- Ethereum developers agreed to split the Pectra update into two stages.

- The first phase of the Pectra update will begin in early 2025 and will include proposals to improve the wallet experience.

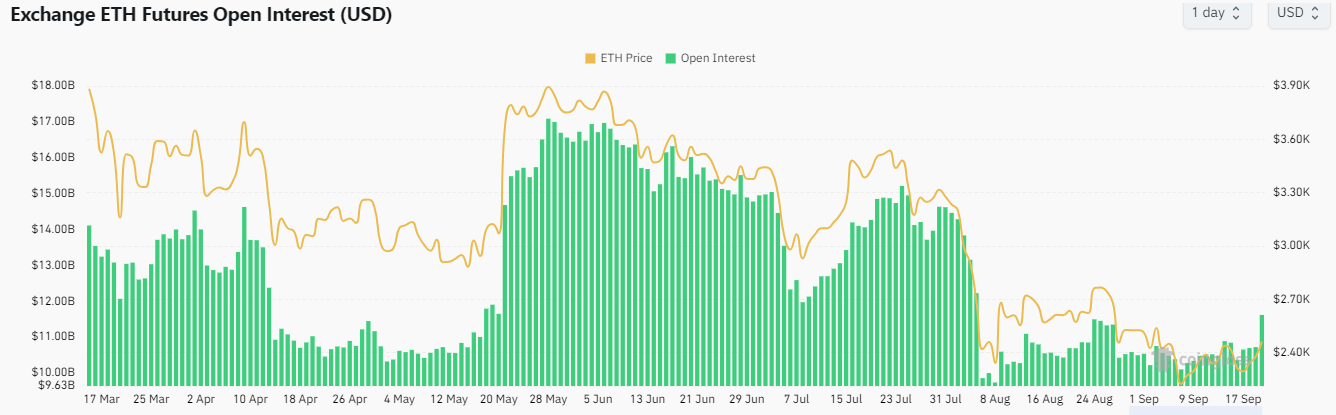

- Ethereum could continue to rise if open interest continues its uptrend and ETH breaks above the $2,595 resistance.

Ethereum rose 6% on Thursday following the recent decision by core mainchain developers to split the upcoming Pectra update into two phases.

Ethereum core developers have agreed to split the Pectra update into two stages

During a consensus conference on Thursday, Ethereum developers decided to split the upcoming Pectra update into two parts. The decision follows concerns about potential risks in submitting a previously approved series of Ethereum Improvement Proposals (EIPs).

Pectra was supposed to be the biggest Ethereum upgrade in recent memory; however, the core developers have decided that it will now include a select number of offerings in two phases to make the update less cumbersome.

The first phase will feature eight EIPs, including Ethereum co-founder Vitalik Buterin’s EIP-7702, which introduces a new account abstraction method that will improve the user experience in wallets.

The second phase will involve updating how bytecode is processed and executed by the Ethereum Virtual Machine, a decentralized virtual computing engine that executes smart contracts on the main chain. It will also include EIP-7594, which aims to implement a protocol to improve blob capacity.

The first stage of the Pectra update will begin, as previously planned, in early 2025, and the second stage will come much later.

According to the core developers, the decision to split the update allows key features to be implemented in the first phase, while leaving room for the second to be implemented correctly.

Meanwhile, Ethereum ETFs saw net outflows of $9.8 million on Wednesday following a $14.7 million exit from Grayscale’s ETHE and an inflow of $4.9 million from BlackRock’s ETHA.

Ethereum could continue to rise if it breaks through the $2,595 resistance

On Thursday, Ethereum traded at $2,460, up more than 6% on the day. In the last 24 hours, over $31 million worth of ETH liquidations were recorded, with long and short liquidations amounting to $5.68 million and $25.33 million respectively.

Ethereum broke above $2,395 and downward trendline resistance as buyers picked up momentum following the Federal Reserve’s (Fed) rate cut by 50 basis points on Wednesday.

4-hour ETH/USDT chart

This move could push ETH higher towards the $2,595 rectangle resistance. If it fails to see a correction around this level, it could target the key price level of $2,817. After setting a yearly high in March, the $2,817 price level served as a major support level for over four months following ETH’s consolidation. A recovery at this level could strengthen the bullish momentum.

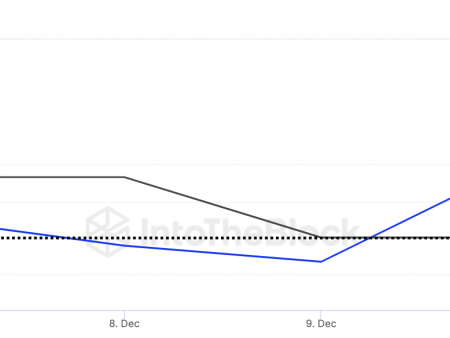

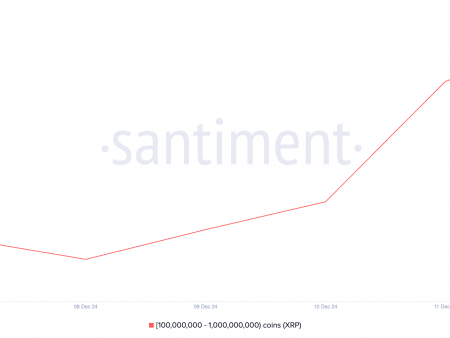

Open interest (OI) in ETH futures also paints a bullish picture, rising more than 10% to over $10.7 billion in the past 24 hours, the highest level since the August 5 market crash.

Open interest is the total number of outstanding long and short positions in the derivatives market. An increase in OI often indicates increased confidence among traders, while a decrease in OI often indicates that traders are either closing positions or undergoing liquidation.

ETH Open Interest

The rise in ETH OI indicates that traders are increasingly confident in the greater growth potential of ETH. A sustained increase in this indicator could result in ETH maintaining its upward trend.

The 4-hour relative strength index (RSI) and stochastic entered oversold territory above 70 and 80 respectively, indicating a potential correction is looming.

A daily candle below $2,395 will invalidate this thesis and lead to another ETH consolidation.

In the short term, $56.57 million worth of positions are at risk of being liquidated if ETH falls to $2,412.