,922 coins (worth $6.06 billion). As long as they keep moving… pic.twitter.com/6EVS9UtFtm

— Santiment (@santimentfeed) November 25, 2024

Even though the Bitcoin price fell below US$95,000 this week, wallets holding at least 10 BTC were actively accumulating, adding more than 63,922 Bitcoins in November alone, worth approximately US$6.06 billion.

As Santiment noted, “any drop could be short-lived” as long as these wallets continue to increase their holdings.

Meanwhile, Ki Young Joo, CEO of CryptoQuant, noted that even during the explosive bull run in 2021, sharp corrections of up to 30% were common.

Even with a parabolic bull run, Bitcoin could see a -30% pullback.

Similar corrections occurred repeatedly during the price opening in 2021 from 17 thousand to 64 thousand.

This is not a call for a correction – just manage your risk and avoid panic selling at local lows. We are in a bull market. pic.twitter.com/B5zpk7P0N9

— Ki Young Ju (@ki_young_ju) November 26, 2024

These pullbacks, he explains, were a natural part of the price discovery process that took Bitcoin from $17,000 to $64,000 in just a few months. As Joo says, “We are in a bull market.”

Adding to this bullish sentiment is crypto analyst Michael van de Poppe, who has highlighted a fundamental difference between this cycle and the past: the sharp decline in Bitcoin reserves held on exchanges.

This is a HUGE difference from previous cycles.

The amount of $BTC on exchanges has decreased significantly and continues to decline.

A supply shock is inevitable as large amounts of liquidity are added.

This cycle will take us much further than we all expect. pic.twitter.com/m5gCMA5isd

– Mikael van de Poppe (@CryptoMichNL) November 25, 2024

This drop means more investors are moving their BTC into long-term storage, effectively reducing the supply available for trading. Van de Poppe sees this as a precursor to a “supply shock,” especially as more liquidity enters the market.

As demand outstrips supply, Bitcoin could outperform expectations. As he predicted: “We will go much further in this cycle than anyone expects.”

What to expect next?

For Bitcoin, the focus remains on investor behavior and macroeconomic factors. While whales and long-term holders are steadily absorbing available supply, short-term volatility persists as speculative traders review their positions.

The market appears to be balancing between two scenarios: a consolidation phase in the $90,000-$95,000 range or a sharper pullback to the $85,000 level driven by liquidity pressures and derivatives positioning.

Despite this, fundamentals such as dwindling foreign exchange reserves and sequential accumulation indicate that any decline is likely to generate strong buying interest.

These dynamics set the stage for a potential recovery if demand picks up sharply, especially since the holiday season often brings increased activity from retail investors.

However, altcoin investors should proceed with caution; While a fall in Bitcoin’s dominance could signal opportunity for altcoins, a sharp correction in Bitcoin could drag the entire market down, which is what we are currently seeing.

These market sentiments are compounded by geopolitical risks. The escalation of the Russian-Ukrainian conflict and growing instability in the Middle East could potentially shake global markets, increasing risk aversion.

Such developments could temporarily impact sentiment in the cryptocurrency space, especially for altcoins, as investors flock to safer assets.

Against this backdrop, all eyes are on the December Federal Reserve meeting, which has key implications for financial markets, including cryptocurrencies.

There is currently a 52% chance that the Fed will cut interest rates by 25 basis points, bringing them to 4.25-4.5%.

If this cut materializes, it could serve as a tailwind for Bitcoin and the broader cryptocurrency market, lowering borrowing costs and increasing liquidity.

Therefore, Bitcoin’s near-term path will likely be determined by the balance between accumulation and market sentiment. As always, trade wisely and never invest more than you can afford to lose.

Disclosure: This article does not constitute investment advice. The content and materials provided on this page are for educational purposes only.