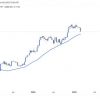

Bitcoin grew over $ 95,000 during low -liquidity hours on Sunday after US President Donald Trump made a major announcement. The formation of the crypto -strategic reserve of the United States, including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL) and Cardano (ADA), prepared the market with speculations. Many traders considered this as a decisive moment that could strengthen the place of crypto in the US financial system, while others remained wary, questioning whether the rally could support themselves outside the direct reaction. Among those skeptical – QCP capital.

The main political play of Bitcoins?

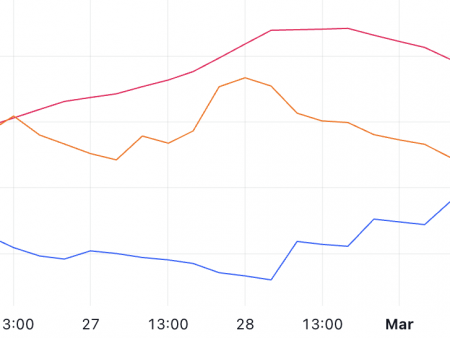

Trump announcements are difficult to ignore. Over the past week, risk assets faced growing pressure, since global markets negatively reacted to a series of economic and geopolitical events. Trump’s newly introduced tariffs worsened confidence in investors, while shaky peaceful negotiations on peaceful conversations in Ukraine-Russian created additional uncertainty. The volatility of the stock market intensified, which is significantly fond of moods throughout the financial sector.

Bitcoin broke below his many -month range, showing signs of weakness before the announcement of Trump. The sudden announcement was a sharp contrast with a low trajectory that followed.

QCP Capital emphasized the political strategy behind this: “For the president, which flourishes in the fact that he is the hero of the market, the indicators of the asset of the risk asset for last week were completely non -inspiring. Its many new tariffs and higher than expected, peaceful negotiations on worldly and-Russia, affected by investors. So, until the time of the SBR is not caused by that he was noticed that he was in honor of what he received, what he received, what he was able to. Very personally. “

Nevertheless, questions remain regarding whether this step is a real shift in politics regarding the long -term introduction of cryptography or simply a timely announcement aimed at stabilizing moods before further economic stress. While Bitcoin’s quick ascent on the weekend is excited for traders, the Qcp Capital remains unconvincing that this rally is a significant breakthrough. The company pointed to several key market signals, which indicate that bitcoins have not yet left the forest.

QCP Capital warned: “We returned to the game? Not really. BTC is still trading in the lower part of its multi-month range, and crypto t.

Lessons from the past: comparison “XI Candle”

For experienced traders, the price effect on the weekend resembles a historical event on the crypto market – the notorious candle of the XI 2019. An outstanding crypto -analyst Cold Blouded Shiller took to X to compare between two events.

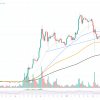

Thinking about the XI candle, the cold Schiller remembered how Bitcoin was in a long descending trend, trading on fresh minimums with market moods at the bottom. Then, it would seem, out of nowhere, China President Xi Jinping announced that China should accept the technology of blockchain. The result was a mass short compression: Bitcoin took off by 40% in just two days. The merchants at that time believed that this marked the beginning of a new bull era for Crypto.

“The setting was to adapt very quickly. You will be surprised (not) to hear that then it did not take much time to form all Twitter’s thinking in the positive and the ability of the market now to have an endless bet, ”he wrote.

Nevertheless, euphoria was short -lived. A few weeks later, China returned to its rhetoric, conducting, introducing fresh repressions on crypto-foreigners and warning investors about the risks of digital assets. Bitcoin is slowly collapsing when the price action was changed over the next month and ultimately immersed below the preliminary level.

“We did not immediately change the candle. In fact, it took many weeks, which did it even more painful for those who exchanged it, or for those who would have bulls of bias, ”Schiller recalls cold blood flow.

The similarity between the candle of SI and the announcement of Trump about the crypto -prisoner is amazing. Both events followed the long periods of market weakness, both saw a dramatic shift in the mood almost overnight, and both created a new bull narrative, which widely covered the market. The key question now is whether Trump’s announcement will lead to a sustainable shift of the trend or, like the candle XI, it will ultimately disappear, leaving the late buyers in a trap at the top.

Key events for viewing this week

Bitcoin’s ability to maintain its benefits or expand, will probably depend on key macroeconomic and regulatory events in the coming days.

On Wednesday, the markets will receive data on the latest data from the procurement (PMI) manager index, which is an important economic indicator that can affect expectations regarding the policy of the federal reserve system. If the PMI data show signs of economic weakness, this can increase speculation on a decrease in potential indicators, which can provide a fair wind for risk assets, including bitcoin. Nevertheless, the data more than expected can strengthen the opinion that the Fed will support its restrictive political position, potentially pressure on cryptography and promotions.

Friday leads to the release of a wage report (NFP), which is not a farmer, a key employment indicator that has historically influenced market moods. A strong report on workplaces can signal further economic stability, reducing the likelihood of a short -term reduction in bets, which can negatively affect Bitcoin. And vice versa, a weaker one than expected, the report can contribute to increasing the risk of mood, which further supports the BTC pulse.

It is also expected that on Friday the crypto -Sammit of the White House will give a critical idea of the future of the Crypto -Strategic reserve of the United States. If tangible ads appear, BTC can rise on. However, if the event cannot provide a significant direction of policy, the market can react negatively, which will lead to an increase in volatility.

As the capital of QCP expressed: “Just when we think that Trump has exhausted his cards, he can still have more surprises in his sleeve. Will this be the impetus for this elusive record maximum? We will watch. “

During the press, BTC traded at $ 90,352.