Cryptocurrencies have been buzzing again with the resurgence of memecoins, capturing the attention of both seasoned investors and newcomers.

Fueled by social hype, celebrity endorsement, and the allure of sudden riches, OG memecoins like Dogecoin, Shiba Inu, and Pepe have risen rapidly, defying logic. The surge has led to a flurry of new launches, and the recent wave of Solana-based memecoins, such as BONK and Dogwifhat (WIF), has further amplified this frenzy. According to Galaxy Digital, Memecoin market capitalization has reached over $60 billion in 2024.

But while memecoins may seem harmless, I believe this speculative playground is detrimental to the long-term health of the DeFi ecosystem. It diverts attention and resources from projects with real-world utility, creating fertile ground for scams and market manipulation. The current memecoin boom ultimately undermines the credibility of DeFi as a legitimate financial system, posing asset allocation risks, liquidity risks, and reputational risks.

And this speculative frenzy also reflects a deeper cultural phenomenon rooted in the Internet’s love of memes. The very concept of “meme”, coined by Richard Dawkins in 1976, describes a unit of cultural transmission that spreads rapidly and evolves through imitation. Memecoins tap into this cultural phenomenon, turning these digital inside jokes into tradable assets, gamifying investments, creating an environment where community-driven hype and FOMO are key factors.

Bybit data reveals that institutional holdings of memecoins tripled from February to March 2024, reaching $204.8 million. Retail investment also grew by 478%. However, the speculative nature of memecoins raises significant concerns. Their value comes solely from hype, with little to no underlying utility. This makes them susceptible to market manipulation, pump-and-dump schemes, and sudden crashes – in fact, this is a feature of memecoins, not a bug.

The rise of a new class of “cultural currencies” centered on cultural values such as politics, brands, religion and lifestyle has the potential to be even more damaging. These coins have already given rise to a darker side of meme culture, with some developers engaging in increasingly outrageous behavior to pump up their tokens. From setting themselves on fire to featuring explicit content in promotional materials, these actions highlight the serious risk of memecoins turning into a realm of bad culture that tarnishes the reputation of the entire crypto space.

Regulatory ambiguity: a clear path for memecoins

The lack of regulatory clarity has created fertile ground for memecoins to flourish, paradoxically stifling the growth of legitimate and innovative DeFi projects.

Due to their simplistic nature and lack of any real-world utility, memecoins bypass regulatory scrutiny. They often launch without an investment structure, instead relying on community-driven hype and organic growth. This allows them to avoid the regulatory scrutiny that plagues more complex DeFi projects, giving them a significant advantage in terms of accessibility and market reach.

As Chris Dixon, general partner at a16z, rightly states, “It is actually safer to release a memecoin today without any use case, rather than launching a token that is useful.” This paradox highlights the unintended consequences of the current regulatory approach that encourages bad behavior and bad culture in the cryptocurrency world.

Read the opposing point of view from our opinion section: Vitalik is wrong: cryptocurrencies really need stupid memecoins

Memecoin and DeFi: A Misleading Focus

The memecoin frenzy has injected a wave of activity into the DeFi space.

New DEXs and trading tools have emerged to meet the growing demand for memecoin trading, and existing platforms like Uniswap have seen a significant increase in trading volumes.

