Table of Contents

Introduction in Technical Analysis

The online space is inundated with advertisements centered around cryptocurrencies, trading, and the apparent triumphs of traders and investors. These narratives often depict luxurious lifestyles, complete with apartments, cars, and yachts, while touting the discovery of the elusive “Holy Grail.”

These success stories are typically founded on elements such as trend lines, chart patterns, indicators, and signals, all of which seem to “work” in the eyes of the average person, transforming ordinary traders into members of the coveted “Millionaires’ Club.”

However, it is crucial to heed the wisdom of Blaise Pascal, who once said, “But we forget that only trained minds make accidental discoveries.” Successful trading requires more than luck; it demands a well-structured trading strategy, effective risk management, and above all, a deep understanding of the profession.

2. Reasons for Low Technical Analysis (TA) Efficiency

In this section, we will explore the reasons behind the inefficiency of technical analysis.

2.1. The Influence of Volume on Price

In our article titled “The Portrait of a Professional Trader,” we emphasized that most traders aim to comprehend past, present, and future price movements. However, a critical oversight lies in the fact that price is the outcome of changes in trading volume. Notably, none of the commonly used technical indicators provide insights into the true state of the market. Analyzing price alone fails to reveal the amount of money waiting in bids or engaged in trades.

To illustrate this, we often liken technical analysis to a magic show. In childhood, watching magicians perform tricks was mesmerizing.

However, as adults, we came to understand that every magic trick conceals a secret, be it sleight of hand, external assistance, or the laws of physics. Yet, some areas still mystify us, such as the belief that prices adhere to predetermined patterns. Technical analysis creates an illusion that people, circumstances, the global economy, political events, and countless other factors must conform to a predefined algorithm.

By unveiling the secrets of the trade, we risk dispelling the magic of technical analysis and illusionism. Once you grasp the trick’s inner workings, faith in miracles dissipates.

2.2. The Illusion of Technical Analysis

Let’s revisit a fundamental principle: the market operates on the principles of supply and demand. Historical demand can be ascertained with precision, but predicting future demand remains elusive.

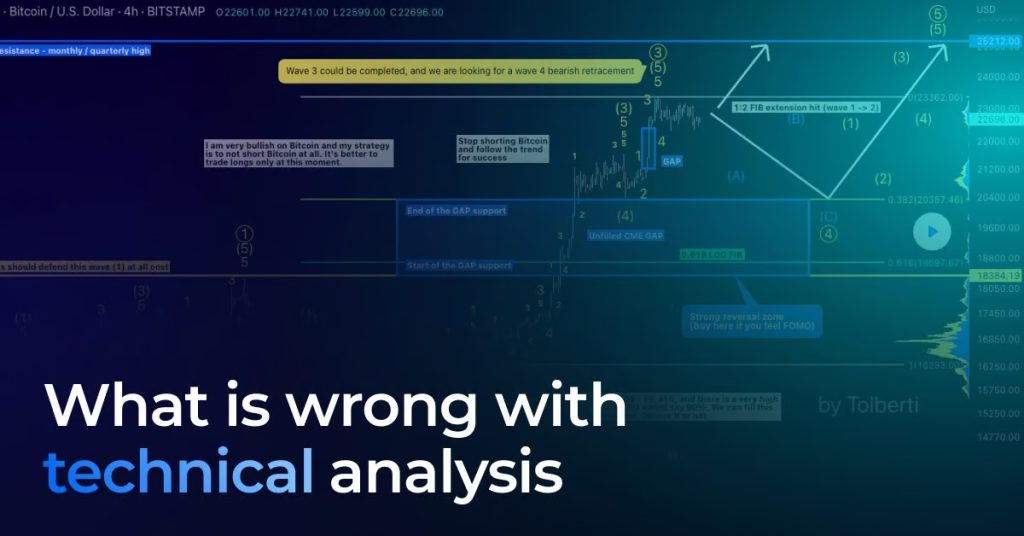

Traders wield an arsenal of historical analysis tools, believing that chart patterns hold the key to forecasting future demand. However, examining a chart provides limited insight. Consider a chart like the one below:

For assets where global events directly influence demand, such as weather, politics, or economics, these indicators may have some utility. However, their effectiveness for most crypto assets remains highly questionable.

Remember this truth: predicting when and at what price someone will buy or sell is beyond anyone’s grasp. The path to profitability is straightforward, requiring no clairvoyance. A speculator’s mission is to identify assets where supply and demand imbalances exist, exploiting market inefficiencies. Focus on purchasing assets in high demand yet to appreciate in price.

Implement risk management strategies, setting predetermined take-profit levels or waiting for seller dominance. Decisions must rely on available data, minimizing reliance on predictions.

3. The Importance of Supply and Demand

In essence, the core of successful trading lies in the interplay of supply and demand. This interplay manifests in various aspects of trading, including order book volumes, transaction speeds, and the sales-to-purchases ratio. Without a substantial presence of supply and demand, the last market price holds little significance. Volume remains the ultimate determinant of market dynamics.

