The price of Ethereum has seen a rapid rise in recent weeks, breaking through several resistance levels. However, the price has reached a significant level that could hold the market back for a while.

Technical analysis

From TradingRage

The daily chart

On the daily chart, the price is constantly increasing, making higher highs and lower lows. The market has fallen far behind the 200-day moving average, a behavior typically seen during cryptocurrency bull markets.

Currently, ETH price is trying to break above the $4,000 resistance level after failing to do so last week.

If the breakout occurred, ETH would likely reach a new all-time high. However, judging by the massive overbought signals on the RSI, a pullback seems quite likely in the near term.

The 4-hour chart

Looking at the 4-hour time frame, it is evident that the price is consolidating from a little below the $4,000 level. However, the bullish momentum seems to have resumed and ETH is on the verge of clearing the $4,000 resistance zone.

The Relative Strength Index also shows values above 50%, but is not yet overbought in this time frame. Therefore, the market may still rise before a possible correction.

Sentiment analysis

From TradingRage

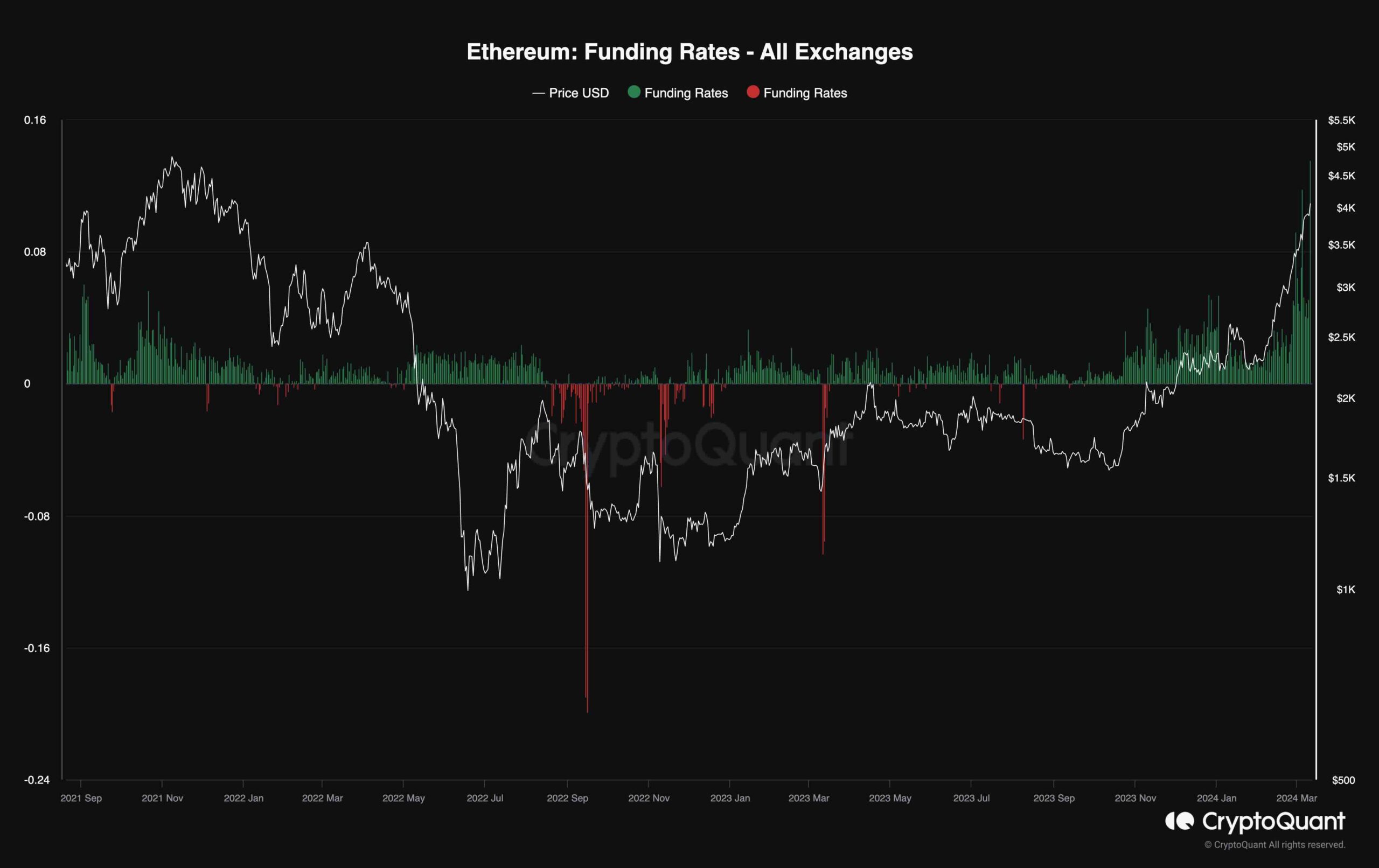

Ethereum funding rate

Although the price of Ethereum has yet to reach a new all-time high, market participants expect the price to rise much higher. This optimistic behavior can easily be witnessed in future market sentiment.

This chart presents Ethereum funding rates, which indicate whether buyers or sellers are executing their orders more aggressively overall. Positive values indicate bullish sentiment, while negative values indicate pessimism among market participants.

The graph shows that financing rates have recently shown extremely high values, even higher than the last historical high. While this aggregate buying pressure is not inherently bad, it can lead to a potential cascade of long-term liquidations that could cause short-term price declines.