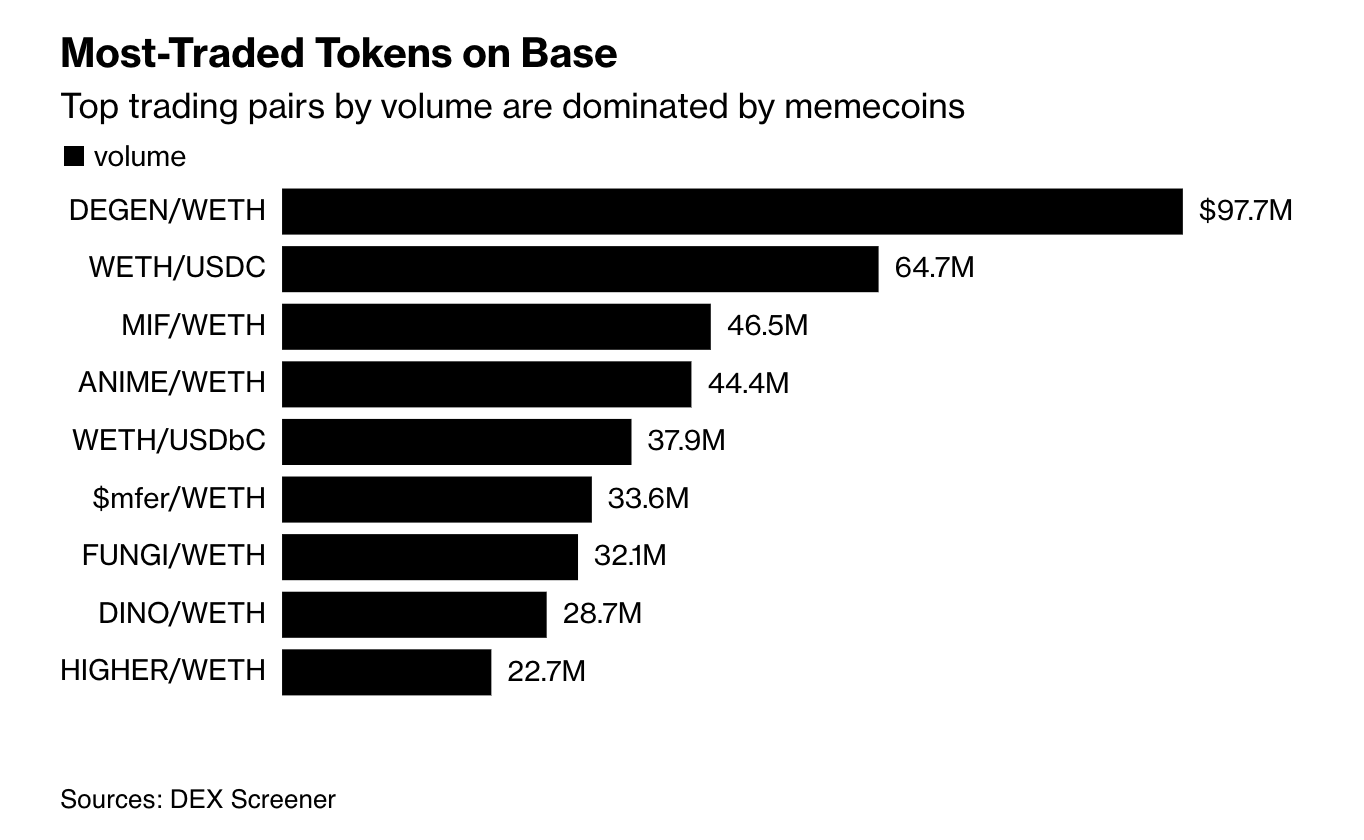

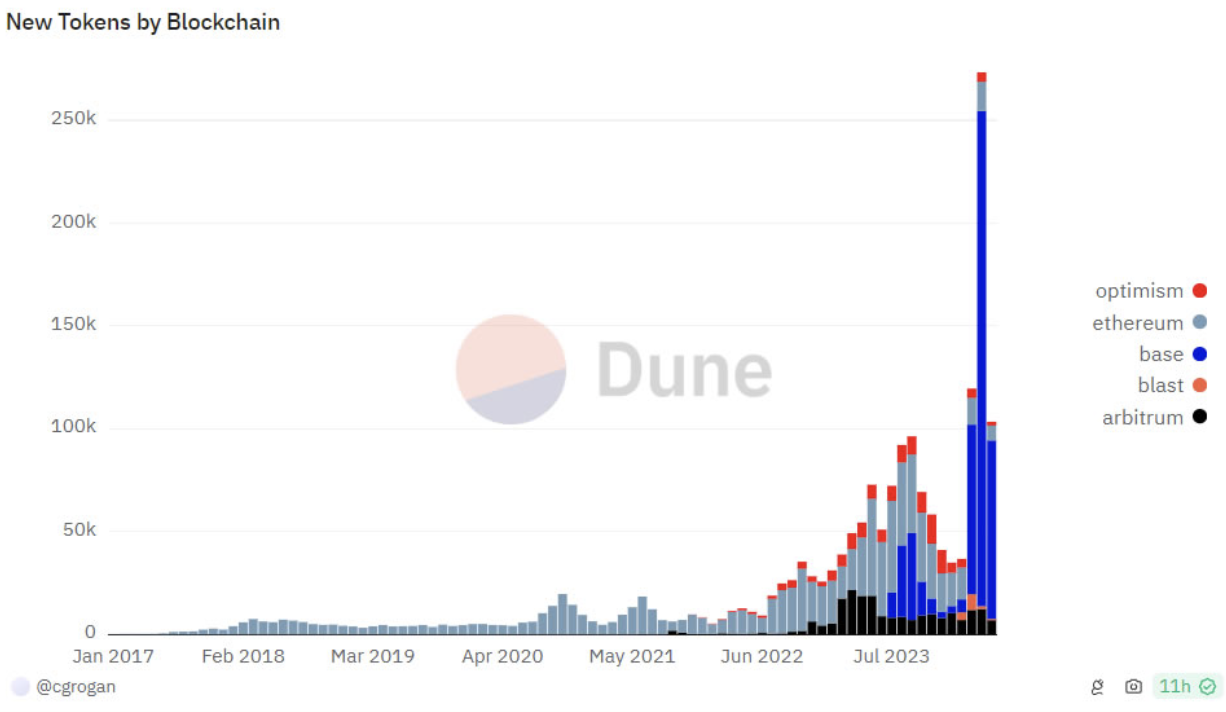

The rise of Coinbase’s blockchain base exemplifies this trend. According to Bloomberg, the total value of cryptocurrencies sent to Base has surpassed $1 billion, with memecoins like ANIME and DEGEN dominating trading pairs. Over the past three months, more than half a million meme tokens have been minted on Solana and Base.

Source: DEX Screener Source: Cointelegraph

The fact that memecoin activity is high on specific alt-1 or layer-2 levels where VCs primarily hold large bags is also indicative of why this shortcut to onchain activity is actively promoted as “adoption ” and even a great framework for the market. Memecoin trading artificially inflates the chain’s overall activity, creating a misleading perception of high user engagement and network usefulness. For example, Solana saw a dramatic increase in transaction volume, reaching $3.52 billion in March and surpassing Ethereum. By promoting memecoins, VCs and teams can increase transaction volumes and token prices, which can attract further investment and publicity despite the lack of genuine, sustainable adoption or innovative use cases.

This irrational narrative is even pumped out by some of the sanest VCs and anointed crypto investors and influencers from Chad. This risks obscuring and compromising the development of truly innovative DeFi solutions capable of transforming the financial systems landscape. Poor allocation of resources and liquidity is an obvious consequence.

