Since on January 20, having reached a record high level (ATH) in the amount of $ 109,114.88, Bitcoin (BTC) was a constant decrease, with all his might, trying to restore the impulse against the background of constant pressure and growing bear dominance in the market.

Now technical indicators indicate a deeper correction, and $ 73,000 is the main goal, as the expert in trade notes. Rend.

Technical analysis: key levels for viewing

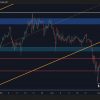

In accordance with RendThe global pulse of Bitcoin Global Growth stalled, and the asset entered the deep phase of correction.

There is not enough liquidity on the market, which makes it unstable for bitcoins to grow exclusively at the expense of buyers and a bull lever. Currently, the price forms a short -term range from 90,000 to 82,000 US dollars after the long -term phase of global consolidation.

The false break in the level of resistance in the amount of $ 91,000, which previously served as strong support, led to further disadvantages, and the BTC is now at risk to fall to $ 82,000 and potentially $ 73,500, if the pressure on the sale is maintained.

At present, Bitcoin has reached the lower boundary of its range, and $ 82,000 acted as a critical level of support.

Sustainable breakdown below this point can accelerate losses, giving the price to $ 78,000 and further to $ 73,000. While the current trend indicates a further drawback, Bitcoin can still take short-term recovery by checking the liquidity zone of $ 83,400 and 84,700 US dollars before resuming its descending movement.

However, if a strong bull catalyst does not appear, BTC remains at risk of falling to $ 73,000.

Analysis of Peter Brandt: Bear of the pennant indicates a further drawback

Veteran merchant Peter Brandt also repeats this bear prospects, noting the completed double fees for $ 108,100, followed by a protest of a bear pennant.

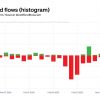

In addition to technical indicators, data in the chain from Sanctiment It reveals significant shifts in the models of accumulating the whale wallet and a wallet with bitcoins over the past six months.

The soft pressure on the sale from mid -February to the beginning of March contributed to the recent decline of Bitcoin, reflecting the wider risk moods in the financial markets. However, from March 3, almost 5,000 bitcoins have accumulated purse from 10+ BTC.

Despite this accumulation, the price of Bitcoin has not yet reflected any bull reaction. If large interested parties continue to buy BTC, the second half of March can see the recovery, provided that the macroeconomic conditions are stabilized.

Nevertheless, investors carefully monitor the releases of the economic data of this week, which can further form expectations in the market.

Shown image through Shutterstock