The price of Dogecoin (DOGE) has slightly decreased by 0.47% over the past 24 hours. Amid this decline, DOGE has formed a key resistance at 32.68 billion coins, according to IntoTheBlock.

What does 32.68 billion resistance mean for DOGE

For DOGE, breaking this resistance is very important as it can determine the future price movement. A rise in total volume above 32.68 billion can trigger an increase in the price of DOGE. If the coin overcomes the current selling pressure and breaks this level, its price can jump to $0.115 in the long term.

On the contrary, a drop below this level could send the meme coin into further downtrends. This means that the current Dogecoin price drop does not hold water until the meme coin crosses this key resistance level.

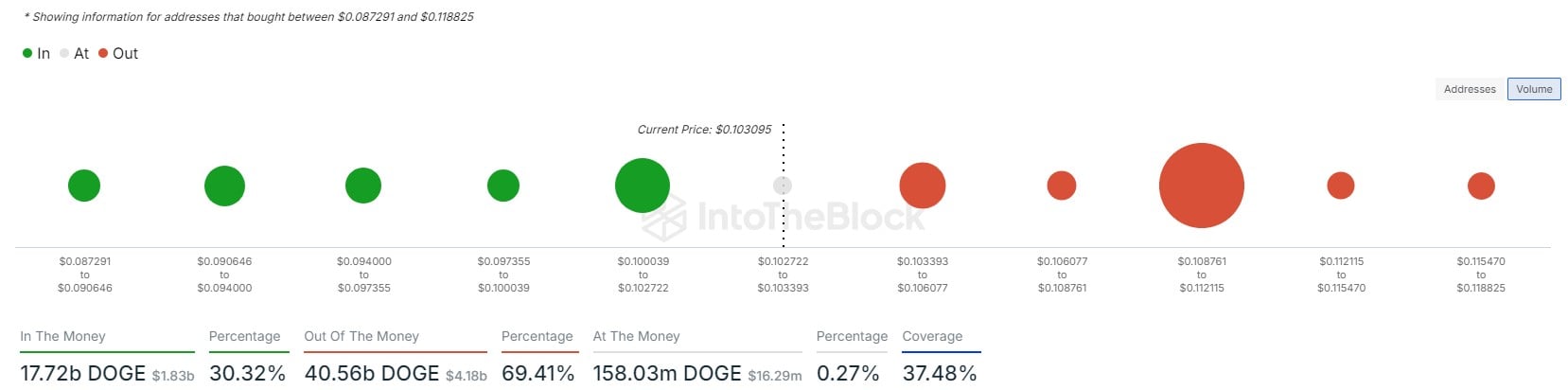

Meanwhile, the in/out of the money indicator, a tool used to assess the profitability of addresses holding DOGE, shows that 69.41% of coin holders are out of the money. This indicates that selling pressure is increasing, as has been noted in Dogecoin’s recent performance.

However, 30.32% of addresses are currently holding DOGE in profit. This percentage represents holders who may be less inclined to sell, providing a solid level of support for the meme coin. Additionally, Dogecoin’s 24-hour trading volume is down 12%, indicating that a potential reversal may be on the horizon.

Faith in Dogecoin’s Recovery

Activity by large coin holders, often referred to as “whales,” has also contributed to Dogecoin’s recent resistance and support levels. Typically, activity by large holders can have a greater impact on price than activity by smaller retail investors.

As previously reported by U.Today, large holders recently withdrew $30 million worth of DOGE from exchanges. This may indicate that these large investors are preparing to hold DOGE for a long period in the hopes of future price growth. Their activity may lead to Dogecoin price stabilization due to less selling pressure caused by smaller stocks on the exchange.