Bitcoin (BTC) holders faced a tough time last Monday, when the price crashed from $61,000 to $54,000 in a matter of hours. The drop, dubbed one of the worst days for BTC this year, resulted in massive losses and liquidations.

While the coin has regained its previously lost peak, the data shows that BTC price may still be at risk of another decline.

Bitcoin Holders’ Behavior Raises Doubts

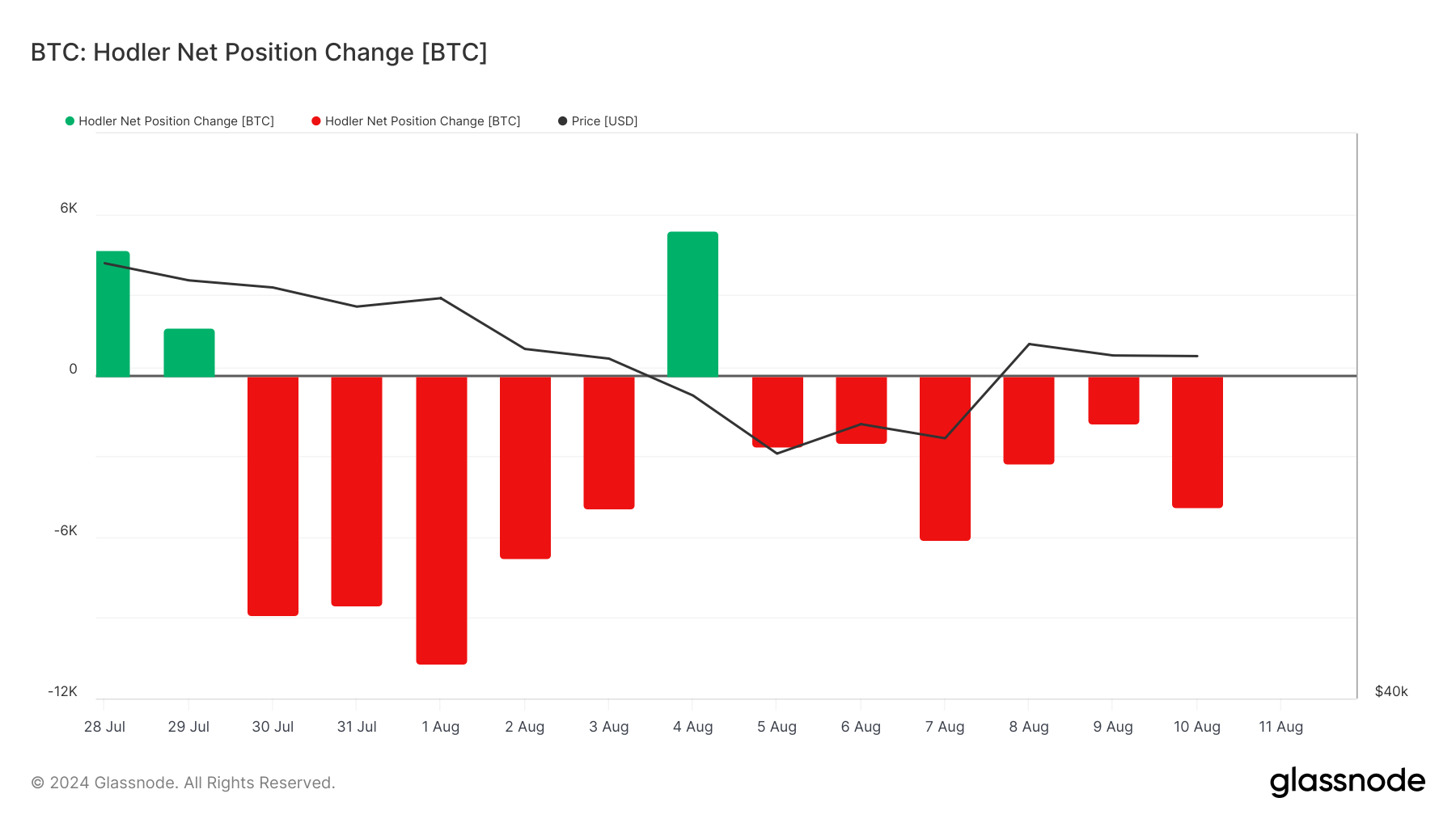

The most important metric that feeds this bias is the change in net holder position of Bitcoin. The change in net holder position tracks whether long-term holders are accumulating more coins or reducing their exposure to the cryptocurrency.

When this number goes up, it means that holders are buying more BTC, which suggests that the price could rise. However, a decline means that these long-term holders are cashing out and putting downward pressure on the price.

According to Glassnode, long-term holders have sold some of their coins since August 5. Despite the spot price rally in BTC, this group still parted with 4,881 BTC on Saturday, August 10.

Read more: Who will own the most Bitcoin in 2024?

Another factor that suggests a price decline in net spot ETF flows. Last Wednesday and Thursday’s trading sessions saw 12 Bitcoin ETFs collectively register inflows.

But on Friday, financial products saw a net inflow of -$89.73 million, according to SoSoValue, indicating there were more outflows than inflows. The surge in ETF inflows was vital to Bitcoin’s rally to its all-time high of $73,750 in March.

A series of outflows in the second quarter of the year also showed that institutional capital played a major role in driving up the price of BTC.

Millions of dollars have exited the ETF during this period, causing a significant drop in the price of BTC. So if the inflow remains negative as the new week begins, BTC could struggle to hold on to the $60,000 area.

Meanwhile, analyst Michael van de Poppe shared his opinion on the dynamics of the Bitcoin price.

“It’s still too early to talk about the start of the month, but if the monthly BTC candle closes around $60,000, it will look like consolidation before a big bullish breakout,” he noted.

BTC Price Prediction: $61,000 Is a Fragile Level

BTC is currently trading at $61,122. However, the daily chart shows that the cryptocurrency is approaching the supply zone between $61,616 and $62,477. If Bitcoin eventually reaches this region, it could face rejection, which could lead to a decline below $60,000.

Additionally, the Awesome Oscillator (AO) remains negative despite minor bullish signals. The AO compares short-term and long-term price movements to determine momentum. A positive reading on this indicator suggests that momentum is bullish and the price may rise.

Therefore, negative readings at press time mean that momentum remains bearish and a decline could be near. While BTC may not face a double-digit correction, the price could fall to $60,499 in the short term.

Read More: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, an increase in ETF inflows, accompanied by a surge in long-term accumulation by holders, could disprove this thesis. If this happens, the price of Bitcoin could jump to $63,205 or $67,058.