As DeFi matures, it is critical to shift focus from speculative allure to building real-world financial solutions, building an application layer that truly attracts broader user participation. This requires a concerted effort from investors and the DeFi community as a whole to overcome this frenzy. The strange Slerf occasionally provides memetic relief and atmosphere to the space, but is not an entire class actively supported by key voices and capital. Go on.

Sri Misra is a serial entrepreneur shaping the future of decentralized finance through the aarnâ protocol, an AI crypto platform that creates the next generation web3 asset management stack to democratize access to the rapidly evolving world of digital assets. As the founder of Milk Mantra, India’s first VC-funded agri-food startup, Sri has championed a new era of ethically sourced premium dairy products, gaining recognition as a practitioner of conscious capitalism. His innovative work has gained global media attention and features in top business school case studies. Previously a key member of the Tata Group’s elite TAS, Sri has gained international experience in London and Johannesburg and led mergers and acquisitions in the consumer food and beverage sector. He has moved through roles and countries, gaining significant experience in consumer markets, finance and technology. Sri has often collaborated with the Indian government’s top policy think tank, contributing to national projects such as a blockchain-based agri-stack presented to the Prime Minister. A member of the Aspen Institute and Yale World Fellow, Sri continues to drive economic innovation while pursuing his passion for the outdoors at high altitude, seeking to scale new heights.