Ripple is trading with a minimum impulse, demonstrating a quiet price effect above a 100-day sliding average.

This phase of consolidation with low volatility involves a temporary market balance, it will probably remain until the decisive breakthrough sets the next direction of the trend.

XRP analysis

Shayan

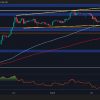

Daily diagram

The price of XRP remains at the same level, with minimal volatility, since it consolidates above a 100-day sliding average of $ 2.3. This tough trading range, determined by the support of $ 2.3 and critical resistance in the amount of $ 3, involves a state of equilibrium between buyers and sellers.

The RSI indicator enhances this indecision, soaring around the neutral level, signaling the balance of market forces. However, this phase of consolidation is unlikely to remain indefinitely, and a decisive breakthrough in any direction seems inevitable. Given the current dynamics of the market, the bull breakthrough seems more likely, potentially paving the way for a new record high level in the coming weeks.

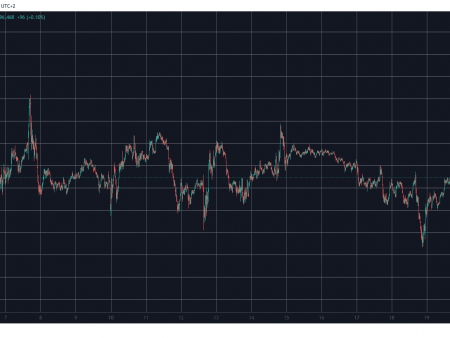

4-hour table

In the lower terms, XRP could not repeatedly break through above the critical resistance of $ 2.8, faced with deviation and minor kickbacks. This price behavior indicates an insufficient bull impulse to maintain an ascending breakthrough, which leads to a long side movement.

Despite this, XRP has formed the ascending wedge scheme, with price fluctuations, limited between a resistance of $ 2.8 and a support zone $ 2.4. The breakthrough of this formation is important for establishing the next main direction of the trend, determining whether Ripple can restore a bull impulse or encounter further consolidation.