XRP has seen fantastic growth lately, reaching remarkable highs and boosting market confidence. However, technical analysis and current network indicators indicate that the rally may be coming to an end. The following three factors suggest a reversal may be imminent. There has not been a sustained increase in trading volume due to the recent rise in XRP prices.

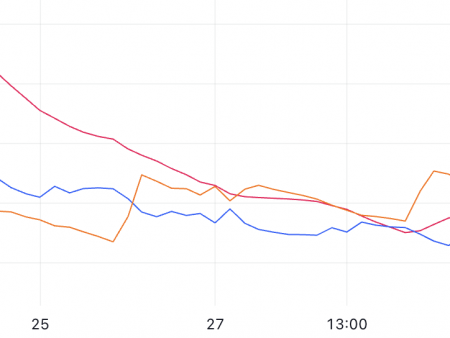

The price managed to break above $1.06 before pulling back, but volume has been falling over the past few sessions, suggesting a lack of sustained buying interest. This divergence suggests that the bullish momentum may soon weaken, and this is often a sign of exhaustion in the market. On-chain data shows that XRP payment volume has declined sharply since peaking in mid-November.

The decrease in the number of active accounts corresponds to this decrease in activity, indicating a decrease in network usage. A decrease in transaction volume in the XRP ecosystem could undermine underlying price support, which could lead to a correction. The XRP Relative Strength Index (RSI), which currently stands at 85, has been consistently in overbought territory for a significant period of time.

Such high RSI values often indicate an overheated market, making the asset susceptible to declines. Taking profits at these levels could lead to further price declines as the bears take control of the situation. The $1.50 level is needed to support XRP. The next major support is around $1.20, and if the price moves outside of this range, it could lead to a larger correction.

However, XRP could consolidate before attempting another rally if buyers step in to defend $1.05. Despite XRP’s impressive recent performance, caution is advised due to warning signs such as declining volume, declining payment activity, and overbought technical indicators. To assess the sustainability of the current uptrend, investors should keep a close eye on these indicators.