Mantle (MNT) decreased by more than 10% after BYBIT hacking, where approximately $ 174 million of the CMET-METH dollars on a based mantle was stolen, which provides liquidity for ETH in the MNT ecosystem. Hacking, associated with the North Korean group of Lazarus, caused the sale of panic, which led to the fact that the MNT (RSI) relative force index fell to revaluation.

Although the RSI MNT has since recovered to 39.9, it remains in the bear territory, reflecting cautious feelings. In addition, MNT Chaikin Money Flow (CMF) is trying to recover, but still deeply negative, while its exponential sliding average (EMA) lines suggest a constant descending impulse.

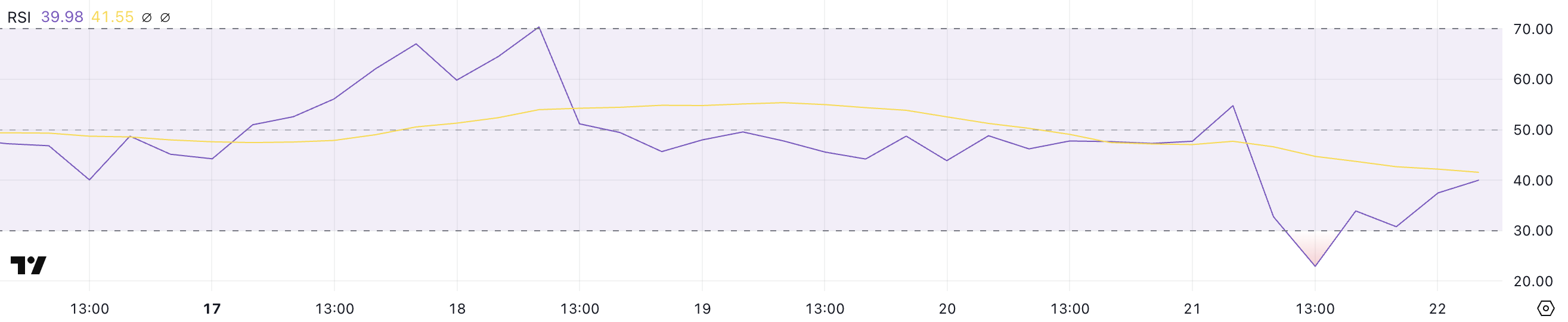

MNT RSI touched the strong levels

The RSI Mantle fell sharply from 54.7 to 22.9 for several hours after the BYBIT hack, where the North Korean hacker group Lazarus stole $ 1.5 billion, making it the largest crypto -hack. Among the stolen assets was CMETH, a coin based on a mantle that provides liquidity for ETH in the MNT ecosystem.

This huge outflow of funds caused panic, which led to a significant decrease in the relative force index of MNT (RSI). RSI is an pulse oscillator that measures the speed and change in prices, usually from 0 to 100.

It is usually used to identify the conditions of rejuvenation or excesses, and the values above 70 indicating the conditions of bought -up and below 30, suggest an excess of territory. The RSI Mantle, which fell to 22.9, signaled the emergency partition, reflecting the feelings intense among bearish among loss of hacking.

After this, a sharp decrease in the RSI Mantle recovered to 39.9, showing signs of recovery over the past few hours. RSI below 30 usually indicates that the asset is resold and can be associated with the rejection of the price, since the pressure in sale is reduced.

Now that the RSI is approaching the neutral zone (range 30-50), this suggests that the extremely selling impulse has decreased, potentially attracting hunters for a deal or lower fisers. If RSI continues to grow, this may indicate a growing bull impulse and a possible change in MNT price.

However, if the RSI cannot exceed 50 thresholds, this may mean constant uncertainty and lack of purchase force, leaving MNT vulnerable to further risk of reduction.

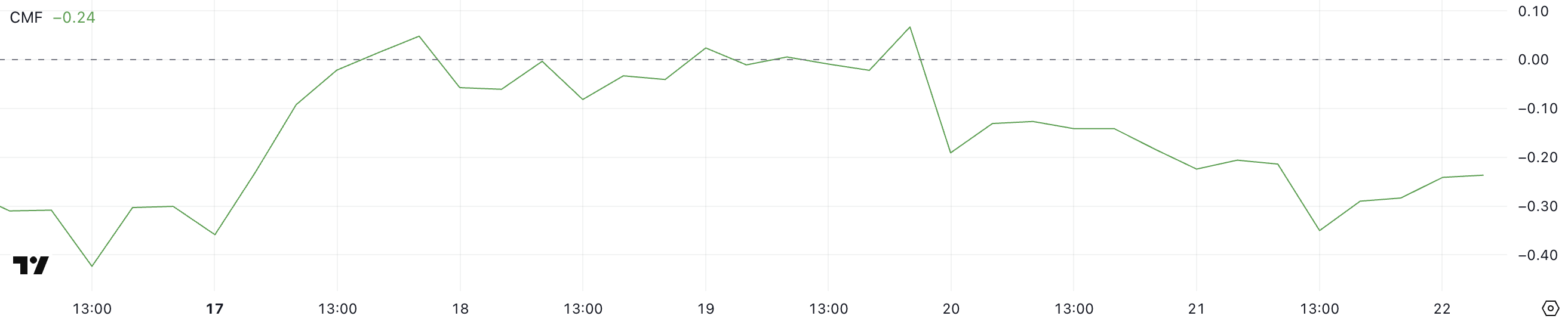

Mantle CMF is trying to recover, but still very negative

MNT Chaikin Money Flow (CMF) was already in the negative territory before BYBIT hacking, reflecting a bear trend and sales pressure. However, after hacking, CMF MNT plunged even further, reaching a negative peak -0.35 yesterday.

CMF is an indicator that measures the average value of accumulation and distribution in volume during the established period. It ranges from -1 to 1, with positive values involving pressure and accumulation of the purchase, while negative values indicate the pressure and distribution of sales.

A sharp decrease to -0.35 signaling the intense outflow of the mantle. This confirms a significant impulse of sales in conditions of increased market fear and uncertainty caused by hacking.

After reaching this negative peak, CMF MNT began to recover, currently sits at -0.24. Despite the fact that they still do not become positive, this ascending movement suggests that the pressure of the sale is gradually softened.

The growing CMF, even if it is negative, may indicate that the pulse is losing pairs. If the purchase volume continues to increase, this can potentially lay the way to stabilize prices or even cancellation. However, while CMF remains in the negative territory, the price of MNT will probably encounter resistance.

The transition to a positive CMF would be a more convincing sign of the return of bull moods. This can signal the higher probability of price restoration.

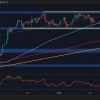

Mantle fell below $ 1 for the first time since early February

The lines of the exponential sliding medium MNT (EMA) are currently very bearish, and all short -term EMA below long -term. This installation indicates a strong impulse of the descending one, since recent prices are weaker than historical trends.

If this bear trend continues, MNT can check support at 0.81 dollars.

On the other hand, if Mantle begins to recover after a recent fall, she can check the resistance of $ 0.98. If this level breaks, the next goal will be 1.08 dollars.

A strong ascending trend can increase MNT to $ 1.31, which is a potential 41% growth. Nevertheless, for this bull script for deployment, the short -term EMA should have crossed above the long -term, signaling the resumption of the purchase pulse.