Given that price indicators and indicators in the chain show an increase in involvement, XRP demonstrates signs of updated market activity. The latest data indicate that traders and investors may return, which will increase demand, even if the asset recently fought with resistance levels. The increased speed with which XRP burns are one of the main signs of this return.

With the destruction of more than 5500 XRP on February 17, the latest data in the chain indicate a significant increase in the combustion of XRP as fees. An increase in the volume of transactions and the overall activity of the blockchain is usually indicated by a higher burn rate, which suggests that the interest in the asset is growing. Since they signal the increase in the use of the network from trading transfers or institutional activities, increasing the bets of burns historically often precedes price movements.

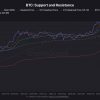

Technically speaking, XRP continues to keep above significant levels of support and is in the main ascending trend. With the support of the ascending trend line, the price holds about $ 2.50 sustainably. XRP may try to break in the range of $ 2.70-2.80, if the pressure on the purchase continues. Nevertheless, a rollback may occur if the current trend is not preserved, and the support of the keys is about $ 2.25. In addition, the sliding medium-sized are still supported largely, and the 50-day EMA serves as a dynamic floor at a XRP price.

There is a possibility that stagnation can occur if the short -term resistance will be broken, but an increase in a bull impulse can be caused by a drop in volume. Although the increased speed of the burn and XRP activity in the chain encourages, the steady increase in prices will depend on the state of the market as a whole and constant demand. In the coming weeks, the technical force and an additional increase in the use of the network can lead to an increase in XRP.

Traiders must monitor the possible phase of consolidation until the next significant movement, although if the pulse decreases. At the moment, XRPS in network activity may be the predecessor of the Renaissance in the trust of investors, paving the path to the next significant price shift.