Economic uncertainty in the US has caused the price of Bitcoin to fall sharply over the past day, with the asset falling below $60,500 for the first time in nearly three weeks.

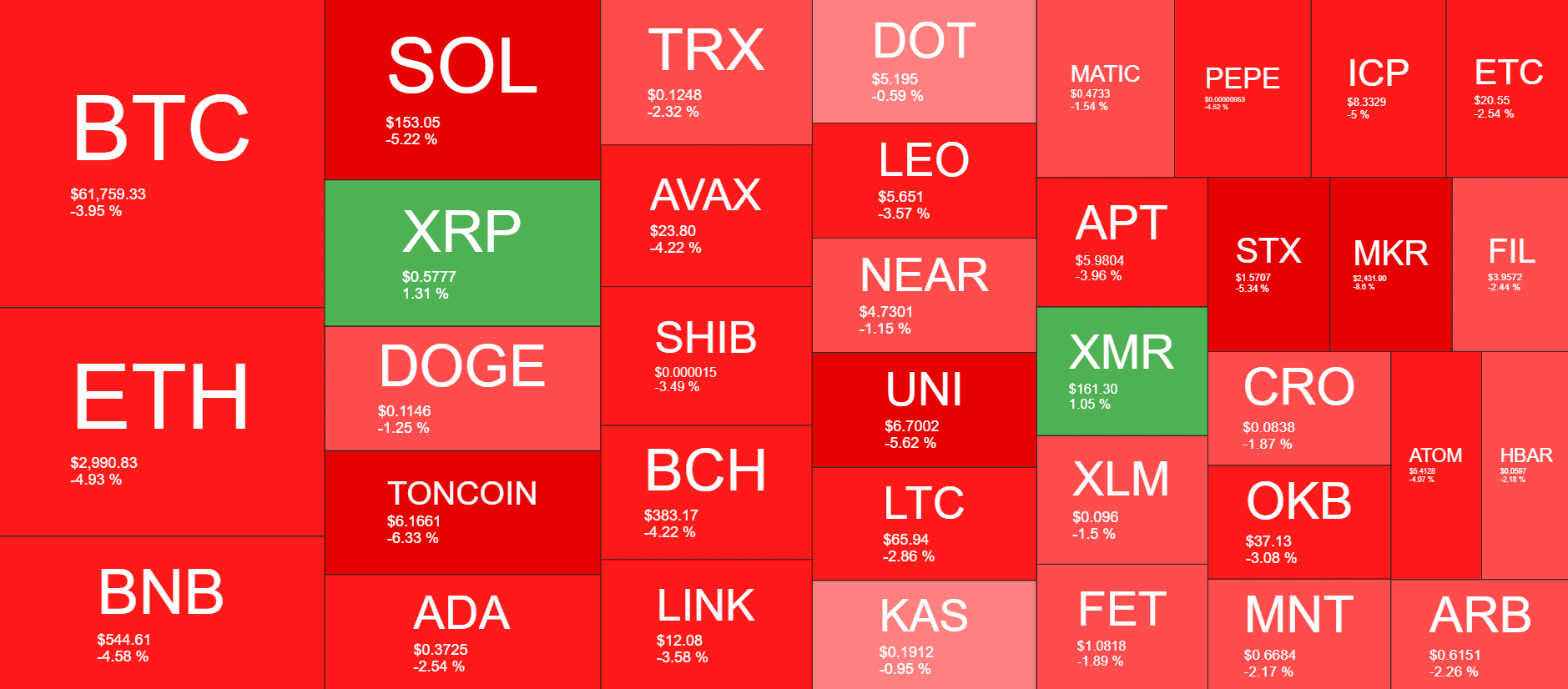

Altcoins are in an even worse position: SOL, TON and UNI have fallen by more than 5% in the last 24 hours. ETH has dropped below $3,000.

