According to the data, liquid staking protocols have accumulated an additional 290,000 ETH over the past 46 days. This increase increased the share of ETH in liquid staking protocols by 0.24%, bringing the total to 11.18% of Ethereum’s circulating supply of 120.2 million.

Liquid Rate Changes: Swell Falls, Frax Ether Rise

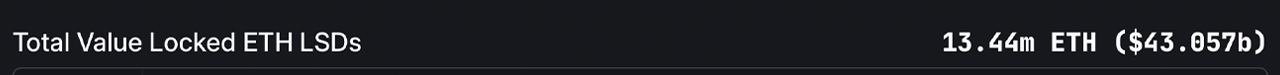

At the time of writing, there are 13.44 million ETH locked in liquid staking protocols, with Lido holding 72.3% of that amount. On May 29, Lido held 9.51 million ETH, and today that number has grown to 9.71 million. That means Lido has absorbed 200,000 of the 290,000 ETH inflows over the past 46 days, according to defillama.com metrics.

During the same period, Rocket Pool, the second-largest liquid staking protocol, received an influx of 20,000 ETH, increasing its total volume from 1.15 million to 1.17 million ETH. Binance’s ETH staking has increased by 13,257 ETH since May 29, while the Mantle protocol has received a deposit of 23,027 ETH over the same time period.

Frax Ether is the fifth largest liquid staking protocol for ETH, holding 197,079. This was previously the position of Swell, but the protocols have dropped from 181,863 ETH to the current 167,241. Swell has fallen to eighth place in terms of largest liquid staking platforms.

As the launch of spot ETH exchange-traded funds (ETFs) approaches, the landscape of liquid staking protocols may be poised for potential shifts. The upcoming changes in market dynamics could very well impact the distribution and growth patterns seen in these protocols. Aside from liquid staking, staking as a whole consumes 27% of ETH’s circulating supply.

What do you think about the liquid staking protocols for Ethereum deposits from May 29? Share your thoughts and opinions on this in the comments section below.