The cryptocurrency market has seen reduced volatility this week as Bitcoin fluctuates between the $100,000 and $90,000 levels. This consolidation trend has stopped the prevailing corrective sentiment in most major altcoins, including SOL. Solana price held above the confluence of major support levels signals the potential for a bullish recovery.

According to Koingeko, SOL price is currently trading at $184.5 with an intraday loss of 2.5%. The market capitalization of assets is $88.5 billion, and 24-hour trading is $3.6 billion.

Key points:

- The resumption of Solana’s TVL uptrend and open interest signals increased acceptance and investor confidence for further gains.

- The downward trend line contributes to the current correction in the price of Solana.

- The $175 support is closely tied to the 50% Fibonacci retracement level, and the 200-day exponential moving average is creating a high accumulation zone.

SOL recovers as open interest and TVL show notable growth

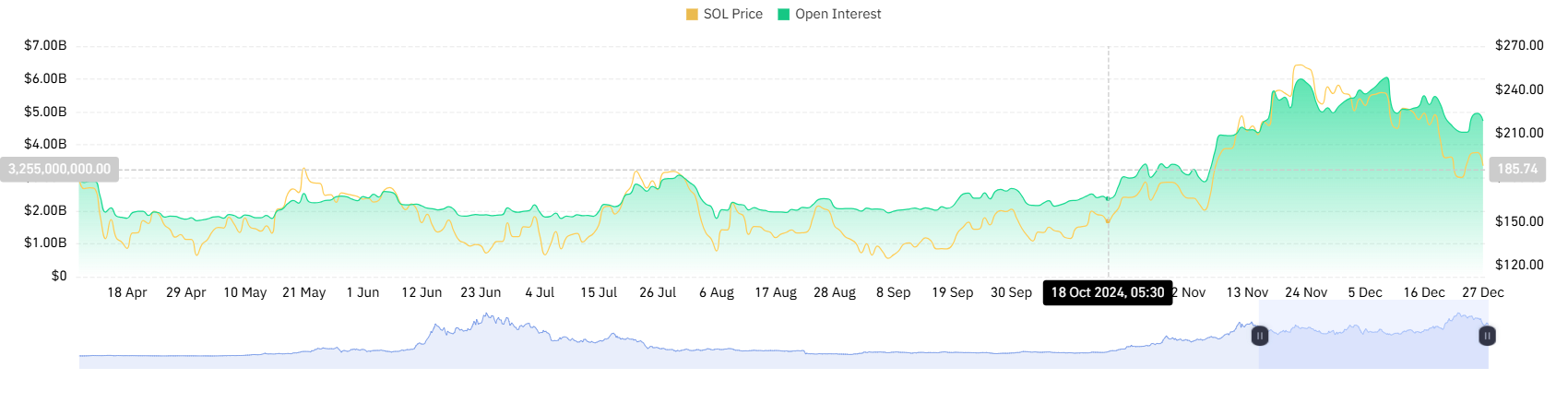

Open interest in SOL futures rose markedly from $4.38 to $4.96, up 13% from last week, according to Coinglass data. Open interest refers to the total number of outstanding derivative contracts that have not yet been settled.

A rise in open interest often suggests increased trading activity, signaling increased interest and confidence in SOL price movements.

During the same period, Solana’s total volume locked (TVL) jumped from $8.06 billion to $8.67 billion, up 7%. The rising TVL demonstrates increased confidence in Solana’s DeFi platforms, suggesting more users are staking, lending or providing liquidity within its ecosystem.

Solana price correction reaches key support

Over the course of more than a month, Solana’s price corrected significantly from $264 to $183, recording a loss of 30%. The pullback is currently looking for support at $175, a horizontal line aligned with the 50% FIB, 50-day EMA, and emerging support trendline.

This creates a high area of interest for buyers to regain bullish momentum and trigger a price reversal. Analysis of the daily chart shows that the support trendline has served as suitable pullback support for SOL since mid-September.

A potential reversal could see the price rise 7.8% ahead of a key breakout of the downtrend line. A successful breakout will further increase pressure leading to a rally above $300.

Read also: Bitfiles for Bitcoin Standard Corporation ETFs with SEC