The price of Bitcoin (BTC) remains highly volatile, and the analyst suggests that a well-defined further decline could end up being bullish for the digital currency.

Notably, in recent trading sessions, Bitcoin has struggled to reclaim the critical $100,000 resistance level, which remains a key threshold for reaching new highs.

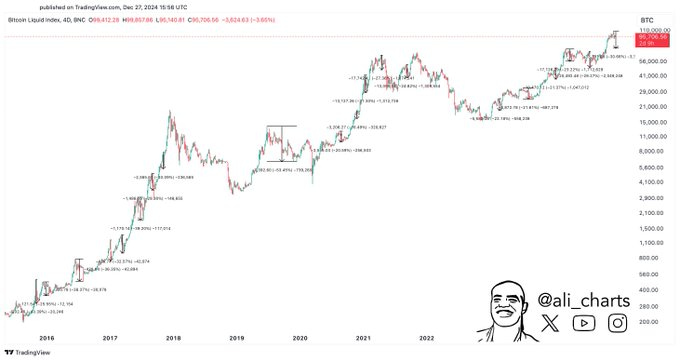

Now, renowned cryptocurrency trading analyst Ali Martinez has highlighted that based on historical trends, a 20-30% correction in Bitcoin could be the “most bullish event” for the asset, as X published in a December 27 post.

According to the analysis, it can be summarized that regular price adjustments are a sign of a healthy market.

“A 20-30% correction is the most bullish thing that could happen to Bitcoin,” he said.

In this regard, Bitcoin has historically shown a repeating pattern of strong rallies followed by notable pullbacks, typically in the 20% to 30% range. Following such trends, Bitcoin has often risen to new highs.

This pattern, observed repeatedly since 2016, suggests that Bitcoin’s current price movement may follow a similar trajectory.

What’s next for Bitcoin?

At the same time, Martinez identified key levels that investors should watch closely. His Dec. 27 post warned of “free fall territory” if Bitcoin fell below $92,730.

“You don’t want Bitcoin to go below $92,730 – that’s essentially free-fall territory if that level breaks,” he warned.

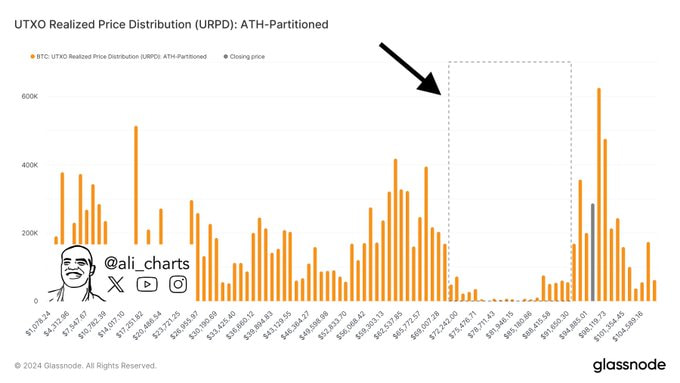

Using UTXO Realized Price Distribution (URPD) chart data, he pointed out a gap in realized price activity between $92,730 and around $105,000. This void indicates that a fall below $92,730 could lead to a sharp decline, potentially pushing Bitcoin down to the $60,000 zone.

Despite short-term bearish forecasts, Bitcoin has seen impressive growth in 2024, increasing its market capitalization by more than $1 trillion. The rally is fueled by the latest halving cycle and optimism generated by Donald Trump’s election victory, with his administration promising to implement pro-crypto policies.

Looking ahead, analysts remain bullish on Bitcoin, especially given expectations of greater institutional adoption under a pro-cryptocurrency government.

To that end, banking giant Standard Chartered predicts that Bitcoin could reach $200,000 by the end of 2024, Finbold reports.

Bitcoin Price Analysis

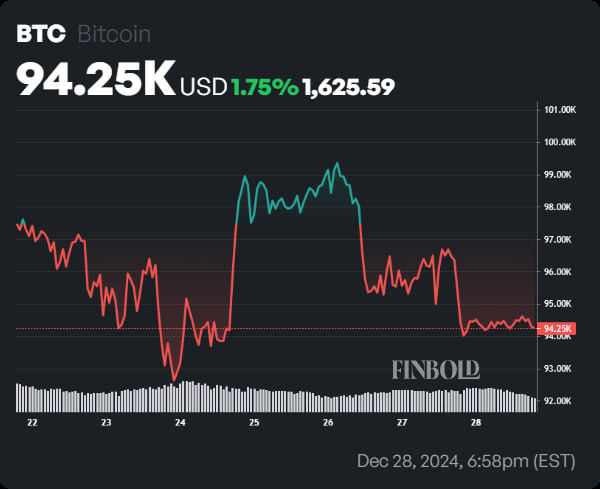

At press time, Bitcoin was trading at $94,249, down 0.15% over the last 24 hours but up 1.75% over the week. However, the short-term technical situation shows that Bitcoin is still in trouble.

For example, Bitcoin’s current price is below its 50-day simple moving average (SMA) of $94,670, signaling moderate short-term weakness.

Additionally, the Fear and Greed Index at 72 (Greed) reflects bullish sentiment, while the 14-day Relative Strength Index (RSI) at 44.41 indicates neutral to slightly bearish.

Despite this, Bitcoin remains well above its 200-day SMA of $70,978, maintaining its bullish long-term trend. Caution is advised in the short term as Bitcoin approaches critical support levels at $92,000 and $90,000.

Featured image via Shutterstock