He cryptocurrency market has faced one of the worst declines since the beginning of the month, with around $500 million in various assets liquidated in a matter of hours. For now, Bitcoin’s performance has stabilized a bit, which should potentially boost buying sentiment on the dip.

He cryptocurrency market has faced one of the worst declines since the beginning of the month, with around $500 million in various assets liquidated in a matter of hours. For now, Bitcoin’s performance has stabilized a bit, which should potentially boost buying sentiment on the dip.

Bitcoin’s most recent price movement indicates that it is testing important support levels at around $65,000. The 50-day EMA and the 200-day EMA are providing important support lines, and holding above these levels may indicate stabilization. There is a chance that investors could take advantage of the current decline to add more Bitcoin because this consolidation phase often precedes potential recoveries.

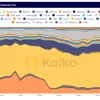

More information can be obtained by examining the financing rates on different exchanges. Positive funding rates exist for popular cryptocurrencies such as Ethereum and Solana, for which traders are willing to pay a premium to maintain their long positions.

When positive, this measure becomes a key indicator of market sentiment and often suggests an upcoming bullish reversal. Furthermore, according to the liquidation heat map, a significant number of long positions are being liquidated (407.91 million over the last day).

While this may seem unfavorable at first, it often hints at a market reset in which excess leverage is removed to make room for a more consistent uptrend, as there is potential for a bullish move without the possibility of sudden breakout conditions. overbought. For now, Bitcoin’s RSI is hovering around the neutral zone. Despite the recent market decline, this and positive funding rates suggest there may be room for optimism. However, it would have been better for the asset if the RSI was around the reversal zone.

Alex Dovbnya

Alex Dovbnya