India’s economy is juggling two realities: a sluggish manufacturing sector and explosive growth in services and cryptocurrencies.

November numbers are missing, and they tell a story of ups and downs that reflect the country’s difficult economic situation. Manufacturing has slowed, services have grown, and cryptocurrency continues to dominate despite regulatory crackdowns and high taxes.

The manufacturing purchasing managers’ index (PMI) fell slightly to 57.3 from October’s 57.5. In contrast, the services index rose to 59.2 from 58.5, according to preliminary data from HSBC Holdings. Together they pushed the composite index to 59.5, a slight increase from 59.1.

A PMI above 50 means growth, below means contraction. So while manufacturing weakened, the services sector shouldered the burden, achieving its highest employment index since December 2005, thanks to strong demand and better business conditions.

Production is slowing, inflation is biting

Even as the manufacturing sector slowed, HSBC India chief economist Pranjul Bhandari said it “managed to beat expectations.” But the rising costs are taking a toll.

Manufacturers face higher commodity prices, while food and wages are driving up inflation in the services sector. As a result, private companies raised prices again in November, passing the costs on to consumers.

City spending is also slowing, making the situation worse. Economists have adjusted their GDP growth forecasts for the year ending March 2025.

Goldman Sachs now forecast growth of 6.4%, a notable downgrade that reflects these challenges. Despite this, the services sector is a bright spot, supported by strong demand and businesses looking to expand.

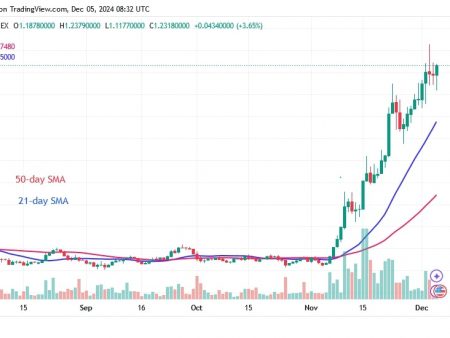

Cryptocurrency is thriving despite strict regulations

The Indian crypto scene is not particularly worried about the slowdown. It thrives even under the strictest regulations in the world. The country has a 30% tax on cryptocurrency profits and a 1% tax on every transaction, known as tax deducted at source (TDS).

These policies have prompted some investors to move to international exchanges with friendlier regulations, but India still leads the world in cryptocurrency adoption. It ranks first in the Global Cryptocurrency Adoption Index and second in the Central and South Asia region based on total cryptocurrency value received.

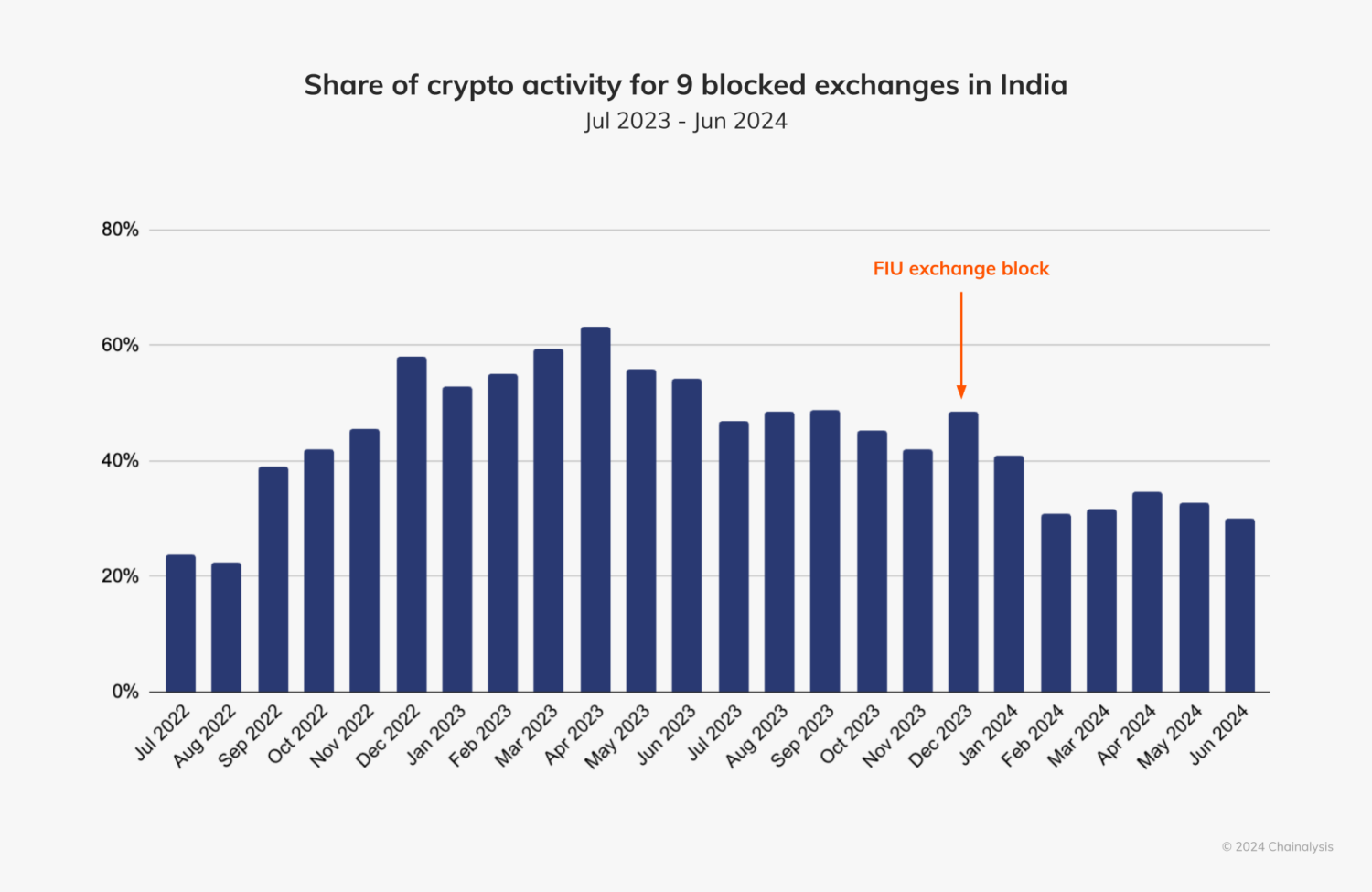

In December 2023, India’s Financial Intelligence Unit (FIU) cracked down on nine offshore exchanges, including Binance, Kraken and KuCoin, for failing to comply with anti-money laundering laws.

The FIU has asked the Ministry of Electronics and Information Technology (MeitY) to block the URLs of these exchanges for Indian users.

However, this block was not as effective as expected. Users who had already downloaded these apps could still access them, and some platforms remained available for new downloads.

From Scratch to Web3 Pro: Your 90-Day Career Start Plan