Bitcoin is traded within a narrow range from $ 90,000 to $ 105,000, the alarm potential for the main price movement in the coming days. The installation of the market is weakened against the background of the report that the Bitcoins millionaires have largely decreased in the second period of Trump.

Despite the recent volatility, the data on the chain suggests that the accumulation remains strong, which indicates the trust of investors. A wider cryptography market also received a blow, the total capitalization has not changed a lot over the past 24 hours.

Bitcoins demand remains strong

The metrics on the chain suggest that the demand for bitcoin remains reliable, despite price fluctuations. From the moment the last peak was reached in mid -December, Bitcoin entered the accumulation phase, following the historical models of expanded corrections after sharp rallies.

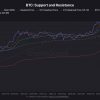

In the current Bitcoin range, there is support for $ 94,340 and the price resistance level of price resistance is $ 106,784. At the time of publication, the price amounted to $ 96, 163, which is only 1.5% more over the past week.

Historically, when Bitcoin remained in a narrow merchant range for a long period, this led to sharp movements. This model involves the possibility of sudden peaks and prices to final breakthrough.

While Bitcoin was held relatively stable, the number of addresses of the millionaire Bitcoins has sharply reduced since Donald Trump returned to the White House, Finbold reported

Initially, his re -election led to optimism in the cryptography market: 11,000 new Bitcoin millionaires appeared in the period from October to November 2024. However, since the inauguration of Trump on January 20, this trend has changed.

Data from Bitinfocharts It shows that in the period from January 21 to February 18, the number of bitcoin -ades having more than $ 1 million decreased by 22,279, on average daily by 795 addresses of the millionaire.

Large wallets also saw steep reduction. The number of addresses with more than 10 million dollars in bitcoins, according to reports, decreased from 18,801 to 15,392. In total, more than 3.54 million bitcoin addresses with at least $ 1 have disappeared from the beginning of the second Trump term.

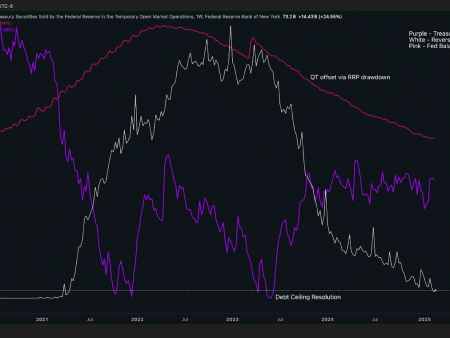

BTC: fundamental analysis

The crypto -market was faced with additional obstacles from recent macroeconomic measures. After the inauguration of Trump, a number of failures in the market contributed to the stagnation of Bitcoin.

The release of the DeepSeek AI model in China caused a wider sale of technology sector, which burst into the cryptography market. This was followed by fears about Trump’s tariffs proposed by China, Mexico and Canada, which led to financial uncertainty.

In addition, inflation indicators since the beginning of 2025 showed an unexpected increase, just a few days after Trump insisted on further decreasing interest rates. Trump’s position on bitcoins and digital assets also created uncertainty.

In addition, the Trump administration was associated with the contradictory launches of cryptocurrencies, including coins for the marking itself, released around its inauguration.