Solana (SOL) glided, seeing a large drop in price and activity. Over the past month, SOL has decreased by almost 40%, and the price is currently about $ 140.54. This is a cool drop compared to the maximum of 2024 at $ 264.

While the pricing accident was part of a larger decline in the market, investors are wondering if Sol can be bounced.

Whale activity redeems selling fears

Lookonchain blockchain analysis platform reported that Kit Nesternity 1 366 028 SOL (worth about 198 million dollars) and sent it to Falconx.

Then Falconx sent 440 202 SOL (62.6 million US dollars) to exchanges, Binance and Coinbase. It looks like a possible sale, adding to negative feelings in the market.

The volume of translation falls, confidence will decrease

Another great concern is a huge fall in the total transmission of Solan. Analyst Ali Martinez notes that the volume of the Sol translation fell from $ 1.99 billion. USA in November 2024 to 14.57 million dollars. USA by February 23. This mass decrease in activity shows less investors’ trust and the weaker use of the network.

#SOLANA $ SOL TRANSFER TOLUME fell from $ 1.99 billion in November 2024 to 14.57 million dollars. USA today! pic.twitter.com/sdib8xwh1e

– Ali (@ali_Charts) February 26, 2025

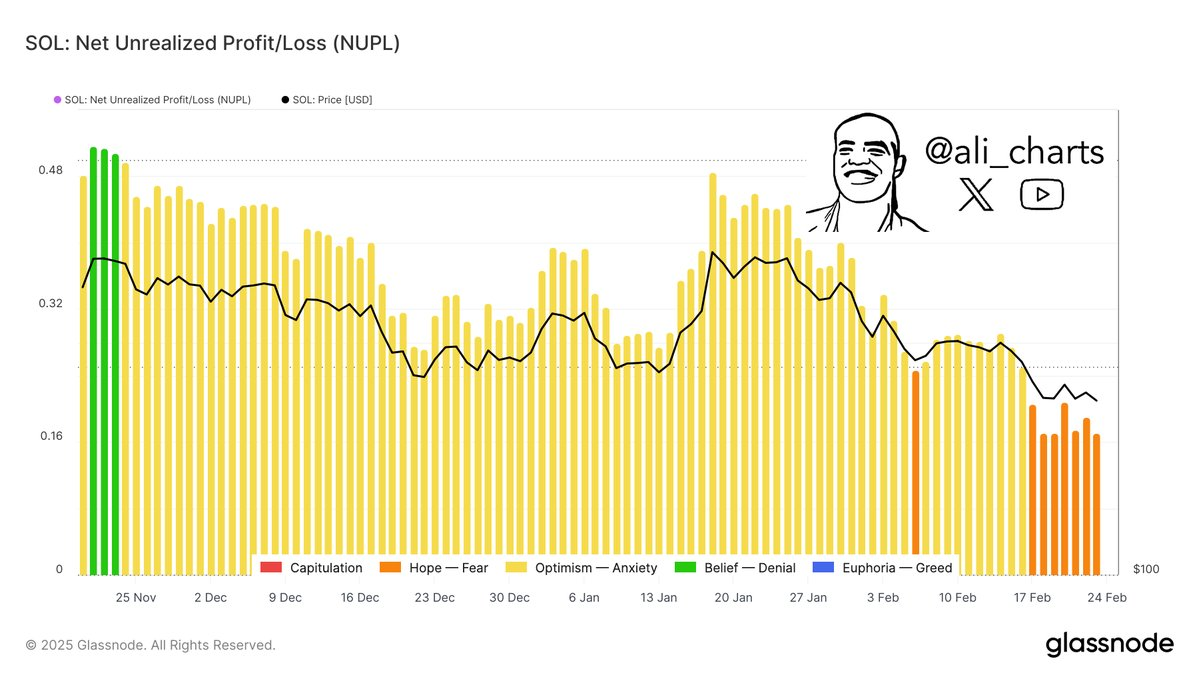

In another post X (earlier on Twitter), Martinez also noted that “SOL investors seem to be in a state of fear,Strengthening the current bear mood surrounding the asset.

Connected: SOLANA WHALALS BECTIONS OF PRICES: Put SPIKE options before unlocking token

SOL prices analysis: key levels for observation

The 20-day exponential sliding average (EMA) for SOL is $ 175.78, which is much higher than the current price. This difference shows a strong impulse.

Sol should return above this level for any real recovery. The daily schedule from TradingView also confirms the Bear Sol.

RSI signals are resold, but bounce off uncertainty

The relative force (RSI) index is currently 26.07, as can be seen on the graph. This means that Sol is resold. Typically, RSI below 30 suggests that the asset is very underestimated and can see short -term growth. However, a strong descending trend can limit any restoration.

Connected: The crypto -market leans to “extreme fear” – is it time to buy?

In addition, SOL is traded near the lower Bollinger group at a price of $ 140.32. This indicates that SOL experiences high volatility and tests the key support zone of $ 140. If this level breaks, the price may fall further.

Refusal of responsibility: The information presented in this article is intended only for information and educational purposes. The article is not a financial advice or what -liba tips. Coin Edition is not responsible for any losses incurred as a result of the use of content, products or the services mentioned. Readers are recommended to be careful before taking any actions related to the company.