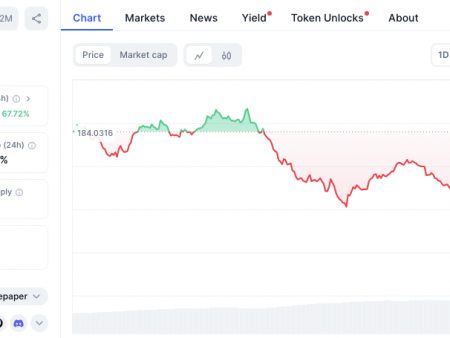

The price of Stellar XLM increased by 14% to $ 0.4795, with a market capitalization of 14.58 billion dollars. USA and a 24-hour trade volume of 1.8 billion dollars. The United States, trading within the intra -day range from 0.4191 to $ 0.4896. The elevation of XLM coincided with the fact that Spike XRP became a witness this week.

Star

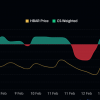

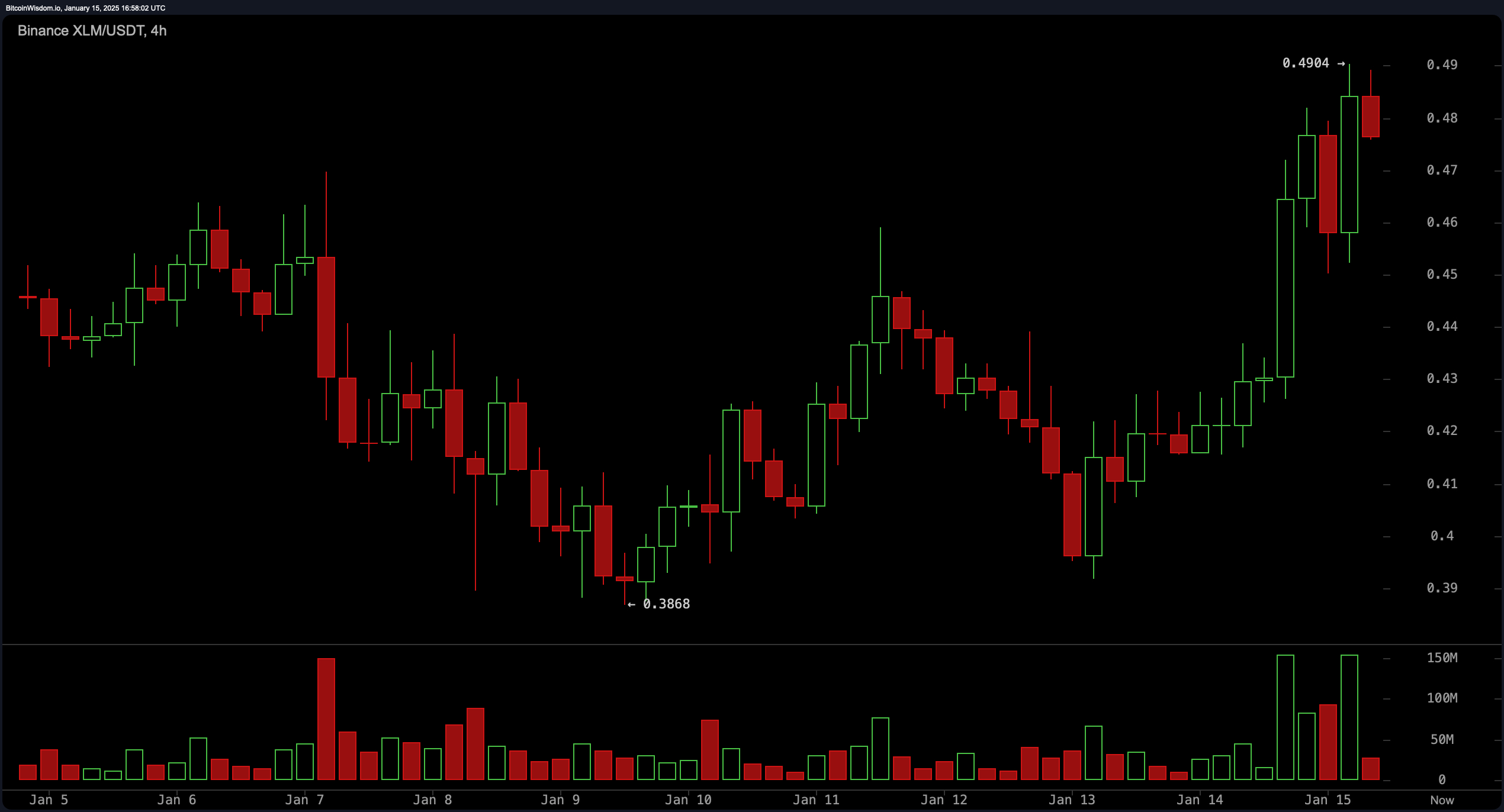

The hourly diagram of the Stellar shows a bull tendency characterized by higher maximums and minimums after falling to $ 0.3918, supported by volumetric spikes near the level of a key breakthrough of $ 0.43 and $ 0.47. The average movements, including the exponential sliding average (EMA) for 10, 20 and 30 periods, the signal continued up the impulse with the purchase actions of $ 0.4316, $ 0.4202 and $ 0.4120, respectively. Oscillators, such as the pulse indicator (10) and the divergence of slip convergence (MACD), also confirm bull moods.

In the four -hour XLM diagram, the formation of a double bottom is about $ 0.3868. Traiders who follow short-term profits can look for records of about 0.47 to $ 0.48, while the exit strategy is aimed at resistance at 0.50 US dollars, although it is warned due to potential kickbacks at this psychological level.

The STELLAR daily diagram emphasizes a longer -term bull, with a recent transmission of consolidation to restoration and support from moderate increase. The key resistance is from 0.55 to 0.60 US dollars, which makes it a critical zone for monitoring traders. All sliding medium, including EMA and a simple sliding average (SMA) for several periods, support the purchase signal, further prices for positive prospects for the STELLAR price trajectory.

The movement of average values for the star (XLM) reflects a strong bull tendency, and all average average values signal positiveness. Exponential average movements (EMA) for 10, 20 and 30 periods are $ 0.4316, $ 0.4202 and $ 0.4120, respectively, while simple sliding medium (SMA) for the same periods Confirm the ascending impulse. These consistent purchase signals indicate reliable support for further prices.

Bull’s verdict:

Stellar (XLM) is positioned for the further upward impulse controlled by bull signals in all the main schedules supported by strong sliding medium and key generators, such as the pulse indicator and the MACD. With a higher maximum and solid restoration after the last minimum, a breakthrough above $ 0.50 could catalyze further results towards the resistance zone from $ 0.60 to the US dollars.

Bear Verdict:

While XLM shows bull tendencies, resistance of $ 0.50 and $ 0.55 represents potential barriers that can cause rollbacks. Oscillators, such as the relative force index (RSI) and stochastic freezing in the neutral territory, suggest caution, and the decreasing volume can weaken the price impulse. The fall below $ 0.46 can confirm bear mood in the short term.