- AAVE has remained stable during the crypto market sell-off and secured $21 billion in volume across various Layer 1 and Layer 2 chains.

- AAVE’s treasury received $6 million in revenue from the liquidations and general carnage in the market.

- DeFi Token Eyes 15% Gain, Daily Chart Shows W-Shaped Formation and Potential Bullish Breakout in AAVE

- On Tuesday, AAVE is trading just below $100.

AAVE generated more than $6 million in revenue during Monday’s crypto market selloff. The decentralized protocol remained stable even as the price of top-30 cryptocurrencies plummeted.

Stani Kulechov, founder of AAVE, notes that the project raised more than $21 billion during the collapse in cryptocurrency markets on Monday.

As of writing on Tuesday, AAVE is trading above $99 and generating $10.905 billion, according to DeFi Llama.

AAVE earns $6 million in revenue

On Monday, Stani Kulechov commented on AAVE’s performance in the recent crypto market correction, which served as a stress test for the DeFi protocol. The project withstood the stress in 14 active markets on both Layer 1 and Layer 2 chains, while securing over $21 billion in value.

The AAVE treasury saw $6 million in revenue overnight, facilitating decentralized liquidations.

The Aave protocol has withstood market stress across 14 active markets at various L1 and L2 levels, generating $21 billion in profits.

Aave’s treasury received $6 million in overnight revenue from decentralized liquidations for securing the markets.

This is why building DeFi is FTW.

– Stani (@StaniKulechov) August 5, 2024

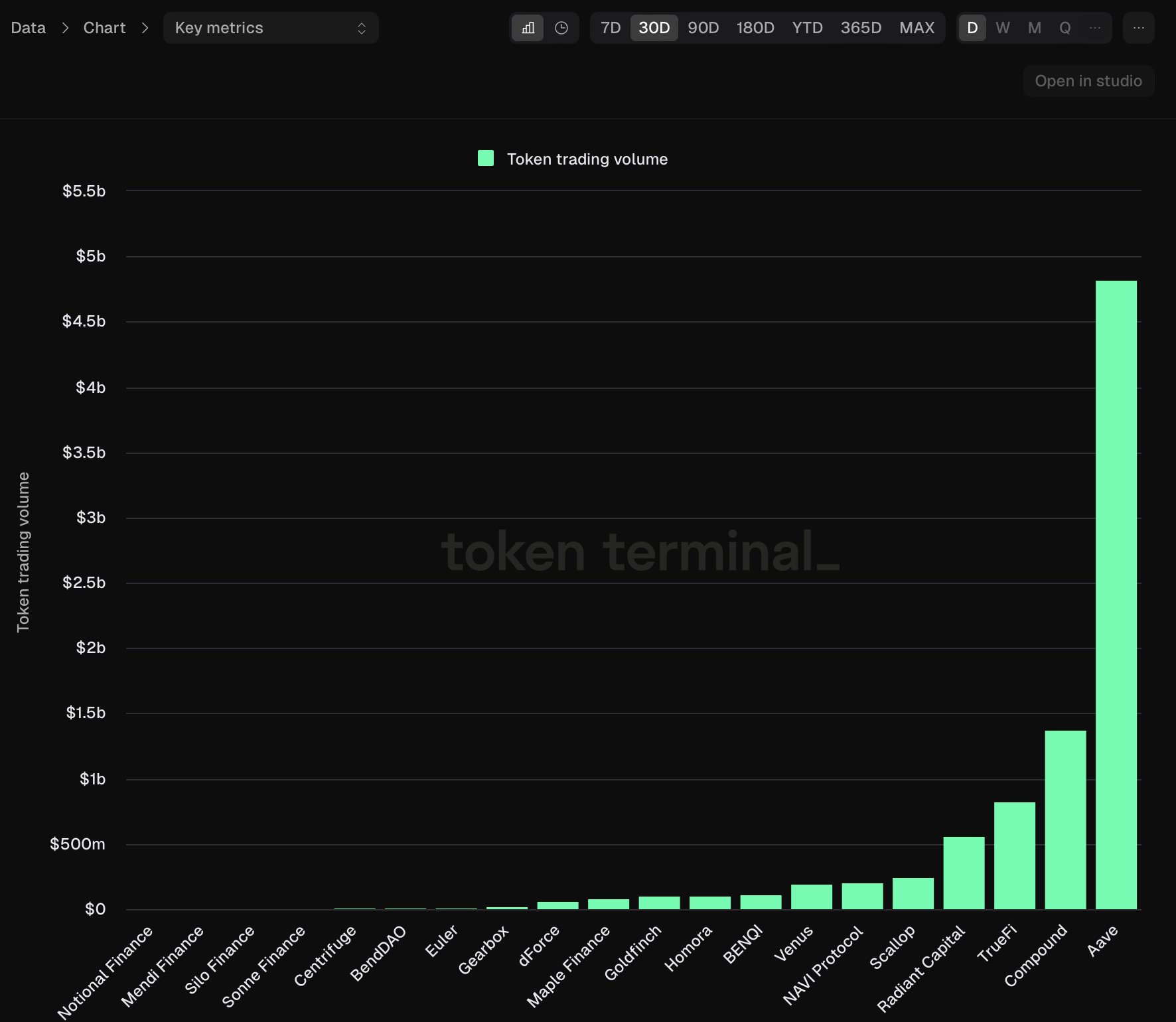

The latest data shows that the project has found great utility and relevance among traders. Token Terminal data shows that AAVE has generated the most interest among traders. The chart below compares the monthly governance token trading volume for projects in the lending market sector.

Token trading volume in the lending sector

AAVE May Increase Growth by 15%

The daily chart of AAVE/USDT shows a W-shaped formation. AAVE is trading at $99.41 at the time of writing, and the DeFi token is likely to continue its gains and move up to $114.74, a key resistance level. This would represent a 154% gain for AAVE.

The token faces resistance at the upper boundary of the fair value gap (FVG) at $103. The relative strength index (RSI) indicator has returned to 50, a neutral level, meaning AAVE lacks any directional momentum.

AAVE/USDT Daily Chart

On the other hand, AAVE may find support in the imbalance zone between $86.17 and $88.20 in case of a price correction of the DeFi token.

Failure to see a daily close above $95 could dampen the bullish outlook for AAVE.