The stock and cryptocurrency markets have experienced significant volatility recently, with both sectors seeing capital outflows.

While both sectors have improved in the short term, there are persistent fears of further correction given the general fears of a recession. Indeed, buying opportunities usually arise in such volatility.

Investors may therefore be looking for the perfect winning combination of stocks and cryptocurrencies. That is why Finbold turned to OpenAI’s latest and most advanced artificial intelligence (AI) tool, ChatGPT-4o, to gather information.

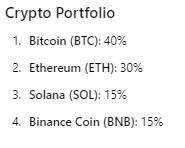

Crypto Choice

ChatGPT-4o has selected the following cryptocurrencies for the winning portfolio:

#1 Bitcoin (BTC)

The AI tool chose Bitcoin (BTC) as the top pick for the crypto portfolio. As the most established and widely accepted cryptocurrency, Bitcoin is often considered a safe haven. ChatGPT-4o noted that Bitcoin’s resilience and dominance make it a cornerstone of any crypto portfolio, recommending a substantial allocation of 40%.

In addition, Bitcoin’s widespread adoption and integration into mainstream financial systems enhances its stability, making it a reliable store of value and a hedge against economic uncertainty.

#2 Ethereum (ETH)

Ethereum (ETH) is in second place, with ChatGPT-4o recommending a 30% allocation, citing the platform’s status as a leader in decentralized applications (dApps) and smart contracts.

Ethereum’s move to a Proof-of-Stake (PoS) model and its role in supporting decentralized finance (DeFi) and non-fungible token (NFT) projects highlight its versatility and potential for future growth.

#3 Solana (SOL)

Solana (SOL), known for its high-speed transactions and low fees, is becoming a serious competitor to Ethereum, according to the AI tool. ChatGPT-4o recommended a 15% allocation, citing the platform’s technological advancements and growing user base as adding to its appeal.

#4 Binance Coin (BNB)

Binance Coin (BNB) also holds 15% of the shares in the portfolio curated by ChatGPT-4o. OpenAI said that Binance Coin, being an integral part of the Binance ecosystem, provides utility for trading fees and other services on one of the largest crypto exchanges, adding to its value.

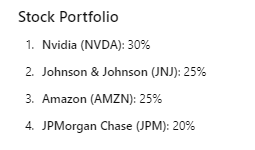

Selecting stocks

In terms of stock selection, ChatGPT-4o’s portfolio includes companies from different sectors such as technology, healthcare, and financials.

#1 Nvidia (NASDAQ: NVDA)

In the stock portfolio, ChatGPT-4o identified Nvidia (NASDAQ: NVDA) as the top pick. The company stands out as a leading provider of GPUs, benefiting from growing trends in AI, gaming, and data centers. Its graphics technology and innovation in AI computing allow it to remain at the forefront of the tech industry, justifying the 30% allocation.

#2 Johnson and Johnson

Johnson & Johnson (NYSE: JNJ), a diversified healthcare giant, offers stable earnings and dividends. With a broad product portfolio and strong R&D portfolio, it delivers consistent growth, and the AI tool recommends a 25% allocation.

Johnson & Johnson’s strong pharmaceuticals, medical devices and personal care segments provide diversified revenue streams.

#3 Amazon (NASDAQ: AMZN)

Amazon (NASDAQ: AMZN), which dominates e-commerce and is rapidly expanding its cloud services through AWS, adds another 25% to the portfolio. Its approach and continued expansion provide strong growth potential.

According to ChatGPT-4o, Amazon’s focus on customer service, logistics efficiency, and technological advances in artificial intelligence and machine learning strengthen its competitive advantage.

#4 JPMorgan Chase (NYSE: JPM)

JPMorgan Chase (NYSE: JPM) was selected from the financial sector for its diversified services, strong capital management, and resilience. Its strategic growth initiatives position it well for future returns, rounding out the portfolio with a 20% allocation.

JPMorgan Chase’s broad range of services, including investment banking, wealth management and consumer banking, as well as robust risk management practices, make it a cornerstone of the financial sector.

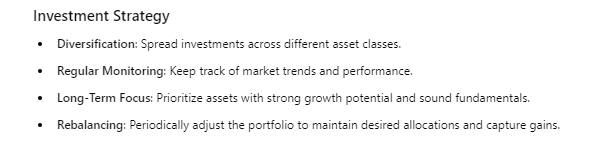

Investment strategy

ChatGPT-4o emphasized the importance of a well-diversified portfolio across asset classes to minimize risk. This approach balances high growth potential with stability.

He noted that maintaining a long-term perspective is key. Focusing on assets with strong growth potential and solid fundamentals is a strategy for building wealth sustainably over time.

Overall, with the US economy facing significant uncertainty due to fears of a looming recession, ChatGPT-4o’s carefully selected stock and crypto portfolio offers a balanced mix of proven, high-quality assets that have historically demonstrated resilience and the ability to weather downturns and benefit from future growth.

Disclaimer: The content of this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.