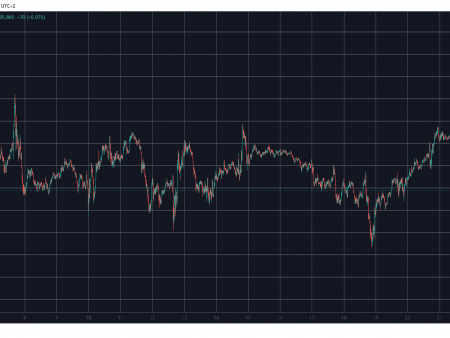

45% fall of SOLANA against bitcoins, of course, is not the most anticipated event in 2025. Solana fell massively sharply, but Bitcoin’s dominance is an important signal that involves the outflow of liquidity from the market.

Capital returned to Bitcoin from alternative assets, such as SOL from his ability to maintain his position near important levels of resistance. Altcoins demonstrated this trend, and many of them are difficult to maintain their relative power compared to bitcoins. Bear Trendy was confirmed by the recent price action of Solana against Bitcoins, who has currently moved it to the lower part of the long trade range.

SOL/BTC tests important multi -month support at 0.001679 BTC; If it cannot stay above this level, additional pressure down can be applied.

Instant support: level 0.0016 BTC, which historically served the most important support, is checked by SOL/BTC. If this level is not supported, Solana can fall to 0.0015 BTC, increasing the likelihood of additional liquidation events.

To have a chance of recovery, SOL/BTC will need to rise above the BTC 0.0020 threshold, which in recent months has limited any significant rallies. To check the change in the trend, a push is required above 0. 0025 BTC.

How about Solan?

Prospects for USD: although Solan has problems with bitcoins, a couple of US dollars was somewhat stable, trading about $ 170. Solana may have problems with maintaining their ascending impulse, given the broader weakness in SOL/BTC.

SOLANA is still one of the best blockchain networks, especially in the Defi and NFT industry, despite the current decline. Solan can continue to work poorly compared to bitcoins, while cryptocurrency remains dominant, and investors are priority for stability over risky investments. In order to turn a tendency into their favor at present, bulls must return important resistance levels. Otherwise, Sol can remain in a descending spiral, at least in the near future, from the growing influence of Bitcoin.