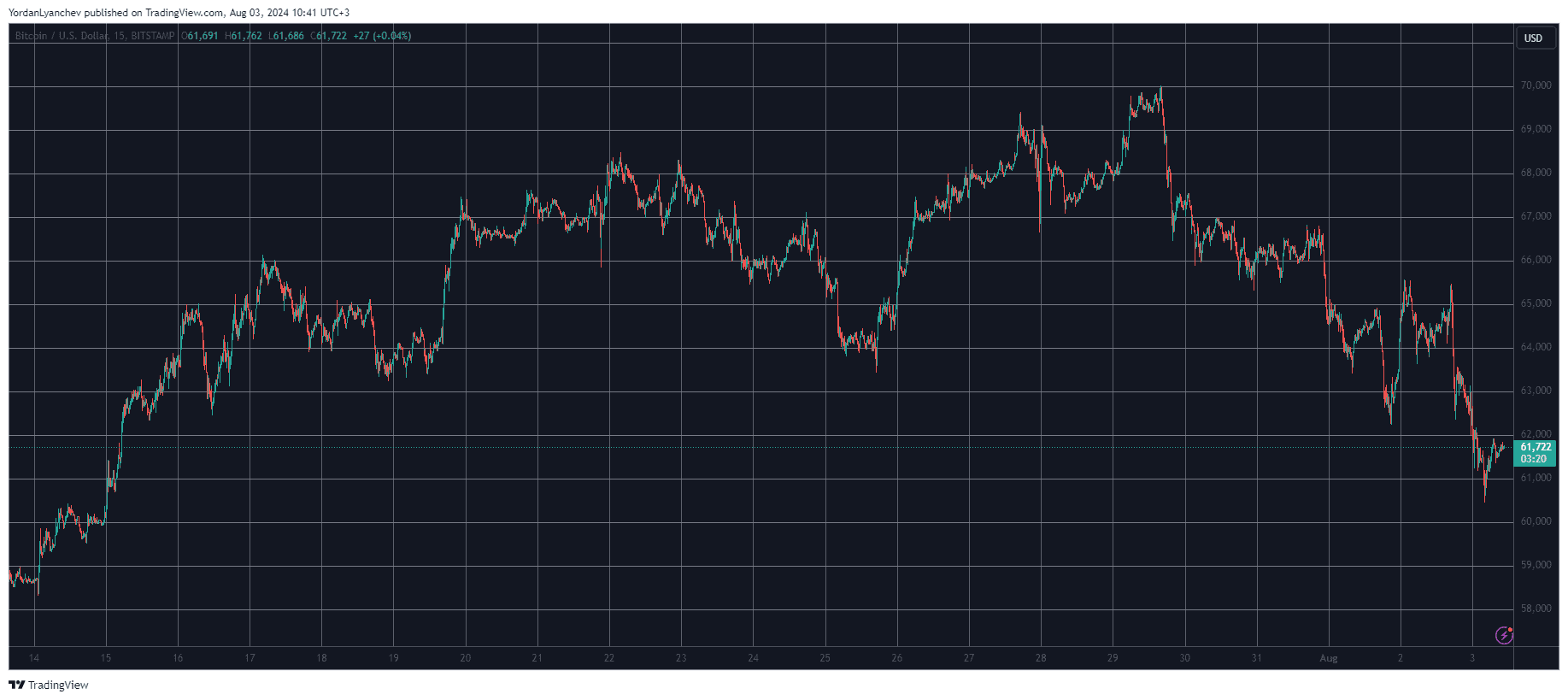

BTC hits 3-week low

The start of the work week could not have predicted what happened just a few days later. The asset soared to $70,000 on Monday after Donald Trump’s triumphant visit to the Bitcoin Conference 2024 in Nashville.

However, it was quickly rejected at that 7-week peak and dropped back to four thousand almost immediately. After a brief lull on Tuesday and Wednesday, the bears regained control on Thursday and Friday and initiated several drops that eventually saw the price fall to $60,500 late in the evening.

This marked the cryptocurrency’s lowest price since July 14. The decline can be attributed largely to uncertainty in the US economy, as a weak jobs report on Friday indicated the highest unemployment rate since October 2021 at 4.3%.

This sent shockwaves through investors, who pulled millions of dollars out of spot Bitcoin ETFs, while Wall Street also took a big hit.

At the moment, BTC has recovered a bit and is approaching $62,000. Its market cap has fallen to less than $1.220 trillion, and its dominance over alts is about 53%.

Alts are bleeding

Alternative coins have followed BTC and even surpassed it on their way south. Ethereum has lost 5% of its value on the day and dropped below $3,000. BNB has seen similar daily losses, and is currently trading below $550.

Even more painful falls are seen in cryptocurrencies such as Solana (-5%), Toncoin (-6%) and Uniswap (-5.5%). Further losses are suffered by FLOW (-12%), MKR (-9.5%), WIF (-9%), JUP (-9%), ONDO (-9%) and others.

The total market capitalization of all crypto assets fell to $2.3 trillion, down $100 billion from yesterday and $150 billion over the past two days.