According to a report by Messari, layer 1 (L1) blockchain Aptos recorded substantial gains in key metrics during the first quarter (Q1) of the year. The growth was driven by the surge in Bitcoin prices record highs and a greater inflow of capital into the market.

However, Aptos’ native token, APT, has struggled with price action, posting modest gains compared to other major cryptocurrencies.

Aptos network activity increases

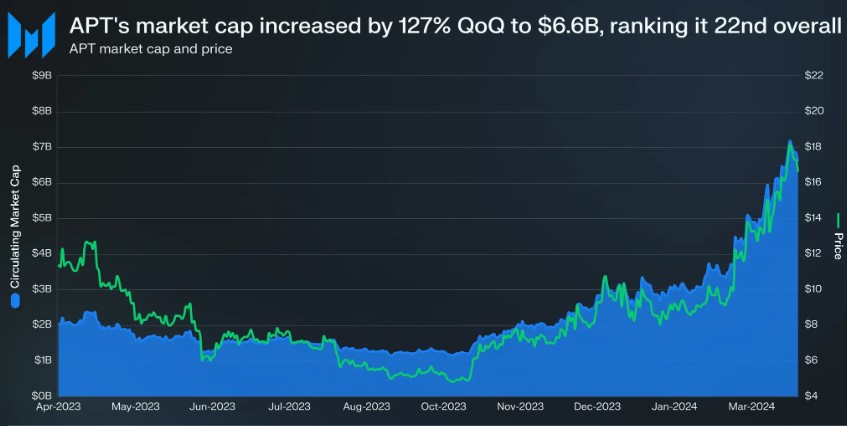

THE relationship highlighted that Aptos’ circulating market capitalization increased by 127% quarter-on-quarter (QoQ) to $6.6 billion.

This growth outpaced other projects with similar market caps, improving its market cap ranking from 33 to 22. Despite this growth, APT’s price saw a more modest increase of 76% quarter-on-quarter.

Aptos’ revenue, which includes all fees collected by the protocol, grew 37% to $475,000. However, when denominated in APT, revenue fell by 10%. All revenue generated by Aptos is burned, but these burned tokens have not significantly reduced inflation.

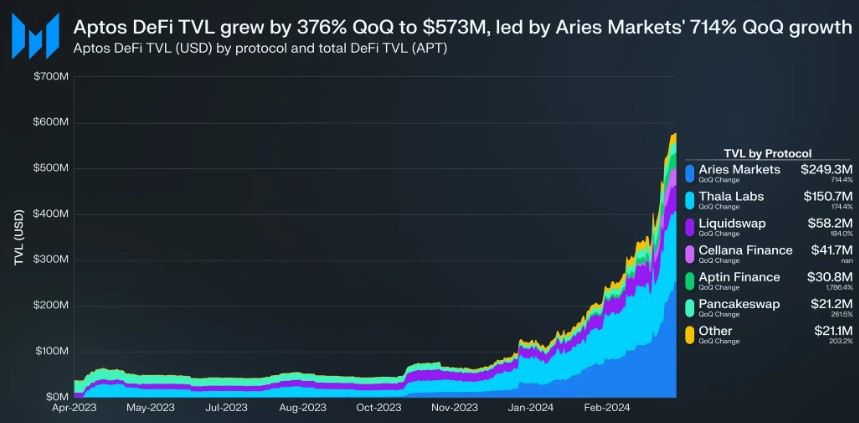

As seen in the chart above, Aptos has also seen growth in its decentralized finance (DeFi) total value blocked (TVL), which increased 376% quarter-over-quarter to $573 million.

According to Messari, this increase is not solely due to the price appreciation of the APT; TVL also grew 170% quarter-on-quarter in terms of APT. Additionally, Aptos stablecoin market capitalization nearly doubled quarter-on-quarter to $97 million.

APT struggles to clear the $8.80 resistance

Despite these positive developments, APT’s price performance has faced challenges. The native token has fallen by more than 16% in the past month, resulting in a modest 2.7% increase year to date. This contrasts with the double- or triple-digit gains seen by other major cryptocurrencies.

Currently trading at $8.46, APT has struggled to break out of its resistance wall closer to $8.80, leading to a consolidation phase between $8.20 and $8.70 over the past month.