Polkadot’s native cryptocurrency DOT finally found favor with bulls in November after months of sustained selling pressure.

However, the bears are at it again this month, judging by the pullback from the recent peak.

The DOT price peaked at $11.64 on December 4th and has since fallen over 35% to a recent low of $7.50 on December 9th. This pullback signaled that strong profit taking had followed the November rally.

More importantly, the recent pullback fell to an important Fibonacci level. It was between the 0.618 and 0.5 Fibonacci price levels based on the November lows and the recent high this month.

DOT selling pressure has eased markedly since it entered the Fibonacci zone. This is because it is in this zone that the bulls are most likely to regain their momentum. This suggests that DOT reaccumulation has already resumed.

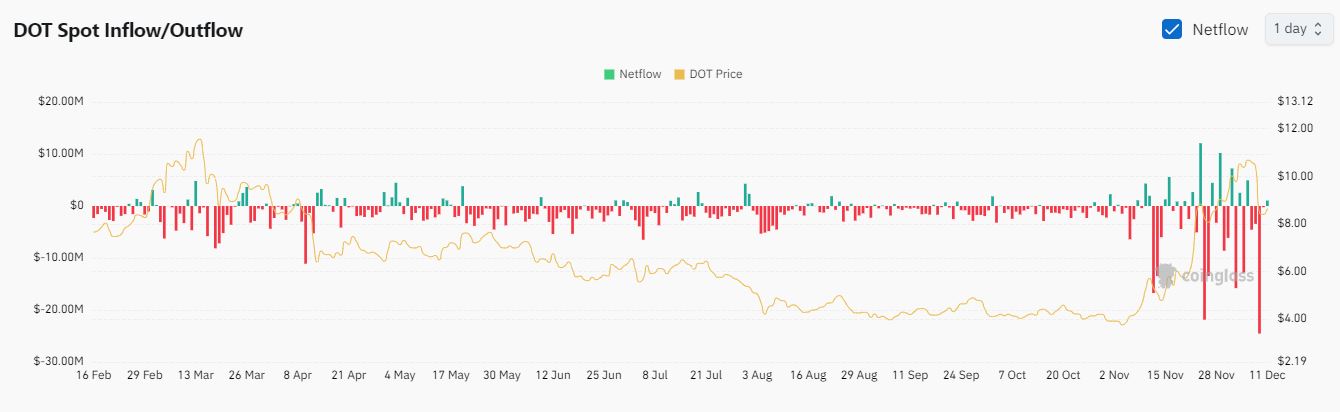

DOT spot outflows increased this week

While bullish momentum is expected due to the recent decline into the Fibonacci zone, the prospects for selling pressure remain strong. DOT spot outflows have been significant since early December.

Spot outflows peaked at $24.52 million on December 9. The largest spot outflows were observed in 2024. However, they have cooled off in the last two days.

This was consistent with the spike in selling pressure seen in the DOT price that same day.

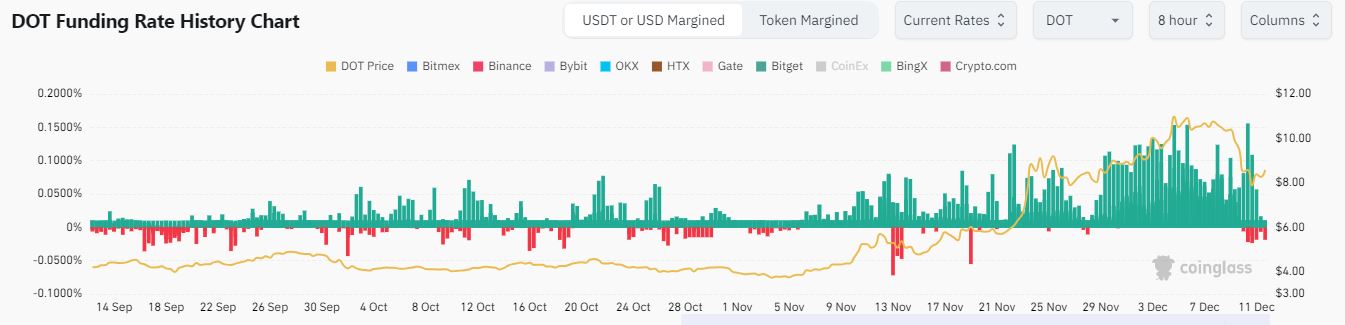

DOT spot flows were also in line with the derivatives segment. Open interest has dropped significantly over the past few days.

It’s worth noting that DOT spot flows have turned positive again over the past 24 hours.

There was also an increase in negative funding rates. This confirmed that derivatives have particularly moved in favor of short positions over the past two days.

The ratio of short to long positions on Coinglass may have signaled a change in sentiment among investors. This was evident from the sudden change in ratio in the last 2 days. On September 9, at the peak of selling pressure, short positions dominated (almost 56%).

Since the DOT price fell to the Fibonacci level, the number of long positions has increased significantly. On December 11, long positions dominated with a return of 51.22%, reflecting the recent rise in prices and change in sentiment.

Traders saw the recent decline as an opportunity for significant gains, especially as the market enters a season of new highs. The price of DOT at the time of publication was up 30% to a recent local high.

Polkadot price forecast

But what are the chances that the price can rise to these highs this week? Well, it turns out that the recent wave of selling pressure has dampened market sentiment.

For context, the Crypto Fear and Greed Index was hovering at 74 at the time of publication, up from 78 the previous day.

A further decline in market sentiment means investors will be hesitant to inject liquidity back into coins like DOT, despite bullish signs.

On the other hand, DOT price could break away from the overall market sentiment if it finds enough bullish support.

If such an outcome occurs, then it could resume the bullish growth as it did in November.