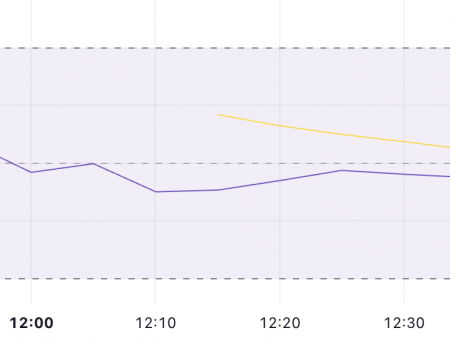

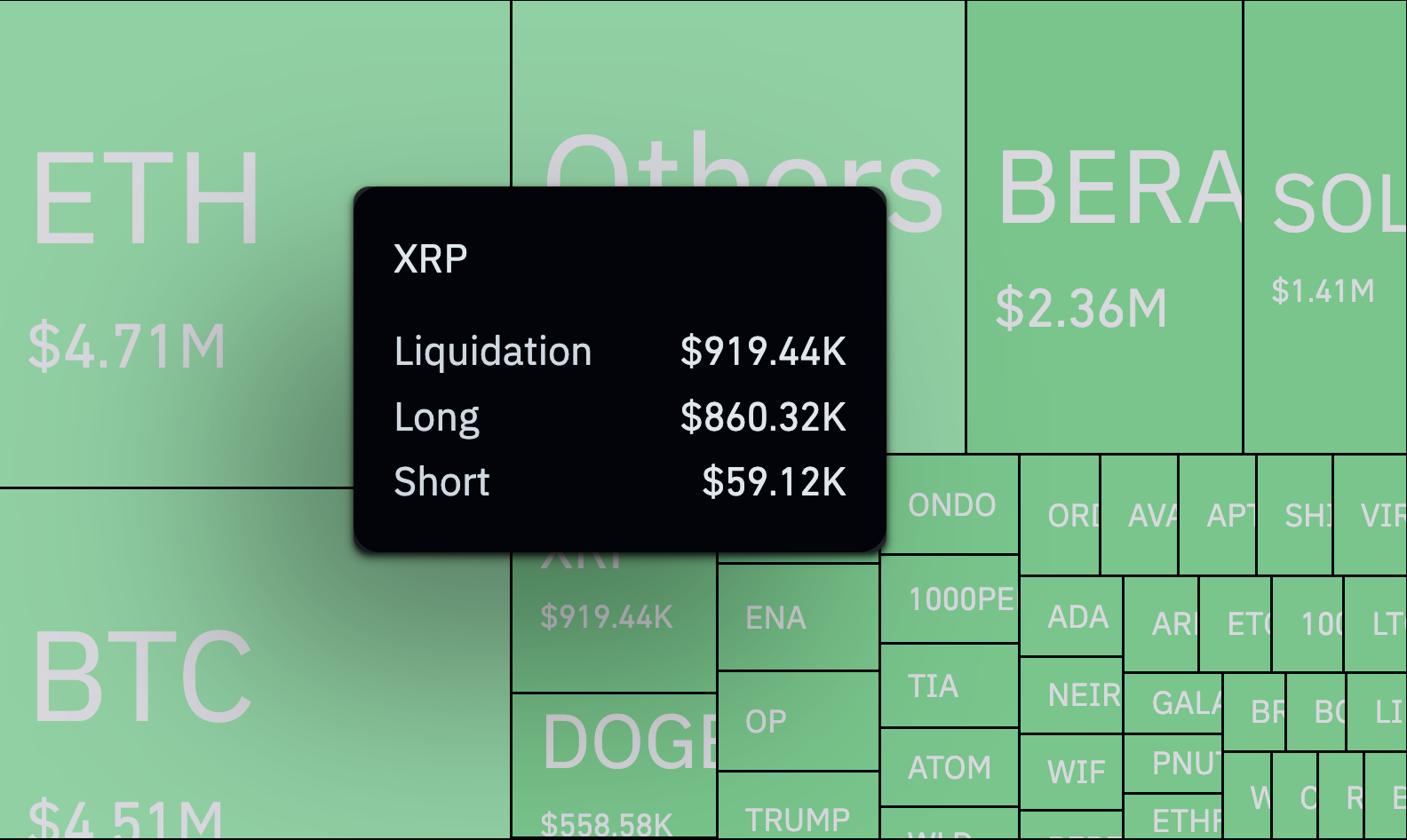

There was a huge gap between the elimination of long and short positions in the market for eternal futures for only one hour in one hour. Data from Coinglass set the overall liquidation for this short period for $ 920,000.

But a real shock? Almost all of this – 93.4% – came from long positions. That is, about $ 860,000 was destroyed, leaving only $ 60,000 tied to shorts.

Even more amazing is the fact that XRP did not experience a large collapse of prices. It fell by only 2.7%. Nothing bad. But traders felt quite optimistic after an increase in 3% and went to the long side. But then, in the blink of an eye, everything changed, and these bets began to fall apart.

It was not just a problem for XRP. The entire crypto -market was pressure. In just one hour, the tremendous 27.7 million dollars were destroyed. This is more than 10% of the total liquidation over the past 24 hours. Long traders suffered the most, with losses of 24.41 million dollars. The United States, which much exceeded $ 3.51 million. The United States as a result of losses from short posts.

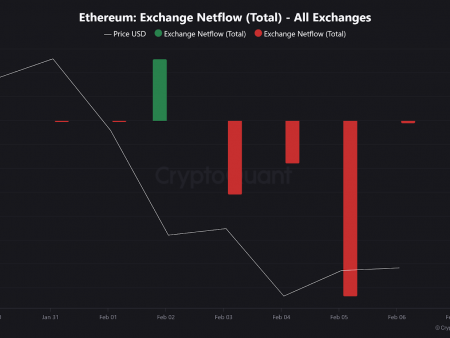

Why did this happen?

The XRP diagram sent bull signals, increasing the bias of the trader to go for a long time. But the balance has changed when the impulse slowed down, and what seemed a firm strategy quickly unraveling. One mood was not enough to keep afloat prices.

Such a setup raises questions. How long is the XRP still a smart move? Right now the numbers say no. It seems that every time there is a chance for rebound, there are only more sales. If buyers continue to push, but the market is not ready to turn, XRP can continue to slide until the pressure finally weakens.