According to a recent report from Copper Research, Bitcoin’s price momentum has slowed due to global events, while Ethereum’s limited supply could push the price higher.

The latest edition of Copper Research’s “Opening Bell” report highlights that despite Bitcoin’s (BTC) resilience to the German government’s 40,000 coin sale, overall market conditions remain challenging, eroding any gains Bitcoin has made since its all-time high in March.

The report says that Bitcoin buying activity is low due to increased market volatility caused by a series of global events. These events include the US election, unrest in the UK, tensions in the Middle East and changes in Japanese central bank policy.

Market participants initially took advantage of the decline during the German sell-off, but the report claims that recent market volatility has dampened interest in riskier assets, leading to minimal Bitcoin buying activity.

Given the unexpected supply from Germany, markets have actually shown no net gains. Since Bitcoin’s peak in March, ETFs have added just 40,000 coins, and prices are currently trading in the same range as during the German sell-off, according to the report.

Ethereum’s End of Year Growth

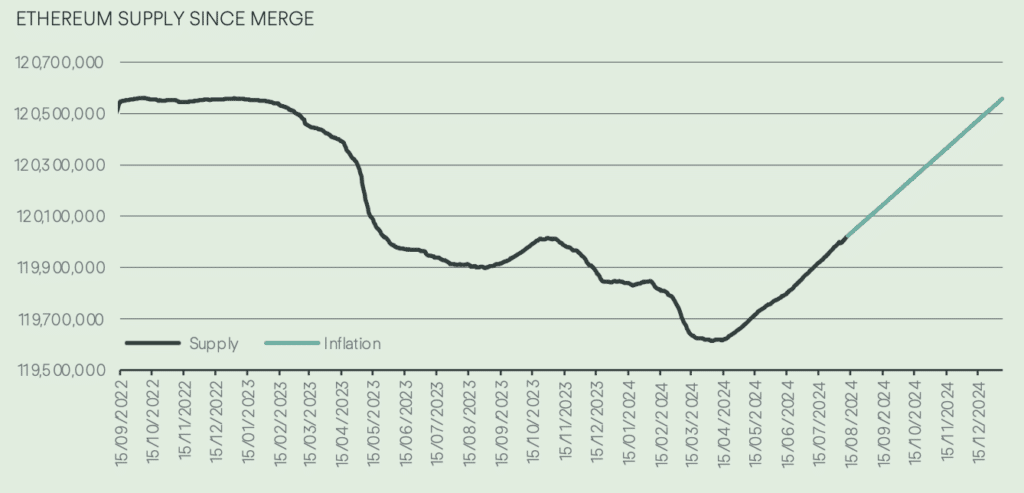

The dynamics of Ethereum (ETH) supply are also under close scrutiny, as the adoption of Layer-2 has returned the asset to an inflationary state since mid-April. However, a significant portion of ETH is locked in smart contracts.

Such limited supply could potentially reduce circulating supply and create upward price pressure towards the end of the year.

As of August 12, 66% of Ethereum addresses are in profit, with ETH trading just above $2,600. That’s up from last week, when only 63% were profitable.

However, that’s still down from the 75% return when ETH was above $3,159 earlier in the month, with 3.59 million addresses needing to push the price to $2,679-$2,755 to become profitable.

The Rise of Tokenized Assets

The report also notes that tokenized assets are experiencing significant growth, with blockchains adding more than $1 billion to tokenized government products this year.

McKinsey recently predicted that the market value of tokenized real-world assets could reach $4 trillion by 2030, driven by factors such as mutual funds and bonds.

BlackRock’s BUIDL product contributed to more than half of this growth, indicating strong market momentum. Other products, including Franklin Templeton’s BENJI 0.6 and Ondo Finance’s USDY and USDG, are also gaining significant traction.