Specifically:

- No candlestick pattern can predict arbitrage opportunities.

- No “support” line reflects true demand for an asset, let alone forecasts order book activity.

- No technical analysis pattern reveals the balance between supply and demand.

- No “wave” anticipates human behavior.

- No Fibonacci zone guarantees order book activity or buyer participation, even in the absence of price movement.

4. Conclusion

In conclusion, technical analysis, while popular, often falls short of delivering consistent trading success. The heart of trading resides in understanding the dynamics of supply and demand. To thrive in the market, focus on identifying assets with conspicuous supply and demand imbalances, thus capitalizing on market inefficiencies. Eschew the allure of predictions and instead base decisions on real-time data and the principles of supply and demand. In this way, trading becomes a rational pursuit, untethered from the illusions of magic and speculation.

You can check resonance web page by making a click here

Liquidity is capital. And any capital affects the market. The analyst’s task is to determine the balance of the asset (the state of balance between supply and demand). The trader’s task is to calculate the liquidity of the asset, assess the amount of capital under management and evaluate the permissible position size for the given liquidity of the asset, calculate the risk per trade and gain a position. If necessary, to exit a position without upsetting the balance of the market.

Each asset has its own balance. Each trader has its own volume of capital. Decision-making on prices and volumes of entry and exit is a matter for each trader. What is acceptable for one is unacceptable for another. One looks at the scale of the last hour, someone looks at the scale of the last year. One has $100 capital, the other has $100,000.

The market is liquidity.

Liquidity is money.

When we trade, we make a lot of transactions.

A lot of trading is liquidity for those who trade intraday and execution of orders of large investors who gain a position over the long term.

A lot of trades means commissions for exchanges and brokers.

The earnings of exchanges and brokers contribute to the development of infrastructure and increase the number of people in the market. Accordingly, liquidity will increase.

The better the infrastructure is developed, the more arbitrage algorithms and the less price manipulation. Less manipulation makes the market more secure, which attracts traders and investors.

We share working strategies so that more people will come to the market. Because everyone will get what they want, traders get volatility and liquidity, funds get liquidity and perspective, exchanges get liquidity and commissions, product companies get clients and infrastructure to develop further.

Resonance will get a professional community, changing the usual ways of doing things.

The price change is a consequence of the volume change.

No indicator reflects the real state of the market, because it is impossible to analyze the price to understand how much money is waiting in the bids and how much money has already been involved in the transactions.

Not a single candlestick configuration does not predict further arbitrage action.

Not a single “support” line shows the real state of demand for an asset. Moreover, it does not predict even the potential appearance of money in the order books.

Not a single technical analysis figure shows the balance between supply and demand.

No “wave” predicts people’s future behavior. It can’t know if people will still buy, it doesn’t know motives which push participants to make transactions.

No Fibonacci zone guarantees the appearance of money in the order books, much less guarantees that even when the prices, buyers will buy creating a “correction.”

No. It never did.

A change in price is a consequence of volume behavior. And volume behavior is a consequence of the actions of market participants (see Market Participants).

Proponents of technical analysis say that when the price reaches a certain level the participants will start buying. Technically they’re right: they will buy as well as sell. Because the market is all buying and selling. You can’t buy if you won’t be sold.

It’s presumptuous to claim in advance that when a certain price point is reached, the amount of money in buyers will exceed the amount of assets in sellers, and that after all the purchases have been made, they will have capital to continue trading (see Arbitrage).

The false Monte Carlo deduction and the Texas sharpshooter fallacy vividly describe this fallacy.

You might think that if the word volume appears here, then it is effective. But no. In this method, price analysis is the key.

For example:

Shorting of Thrust (SOT) – selling attempt – a signal when a sale is moving up and trying to get past some level that someone is selling (Wikipedia).

Up-Thrust – a manipulative signal where price makes an attempt to go up (Wikipedia).

VSA uses candlestick charts (see Candlestick chart, section TA). This method discards the presence of arbitrage algorithms and the concept of market balance. VSA rejects the presence of volume manipulation and spoofing.

All VSA analysts without exception claim that any price movement is market maker’s manipulation. If a person put a stop loss under a level and the price went down there so that their stop loss triggered, they claim that the MM took their money. Listening to such analysts, you get the impression that there are only two people in the market: the market maker and he. That the price was lowered not by active sales on the spot market, but by MM’s desire to take the trader’s money (see Arbitrage).

Definitely not. Because there is no proven, objective reason to search among the noise of the futures trades for reasons to move the spot market. The futures market does not move the price of spot assets. It always follows the price of spot assets.

A promise to pay the difference (a bid reward) can’t move the price of the real commodity. No matter what financial services salespeople tell you, it is physically impossible.

It is possible to trade futures and options, they are liquidity for us, but to analyze them is to engage in self-deception.

But if a market maker does decide to start manipulating the market, he will start pouring money into the spot market and shifting the balance of supply and demand, he will definitely leave a lot of traces and create a sustained deficit. And this we will notice (identify) fairly quickly. If he did not leave traces, it means that he did not affect the balance, and therefore he will not move the price.